Bitcoin HODLERS Have an Essential Advantage Over Bitcoin Traders

You must absolutely choose to adopt the right strategy with Bitcoin.

I meet more and more frequently with people who are interested in Bitcoin. Nothing says that they will buy Bitcoin, but I feel that the possibility of an alternative to the current monetary and financial system is beginning to appeal to them.

So they want to learn how Bitcoin works and then quickly come to wonder what the difference is between Bitcoin HODLERS and Bitcoin Traders.

This is a very interesting question, and one that many people who have just bought Bitcoin should ask themselves. The answer I’m going to give to that question is also very important to me. It should make you very aware of the right strategy to adopt in order to fully benefit from Bitcoin.

Before giving you my answer, I will first explain what I think a Bitcoin Trader is, and then what a Bitcoin HODLER is. Once these two concepts have been defined, I will explain why I think Bitcoin HODLERS have an essential advantage over Bitcoin Traders.

Defining a Bitcoin Trader

A Bitcoin Trader is a person who sees Bitcoin solely through the prism of financial investment. If you fall into this category of people, you will consider Bitcoin to be an asset like any other that you should consider when making a profit.

The fact that Bitcoin allowed some people to transform $1 invested at the beginning of 2010 into $90K at the end of 2019 does not leave you indifferent.

You don’t really believe in Bitcoin, and you don’t even know how it works. In fact, a Bitcoin Trader is not really interested in Bitcoin as a completely decentralized Peer-to-Peer payment system.

The Bitcoin trader simply thinks that if there is one chance in a hundred that Bitcoin will perform in this new decade as well as it did in the last decade, he should try to buy some Bitcoins.

A simple way to recognize a Bitcoin Trader is to ask him if he has bought some Bitcoins. Most of the time he will tell you that he has invested in Bitcoin. This type of answer will allow you to identify him immediately.

For the Bitcoin Trader, buying Bitcoin is equivalent to investing in a company by buying shares on Wall Street.

When Bitcoin price falls sharply as it did on March 12, 2020, the Bitcoin Trader will obviously capitulate. Quickly, he will make the decision to sell all his Bitcoins, even at a loss.

For him, it’s all about risk management. If Bitcoin falls sharply, he will prefer to recover cash and put it into gold, which is a safer safe haven for him. This will not prevent him from buying Bitcoin again when Bitcoin price goes up again later.

The Bitcoin Trader is therefore acting as a Momentum Trader, which I think is a fundamental mistake.

In short, you will have understood that the Bitcoin Trader is not interested in the ideological and social revolution that Bitcoin represents. He is only interested in profit.

Defining a Bitcoin HODLER

First of all, you should know that there are several types of Bitcoin HODLERS. However, I only consider here Bitcoiners, those who fundamentally believe in Bitcoin. These Bitcoiners play the essential role of HODLER of last resort.

This kind of Bitcoin HODLER will therefore keep his Bitcoins no matter what it takes.

When Bitcoin price loses 50% of its value in a few hours, as was the case on March 12, 2020, the Bitcoin HODLER will not waver. He is aware that Bitcoin’s volatility is double-edged, and that in order to fully benefit from it he has to aim for the long term with Bitcoin.

Aiming for the long term with Bitcoin is not difficult for the Bitcoin HODLER. Why? Simply because it has total confidence in Bitcoin and the revolution it is building for the future world.

Bitcoin HODLER has become aware that the current monetary and financial system is no longer working. He understands that this 49 year old system only accentuates the inequalities between the very rich and the poor.

Bitcoin appears to him as an opt-out solution in order to regain control over what he owns.

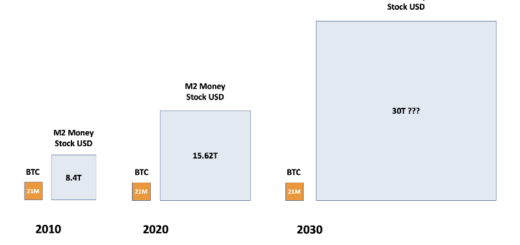

The mere fact that Bitcoin’s money supply is fixed at 21 million units, and that this is immutable, guarantees to the Bitcoin HODLER that his efforts to save will not be in vain.

When the Federal Reserve announces an infinite quantitative easing program to support the American economy as it just did on Monday 23rd March 2020, the Bitcoin HODLER is strengthened in its position.

It knows that quantitative easing ultimately means a currency devaluation of the U.S. dollar. This devaluation should decrease the value of what he owns.

Bitcoin is therefore his hedge to fight against the effects of this currency devaluation.

This absolute belief in Bitcoin has allowed the Bitcoin HODLER to see the drop in its price on March 12, 2020 as an incredible opportunity to accumulate more Bitcoin. This is what he has done, and he believes it will bring him great benefit in the future.

Bitcoin HODLER Has an Essential Advantage

In my opinion, the Bitcoin HODLER has an essential advantage over the Bitcoin Trader. That essential advantage is its absolute belief in Bitcoin and the fairer system for all that it seeks to build for the future.

The simple fact of fundamentally believing in Bitcoin allows the Bitcoin HODLER to lead a much quieter life in which he accumulates Bitcoins.

When Bitcoin price varies greatly, the Bitcoin HODLER is zen. He knows that Bitcoin is here to stay, and that his ambitious goals are long term. The 50% drop in Bitcoin price on March 12, 2020 should therefore in a bigger picture.

In hindsight, HODLER Bitcoin sees the bigger picture, and is convinced that this fall will be quickly forgotten in the months and years to come. Bitcoin’s fundamentals remain the same, so there is no reason to panic.

Panic is precisely what characterizes the Bitcoin Trader.

His life is far from being a long quiet river. He constantly follows the Bitcoin price and other financial assets’ price. As a day trader, he is under constant stress.

With Bitcoin, his life is complicated. Bitcoin is the only true free market in the world. Trading never stops, and its users have the power to decide the true break-even price. In fact, the price of Bitcoin can be extremely volatile.

The Bitcoin Trader will have a hard time managing its volatility that will become its greatest enemy.

Generally, the Bitcoin Trader is much more likely to lose money with Bitcoin than the Bitcoin HODLER. Indeed, several past studies have already shown that HODLING is the best strategy to make profits with Bitcoin.

The Bitcoin HODLER is therefore a winner on all grounds with its total confidence in Bitcoin.

He leads a peaceful life, protects his wealth for the future, while seeing his wealth increase in value over time. Finally, his absolute belief in Bitcoin will be rewarded in the future when he successfully completes his revolution.

You don’t have to buy Bitcoins, but if you make the personal decision to do so, you should strongly consider becoming a Bitcoin HODLER as well in order to take full advantage of the Bitcoin revolution.

If you still choose to remain a Bitcoin Trader, you will do so at your own risk.

2 Responses

[…] By choosing to be a Bitcoin HODLer rather than a Bitcoin Trader, you will have one essential advanta…: you will be more Zen daily, and you will have more time to deepen your knowledge of Bitcoin. […]

[…] simple strategy will allow you to become a Bitcoin HODLER. You’ll have an essential advantage over Bitcoin Traders: you’ll be able to lead a more Zen life, and more importantly, you’ll be able to focus on the […]