The Bitcoin Rally That We Have Just Experienced Is Promising Because It Is Due to Smart Money

Retail investors have not yet arrived in droves.

The first week of November 2020 will remain a week apart. It is indeed during this week that the Americans decided to put an end to Donald Trump’s experience as President of the United States. Whether Donald Trump likes it or not, Joe Biden was indeed elected to become the 46th president in the history of the United States.

During the two days of great uncertainty that followed the voting day, Bitcoin experienced a rally allowing its price to rise from $13.5K to nearly $16K.

This represents an increase of +17% in just 48 hours. This return of volatility in the Bitcoin world helped to draw attention to the best hedge against uncertainty.

Bitcoin has entered a positive feedback loop that promises to drive its price towards a new All-Time High (ATH) in the coming months. At the time of writing, Bitcoin is firmly anchored above $15K as its price is $15.3K.

Research volumes show that the general public is not yet back in Bitcoin

This Bitcoin rally that we have just experienced is even more promising than what some may think in my opinion.

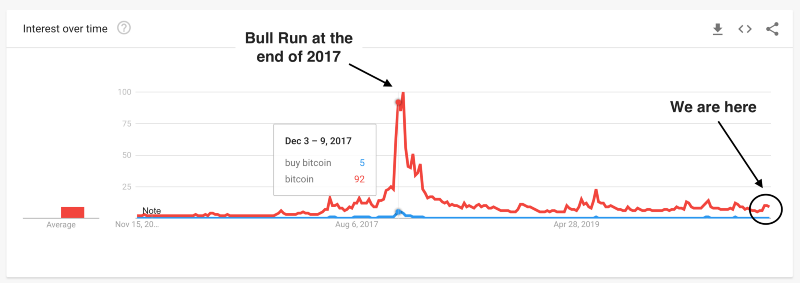

To understand this, I suggest you look at the Google search volumes for the terms “Bitcoin” and “Buy Bitcoin”:

As you can see, at the peak of the Bull Run at the end of 2017, madness had seized the Web regarding Bitcoin. Interest in Bitcoin had then overtaken the Bitcoin world, but also that of the financial markets.

The general public wanted to discover what Bitcoin was. The number of people wanting to buy Bitcoin was literally exploding day by day. At the peak of the Bull Run in 2017, Coinbase was receiving up to 100,000 applications per day.

That’s huge, and it’s nothing compared to what’s going to happen during the next Bitcoin Bull Run.

If we are getting closer and closer to this Bull Run, we are not there yet. We won’t get there until the record price of $20K is beaten for Bitcoin. So just be patient.

Since the rally we have just experienced in the Bitcoin world is not the work of the general public and retail investors, it is interesting to ask who was at the maneuver between November 4 and 6, 2020.

The Bitcoin rally that we just experienced is due to smart money

Obviously, it was the whales and institutional investors who came to buy a lot of BTC during these 48 hours. This corresponds to what is called smart money in the Bitcoin world. Fresh money that has allowed the Bitcoin price to soar.

The number of addresses with at least 100 BTC reached a 7-month high after the Bitcoin rally. This is a sign that does not deceive. The investors with the most means were in the maneuver.

The Whales are more and more numerous. This indicates that confidence in Bitcoin for the coming months continues to grow. Everyone is confident that the coming months will bring new records for the Bitcoin price.

So we are clearly only at the beginning of the next Bull Run.

This is what is ultra promising. Bitcoin is likely to surpass a price of $20K without the madness of the general public about Bitcoin having taken hold yet.

This gives you an idea of the incredible upside potential that Bitcoin has by the end of 2021.

More favorable regulation for Bitcoin could speed things up

Institutional investors will continue to flock to Bitcoin, while large companies will follow the lead of MicroStrategy and Square. While the arrival of PayPal will not bring 346 million new Bitcoin users overnight, it will bring undeniable credibility around Bitcoin to the general public.

U.S. banks will sooner or later offer their customers the possibility to buy and hold Bitcoin through their platforms.

The election of Joe Biden as the new President of the United States opens up prospects on several levels, but the most important in the long term is the establishment of a favorable regulatory environment for Bitcoin. This is probably the last thing that is really missing right now.

The fact that former CFTC Chief Gary Gensler has been appointed to advise Biden on Wall Street as part of Joe Biden’s presidential transition is a reason for hope in this regard. Indeed, Gary Gensler is a long time Bitcoin advocate. Seeing him working with the Biden administration in the coming months could help to define a favorable regulation for Bitcoin in the long run.

A clear and favorable regulation would be the last element before the general public ends up buying Bitcoin in bulk.

We are not there yet, but things continue to move in the right direction for Bitcoin. In the short term, a new stimulus plan from the U.S. authorities, as well as the Fed’s announcement on the extension of an aggressive monetary policy, will also help the Bitcoin price to rise.

Conclusion

As the Bitcoin price rises in the coming months, interest from the general public will increase. As the positive feedback loop in which Bitcoin enters shows us empirically since its creation, this will increase the volatility of its price, which will lead to even more players in the Bitcoin world.

The volumes of searches for Bitcoin will naturally increase on Google. When they reach and exceed those of the end of 2017, don’t be surprised by the price that Bitcoin will have reached by then. The current price of $15K will then seem extremely cheap to you.