A Digital Dollar Is a Double-Edged Sword That Could Accelerate Bitcoin’s Adoption

The idea of a digital dollar as a monetary stimulus is resurfacing.

The world is on the brink of a great economic crisis. In this difficult context filled with uncertainty, the United States is doing its utmost to try to save the current monetary and financial system. The Federal Reserve has taken the first step by announcing a massive quantitative easing program with an injection of $700 billion in liquidity on Mars 15, 2020.

Wall Street’s rejection of this first monetary stimulus led the Federal Reserve to change its tune. From bazooka, the Federal Reserve went nuclear. Just eight days after its first announcement, the Federal Reserve announced on March 23, 2020 that it would begin an emergency program of unlimited quantitative easing.

You read that correctly. The Federal Reserve is now prepared to do whatever it takes to save the current system. In terms of numbers, the bill for this cash injection could exceed $6 trillion. This is a staggering figure that will instantly add up to the Federal Reserve’s balance sheet.

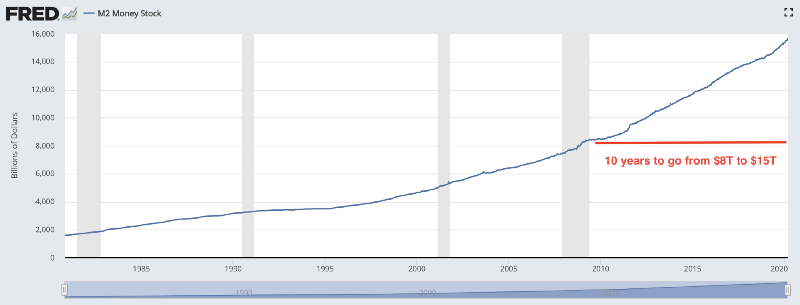

The Federal Reserve’s M2 Money Stock could increase by 40% in the space of a few weeks. It would go from $15T to $21T. Such an increase would de facto constitute an unprecedented currency devaluation of the U.S. dollar.

As a reminder, the M2 Money Stock had taken 10 years to go from $8T to $15T:

With the economic crisis we are about to experience, an increase of the same amount would be achieved in just a few weeks. We are therefore really facing a new situation.

All these measures decided by the Federal Reserve have one thing in common: they are all aimed at saving the current system by helping the financial markets, the banks and U.S. companies.

In this context, many voices are being raised in the United States to explain that the majority must not be forgotten in this economic crisis. When I talk about the majority, I am talking about the American people who deserve a bailout much more than the financial markets or the banks.

Members of Congress have therefore reflected on different hypotheses that could provoke a monetary stimulus among the American population. First of all, many have talked about the possibility of handing out a check for at least $1,000 to every American without means testing.

Other members of Congress then proposed the creation of a digital dollar that would be accompanied by the creation of a digital dollar wallet that would allow American citizens to use their digital dollars.

A Digital Dollar Would Accelerate a Monetary Stimulus for the Largest Number of People

This proposal at least has the merit of being clear. Politicians are now putting their cards on the table. Whereas the possibility of a digital dollar was ruled out a few months ago, the current situation shows that this solution has already been considered for some time.

A digital dollar would speed things up as part of a major monetary stimulus for the entire American population.

In concrete terms, the administration could offer a website on which every American citizen wishing to benefit from it could register. An American citizen would provide the required identity documents, and after a few days, he or she would receive authorization to install the digital dollar wallet on his or her smartphone, for example.

For the U.S. administration, such a solution would be much cheaper than sending a check to every American. In addition, it would be much faster.

Given the current situation, it is obvious that acting quickly is a necessity in order for this monetary stimulus to produce maximum effects to revive the U.S. economy.

Finally, a digital dollar would allow them to have better control over how and when that money would be used.

A Digital Dollar Would Strengthen a Cashless Society With More Surveillance

Naturally, American citizens would rush to a digital dollar. However, this solution is not without a number of questions. Especially in terms of the privacy of American citizens.

A digital dollar would probably mark a turning point towards the cashless society promised for the world of the future.

By using the money available on their digital wallet dollar, Americans could be much more easily monitored by the U.S. authorities.

The government could track in more detail what each person did with the money received as a monetary stimulus. In addition, this switch to a digital dollar would strengthen the government’s power over what U.S. citizens own. It would make it even easier for them to block payments arbitrarily, or to confiscate funds from individuals.

I mention only the most obvious examples here, but these new possibilities would enable the government to significantly strengthen its control capabilities.

A Digital Dollar Will Be Born Sooner or Later

As I write this story, the White House and the U.S. Senate have finally reached a $2 trillion deal to stimulate the U.S. economy. Included in this package is a $1,200 check for every U.S. citizen.

The idea of a digital dollar seems to be abandoned for the moment.

I say for the moment, because I think that sooner or later the government will have to come to terms with it. The digitalization of the currency clearly seems inevitable in the future. It is therefore only a matter of time.

If this monetary stimulus for the population that has been decided upon is not sufficient to revive the U.S. economy, the idea of a digital dollar might even come back on the table much sooner than expected.

In my opinion, this idea has positive implications for the U.S. government, as I explained at the beginning of this story. Nevertheless, a digital dollar must be seen as a double-edged sword.

In pushing Americans to use a digital currency, the government should necessarily educate them on the subject to help them using it properly. By educating American citizens in the use of a digital dollar, the authorities will run the risk that they will then be interested in the cryptocurrencies that are the logical extension of it.

A Digital Dollar Could Accelerate Bitcoin Adoption

When people are interested in cryptocurrencies, they are interested in Bitcoin 99% of the time in the first place. After learning how to use a digital dollar, U.S. citizens might therefore be strongly tempted to discover Bitcoin.

I’m making this bet because I just think that a digital dollar will not correct the flaws of the U.S. dollar they use, and more globally of the fiat system.

Digital or not, the Federal Reserve will always have the ability to print dollars over and over again. The U.S. dollar is not sound money. The population will always suffer currency devaluations with a digital dollar.

Sooner or later, those disappointed in this fiat system will look for an alternative that is more protective of what they own. Embedded in the world of digital currencies, they will find Bitcoin as a logical extension to one notable difference: Bitcoin’s monetary policy.

Bitcoin has a very clear monetary policy: a maximum supply of 21 million units, and an inflation of newly created Bitcoins that decreases over time towards zero. Bitcoin’s monetary policy is automatic and predictable. It is written within the Bitcoin source code itself.

In a future world where all currencies will be digitized, the difference will be in the monetary policy. And in this area, Bitcoin is the best there is.

Bitcoin is clearly the soundest money that can be found in the world today. This intrinsic characteristic will enable Bitcoin to appeal to more and more people in the years to come. People will choose to turn their fiat money into sound money in order to truly protect their wealth.

The American government and the Federal Reserve are well aware of this major risk to their prerogatives. This is the reason why the idea of the digital dollar has not been retained for the moment.

Conclusion

Faced with the crisis we are going through, U.S. authorities are still looking for the right solution to support the American economy and avoid an unprecedented recession. The idea of a digital dollar with a digital dollar wallet is back on the table.

This idea at least has the merit of seeing politicians playing their cards on the table in the uncertain situation we are going through. Such a solution would clearly be a double-edged sword for the U.S. government.

On the one hand, a digital dollar could create an instant monetary stimulus for the American population while allowing the authorities to better monitor the use that would be made of this given money. On the other hand, it would introduce millions of Americans to digital currencies, who might then be tempted to switch to Bitcoin.

Such a solution could therefore accelerate the adoption of Bitcoin in the United States. Well aware of this risk, the US government has finally opted for the check solution, but the big question is whether this will be enough to revive the US economy.

If not, the idea of a digital dollar will surely resurface. And sooner or later, it will become inevitable.

1 Response

[…] A Digital Dollar Is a Double-Edged Sword That Could Accelerate Bitcoin’s Adoption […]