Bitcoin Is Your Way out of the Infinite Vicious Circle in Which the Current System Locks You In

Without Bitcoin, we would have no hope today.

The current economic crisis highlights more than ever the flaws of the current monetary and financial system. For those who are really interested in the economy, as well as in how money works, these flaws of the current system are not new.

For many years now, voices have been raised to say that the current system, which will soon be 50 years old, has failed in its mission to stabilize the world economy.

The number of economic and banking crises has never been higher than since Richard Nixon unilaterally ended the convertibility of the U.S. dollar into gold in August 1971.

This decision put an end to the gold standard system established at Bretton Woods in 1944 at the end of World War II.

The current system has failed in its mission to stabilize the world economy

Since then, the U.S. dollar, but also all other fiat currencies, are no longer based on anything tangible. The central banks of each country are free to print as much fiat currency as they wish.

The result of this lack of hard money at the global level is disastrous for the majority of the world’s inhabitants.

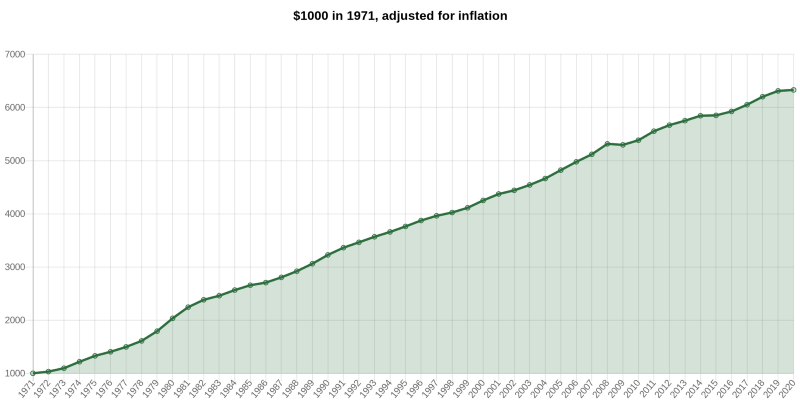

Since 1971, a purchasing power of $1,000 has lost 85% of its value. If you had wanted to beat the effects of inflation since 1971, you would have been able to turn that $1,000 into $6,330 by 2020:

When you discover the devastating effects of monetary inflation on what you own in U.S. dollar, you will probably come to the same conclusion as me and so many others:

We are slaves to the current system that forces us to earn more and more U.S. dollar just to have the chance to maintain the same standard of living.

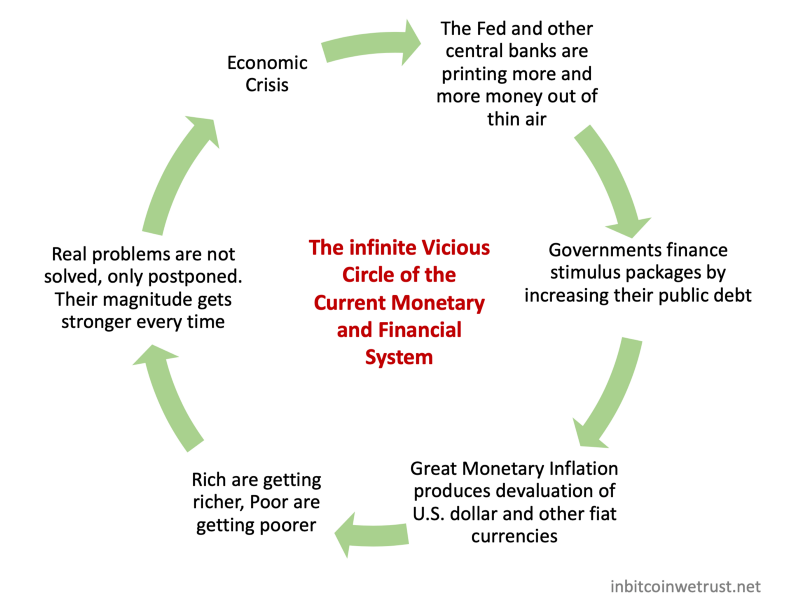

The current system locks you into an infinite vicious circle

The current monetary and financial system enriches a minority of people, while trapping the majority in an infinite vicious circle:

This vicious circle is made up of six major stages which have been in an infinite loop since the establishment of the current monetary and financial system in August 1971:

- An economic crisis intervenes. The reasons can be a banking crisis as in 2008, or a health crisis as in 2020 with the coronavirus pandemic.

- Faced with this economic crisis, the Fed and the other central banks always end up opting for the same solution: to print more and more fiat money. This fiat money printed out of thin air is then injected directly into the monetary and financial system.

- The governments of the major economic powers implement stimulus plans, which are almost always financed by an increase in public debt. The public debt-to-GDP ratio of most G20 countries is now above 100% or even worse.

- All of these decisions lead to great monetary inflation. The value of the U.S. dollar, which is the world’s reserve currency, has been steadily declining over time, as shown by the change in purchasing power in U.S. dollar since 1971.

- The injections of money benefit the richest people. Each economic crisis further strengthens their wealth. The poorest, who need help the most, are put in even greater difficulty by these decisions. The current system therefore benefits a minority of people who are already rich.

- The real problems of the monetary and financial system are known, but they are never really addressed. Injections of money in almost infinite amounts only serve to postpone the resolution of problems. As these are never solved, a new economic crisis always occurs about ten years later.

The vicious circle of the current system is dramatic because from crisis to crisis, the magnitude of the problems increases.

Each economic crisis is much worse than the previous one

While a few hundred billion dollars were enough in 2008 to postpone the economic crisis, the economic crisis of 2020 has already required the injection of more than 10,000 billion dollars from the world’s major central banks.

Despite this, the recession is still there. Those who hoped for a rapid restoration of the economy must face the facts:

The U.S. economy, and most of the G20 economies, will suffer a W-shaped recession.

The economic crisis of 2020 will therefore last for many more months. Unfortunately, I fear that the worst is yet to come. The stock market, which is currently facing the illusion of an iceberg, will not be able to remain disconnected from the real economy indefinitely.

Sooner or later, the stock market will fall back into line with the situation of the real economy.

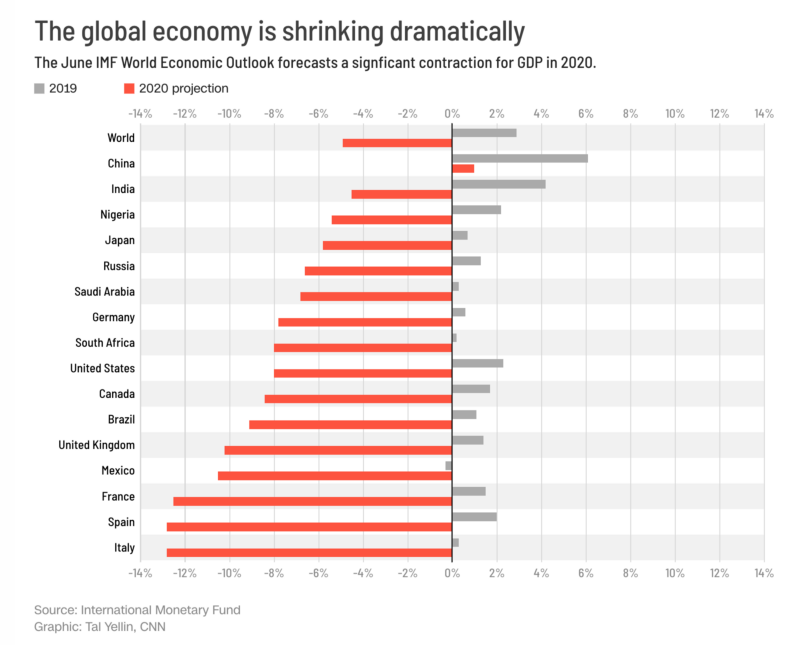

This real economy for which the IMF anticipates GDP falls of 6 to 14% for most G20 countries:

With the exception of China, which is expected to show timid growth of 1% of its GDP in 2020, all the other major world economic powers will be in recession in 2020.

The Fed and other central banks will probably have to print more fiat money in the coming months.

Governments will have to put in place new stimulus plans that will further increase their respective public debts. For example, United States now has a public debt of over $26 trillion.

At the current pace, and given the seriousness of the current economic situation, the threshold of 30 trillion dollars of public debt by the end of 2020 seems unfortunately inevitable for the United States.

The powerful people at the head of the current system do not seek to make it fairer

The goal of the Fed and other central banks at this time is just to support the economy until the situation allows for a return to growth. None of the powerful at the head of the current system are therefore seeking to resolve the flaws of the system.

However, they are all well aware of the limits of the current system, which is totally unfair to the poorest, as Jerome Powell explained in an interview for 60 Minutes on May 17, 2020:

“The people who’re getting hurt the worst are the most recently hired, the lowest paid people. It’s women to an extraordinary extent. We’re actually releasing a report tomorrow that shows that, of the people who were working in February who were making less than $40,000 per year, almost 40% have lost their jobs in the last month or so. Extraordinary statistic. So that’s who’s really bearing the brunt of this.”

— Jerome Powell

In 2008, in the same situation, except that the injections of money into the system were “only” in the order of a few hundred billion dollars, we were all rather resigned.

Indeed, there was no credible alternative to the monetary and financial system established in 1971 by Richard Nixon.

At the time, we didn’t see any possibility of change. We were going to have to make do with this flawed system that no one wants to change so that it would better respect the inhabitants of the Earth.

And then Satoshi Nakamoto created Bitcoin at the end of 2008.

One cannot help but see Bitcoin as the answer to the flaws of the current system that locks us into an infinite vicious circle of economic crises.

Without Bitcoin, we would still be without hope for a better world in 2020.

Bitcoin is our only hope for a fairer world for all

Today, we have Bitcoin at our disposal. Bitcoin is a hard money that has the potential to stabilize the world economy in the future.

In the meantime, Bitcoin is the best weapon at our disposal to break the vicious circle in which the current system traps us. With Bitcoin, you are able to fully protect your wealth. Better yet, you have the best tool to fight against the censorship of governments and other powerful people in the current system.

Bitcoin allows you to take full responsibility for what you own.

As long as you have the private keys to your Bitcoins in your possession, no one can confiscate them, or prevent you from making the transactions you want to make with them.

By making the decision to buy Bitcoin today, you are opting out of a flawed monetary and financial system that no one wants to change to create the conditions for a better world for the majority of people.

The millions of people in countries under authoritarian regimes who are already using Bitcoin as a Plan A today are proof that Bitcoin is necessary for the world of the future. Bitcoin will enable the financial inclusion of hundreds of millions of people excluded from the current system.

A solution that is inclusive and protective of the people could only emerge from the people. Bitcoin is that totally democratic solution whose success or failure depends solely on its users.

Bitcoin needs you as much as you need Bitcoin. This interdependence is essential. Without you, Bitcoin cannot succeed. Without Bitcoin, you are condemned to the infinite vicious circle of the current system with central banks printing more and more fiat money.

This is the fundamental reason why I believe so strongly in Bitcoin.

Conclusion

More and more people are opening their eyes every day, and it is only a matter of time before they decide to come and test a credible alternative to the current system. Sooner or later they will buy Bitcoin to protect themselves from the flaws of the current system.

Bitcoin will probably never replace the current system, but it will be a leading alternative solution that allows every person on Earth to choose whether or not to live their lives on their own terms.

As such, Bitcoin is an incredible hope in a world where everything seems to be turning upside down in 2020. Buying Bitcoin also means believing in this world of a better future for all.

2 Responses

[…] drove them to buy Bitcoin. These people had already realized that the current system was flawed, so they were looking for an escape from this vicious circle. Bitcoin was the opportunity they had been waiting for for a long […]

[…] The current system locks us into a vicious circle: […]