The Obvious Reason Why Bitcoin’s Halving Will Skyrocket Its Price Is Law of Supply and Demand

I’m not asking you to take my word for it, but simply to study the law of supply and demand.

I am convinced that the third Bitcoin Halving will have a huge effect on its price in the next 18 months. I’m obviously not alone in thinking this. All Bitcoiners think so too.

Better yet, we are joined in this analysis by many observers from the traditional financial markets.

A quick look at the evolution of the Bitcoin price after the two previous Halvings in 2012 and 2016 reinforces this conviction.

The approach of this third Halving in the history of Bitcoin is putting the world of cryptocurrencies in turmoil. Bitcoin has seen its price rise from $6,950 to $10,300 in the 40 days since the beginning of the year.

As was the case throughout 2017, I am meeting more and more people asking me questions about Bitcoin. Proof, if proof were needed, that something big is getting ready for Bitcoin.

Many of these questions revolve around the same theme:

Why will the third Bitcoin Halving have a significant upward effect on Bitcoin price?

In order to answer this question, I think there is nothing better than to go back to the basics and rely on the famous law of supply and demand.

This law alone is an obvious reason why Bitcoin price will soar in the months following the third Halving.

The Law of Supply and Demand

The law of supply and demand is an economic model used to determine the price of an asset in a market.

This law explains that the unit price of an asset will vary until an equilibrium point is found where the quantity demanded will be equal to the quantity supplied.

This law of supply and demand will therefore lead to an economic equilibrium for the price of an asset as well as the volume of trade.

An existing asset in limited quantity for which demand would be strong would necessarily see its price increase if we stick to this law.

Indeed, strong demand from buyers would allow sellers to sell at a higher price.

Bitcoin Supply Is Limited and Will Become Scarcer Over Time

With regard to the law of supply and demand, Bitcoin presents an initial guarantee concerning the available supply.

Bitcoin exists in finite quantities and the number of Bitcoins that will be put into circulation is 21 million.

This guarantee is verifiable since it is written into the Bitcoin source code itself.

By arbitrarily setting this limit when creating Bitcoin, Satoshi Nakamoto has decided to make Bitcoin something scarce.

We also know how many Bitcoins have already been mined.

18,218,287 Bitcoins have already been mined as of February 15, 2020.

Best of all, the Bitcoin production model is predictive.

As the Bitcoin Blockchain was designed, we know that the production of new Bitcoins will slow down every 210,000 validated transaction blocks.

By 2140, all Bitcoins will have been put into circulation.

Halving is the name given to the reduction in the number of Bitcoins produced. It is an automatic operation written into the Bitcoin source code.

As you know, the production of new Bitcoins is done each time a new block of transactions is validated and then added to the Bitcoin Blockchain.

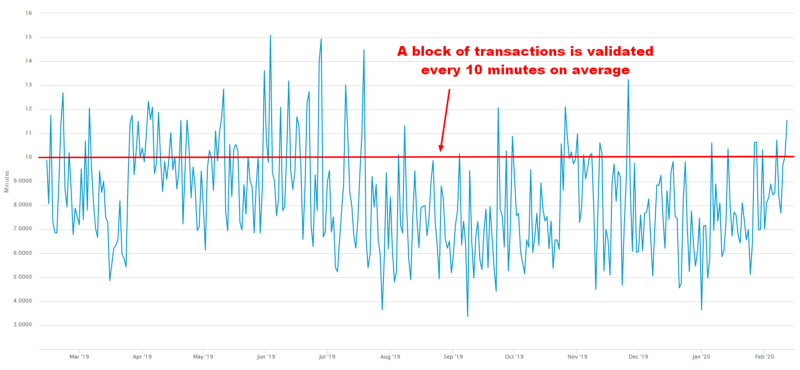

A block of transactions is validated every 10 minutes on average on the Bitcoin network:

So in one day, we have an average of 144 blocks that are added to the Bitcoin Blockchain right now.

Since the reward given to miners for validating a block is currently 12.5 BTC, we have the creation of 1800 new Bitcoins every day on average.

For 11 years, Bitcoin has never been hacked and its network has an uptime of 99.98%.

The Bitcoin therefore gives very strong guarantees on its functioning and the respect of this availability of new Bitcoins on a continuous basis.

As of February 15, 2020, Bitcoin is at block 617,464.

When the 630,000 block is added, Bitcoin’s third Halving will take place.

This leaves 12,536 blocks before reaching this crucial moment in the history of Bitcoin.

At the current rate of 144 mined blocks per day, this third Halving of Bitcoin is scheduled to take place in 87 days.

On May 12, 2020, the reward allocated to miners for the validation of a block will therefore be halved to 6.25 BTC.

From 1800 new Bitcoins produced every day, we will decrease to only 900 new Bitcoins produced every day.

With this third Halving, Bitcoin will therefore experience a monetary creation shock.

The Big Question Is the Increasing Demand for Bitcoin

We now need to focus on the demand side of this law.

The big question for the coming months and years is the increasing demand for Bitcoin.

On the certainty side, we know that the world is set to become increasingly unstable economically and politically in the months and years ahead.

Coronavirus is becoming a global health crisis and the resulting economic difficulties in China are likely to affect most of the world’s major economic powers in 2020.

The economic crisis that has been expected for the past ten years will come sooner or later, so it could well be in 2020 or 2021.

Tensions between the United States and Iran have never been so high. The risk of war between the two countries has never been greater than since the beginning of 2020.

The situation between the United States and North Korea eased in 2019, but this is by no means final because the substance of the problem is still unresolved.

The trade war between the United States and China is not yet completely over. A twist is always possible, especially with Donald Trump at the controls.

The more than delicate situations in Venezuela, Zimbabwe, Argentina or even Russia will also reinforce this global instability.

Bitcoin is really establishing itself as a safe haven in times of crisis now.

This instability will encourage a greater demand for Bitcoin.

In this year of Halving, Bitcoin will get much more media exposure.

We can already feel the excitement around Bitcoin that is reminiscent of 2017.

The mere fact that Bitcoin broke the $10K mark for the third time in its history at the beginning of February 2020 had a strong media impact.

The result is immediate with more and more people asking questions about Bitcoin in order to acquire some.

And all this is nothing compared to the waves of sign-ups on a platform like Coinbase, which are likely to happen as soon as the price of Bitcoin rises above $15K, and then $20K.

As the price of Bitcoin increases, so will the media coverage, which will play a role in increasing the demand for Bitcoin.

Finally, more and more people are becoming interested in how money works. They understand that there is something wrong with the current monetary and financial system.

For a growing number of people, the result is a strong desire to discover something else.

All this will have a positive impact on the demand for Bitcoin which remains the leading cryptocurrency bought by those entering the market.

Scarcity of Supply Will Combine With Rising Demand to Produce a Shock in the Price of Bitcoin

The already limited supply of Bitcoin will become even more scarce as of May 12, 2020. The daily creation of new Bitcoins will decrease from 1800 to 900.

With constant demand, this scarcity of new Bitcoins will inevitably lead to a price increase.

This price increase will be necessary so that an equilibrium price is once again found between sellers and buyers.

Everyone has been waiting for the Halving for many months now.

This high expectation around third Bitcoin Halving will result in a lot of media coverage.

As the price of Bitcoin moves closer to its all-time high at the end of 2017, the excitement around Bitcoin will intensify.

This will create a virtuous circle that will make the price of Bitcoin soar.

Thus, the more people talk about Bitcoin, the more new people will seek to buy Bitcoin. The new money that will come on the market will help the price of Bitcoin to rise again.

And so on.

Based on what happened in 2012 and 2016 for the previous Halvings, the strong bull market resulting from this supply shock in Bitcoin will last 18 months.

The sharp rise in the price of Bitcoin is unlikely to begin until late summer 2020.

The peak of this increase will occur in 2021.

Conclusion

Following the economic model defined by the law of supply and demand, it seems obvious that the third Bitcoin Halving will have a huge effect on its price.

Bitcoin will enter a virtuous circle that will allow its price to beat its previous historical record of $20K reached at the end of 2017.

In order for this historic price of Bitcoin to last, it will be essential that the price increase continues to occur in the same way as it has since the beginning of 2020.

Indeed, the price of Bitcoin is rising steadily but never insanely in a matter of hours.

This protects Bitcoin from the creation of a speculative bubble as was the case at the end of 2017 with the unfortunate result that we know.

With much stronger fundamentals than in 2017, the future rise in Bitcoin’s price should be sustainable and allow Bitcoin to continue moving towards its destiny: to become a credible alternative to the current monetary and financial system.

1 Response

[…] It will be a simple application of the law of supply and demand. […]