With Reserve Requirement for Banks Set to Zero by the Fed, You Need to Think Making Bitcoin Your Own Bank

If you continue to trust the banks, it will be at your own risk.

The month of March 2020 is forever etched in history. The strong spread of the coronavirus around the world will have played the role of trigger in the economic crisis announced for years by economists from all sides.

The financial markets were the first to be shaken by this strong climate of uncertainty. Panic even gripped the markets during the week of March. From this panic came a liquidity crisis that spared none of the liquid markets.

Concretely, a large majority of people wanted to recover as much liquidity as possible. Wall Street signed its worst month since 1987. Gold even lost more than 10% in the middle of March before recovering since then. Bitcoin had its Black Thursday on March 12, 2020. On that day, Bitcoin price dropped more than 50% from $8K to 3.8K.

Like gold, Bitcoin has since recovered to see its price rise above $6K in a move that seems to prove its status as a hedge against currency devaluation.

The big issue for individuals like you and me is precisely this large-scale currency devaluation that we will have to face in the coming weeks. This unprecedented currency devaluation in such a short period of time has been decided by the Federal Reserve in a totally arbitrary manner.

Not elected by the people, the members of this institution simply decided to carry out a program of unlimited quantitative easing. Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, even went so far as to say that the Fed had an infinite amount of U.S. dollar at its disposal to save the banking system:

“There is an infinite amount of cash in the Federal Reserve. We will do whatever we need to do to make sure there’s enough cash in the banking system.”

— Neel Kashkari

To facilitate this easy money policy, the Fed had paved the way ahead in the previous days by cutting interest rates by 150 basis points in two steps: 50 basis points on March 3, 2020 and 100 basis points on March 15, 2020.

With interest rates at zero, the Fed can now afford all the craziness even if it means devaluing even more what American citizens own. The current monetary and financial system must be saved at all costs.

You are aware of this problem which makes the Bitcoin plan increasingly inevitable.

Among the measures announced by the Fed during the month of March 2020, there is one that is just as serious, if not more, that has escaped many people so far.

The measure of concern is the lowering of the reserve requirement for U.S. banks to zero. In what follows, I propose to explain to you why this is a major threat to your money, and especially what you can do to prevent against it.

What Is the Reserve Requirement Rate for Banks?

I don’t think many people have reacted when reading that the Fed was lowering the reserve requirement for banks to zero for the simple reason that it doesn’t speak to ordinary people.

A lot of people don’t know what that means. Thinking that these are still technical matters in the banking world, majority of people preferred to move on.

This is a mistake, and you should always try to go beyond what the powerful people at the head of the fiat system want you to know.

So first of all, I’m going to explain to you what this famous reserve requirement rate is for banks. This rate is the percentage of what the banks have to keep in cash when a customer makes a deposit in their institution.

Let’s take the example of the 10% rate that the Fed has been asking the banks to apply until now before these changes.

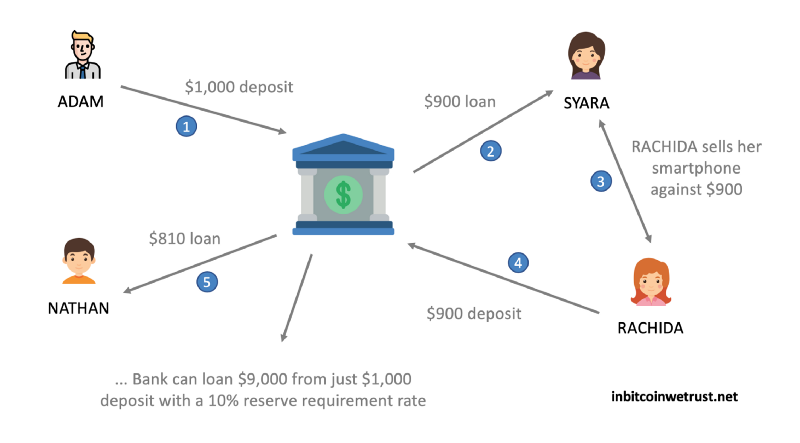

Adam is going to deposit $1,000 in the bank. At the same time, the bank can then loan $900 to Nathan. With that $900 loan, Nathan will buy a smartphone from Syara. Syara will then have $900 that she will put in the bank.

With this amount of $900, the bank will be able to grant a loan of $810 to Rachida.

Needless to continue, I think you understand the mechanism. With $1,000 initially deposited, the bank is then able to make up to $9,000 in bank loans.

To make you understand better, this is equivalent to creating $9,000 of debt.

This all sounds very nice. Now, let’s imagine that the $9,000 of money comes to be withdrawn at the same time by the depositors. The bank would not be able to pay $9,000, since it really only has $1,000.

The bank would therefore go straight to bankruptcy.

However, the system is based on the principle that as people who have taken out loans pay back, the money will be available to the depositaries again. Furthermore, it is based on the principle that not everyone will withdraw all their money at the same time.

To ensure this, the banks obviously have the power to prohibit withdrawals at any time in the event of a serious crisis.

The Zero Reserve Requirement for Banks Is a Threat to You

With a reserve requirement rate set at 10%, the risk was present, but still limited, since it was not possible to lend money infinitely from an initial deposit.

On March 15, 2020, the Fed blew this safeguard by lowering the reserve requirement rate for banks to zero.

The Fed justified this exceptional measure by arguing that it was intended to support the U.S. economy, which was about to be hit hard by the effects of the coronavirus.

From now on, U.S. banks no longer need to have any reserves on deposits made in their institutions. In practical terms, this means that U.S. banks have the ability to create money ad infinitum in the manner of the Federal Reserve.

Any U.S. bank can lend money to whomever it wants without having to account for its decisions. In fact, the regulations in force are based on the reserve requirements of banks. Now that they no longer have any obligation in this respect, they can do what they want.

Some people say that this is a good measure because it will increase the chances of the poorest U.S. citizens getting mortgages or loans from banks.

From that point of view, this measure will support the economy. Nevertheless, it will not be without risks.

From now on, when a customer goes to see the balance of his bank account, and he will see $10,000, he will have no guarantee that the bank has this amount available if he wants to recover his liquidity.

As explained earlier, if everyone wanted their money back at the same time, most banks could end up going bankrupt.

The liquidity crisis we have seen is linked to this type of fear. In such a situation, it’s better to keep your money in cash with you, to make sure you have it available.

In order to prevent all banks from going bankrupt in the event of a massive withdrawal by depositors, measures can be taken to limit the amount of withdrawals.

If you doubt that this can actually happen, you should know that this has already happened in Greece during the month of July 2015. For several days, savers had their withdrawals limited to 60 euros per day regardless of the amount they had in their bank account.

This is clearly unfair. You must be aware of this, and you are asking in the current situation what your options are to protect yourself from this major risk to what you own.

Bitcoin Can Allow You to Become Your Own Bank

With the economic crisis ahead of us, you are well aware that the Fed is going to do everything it can to save the current monetary and financial system. And this, regardless of the price to be paid by the citizens.

As an individual, the Fed’s lowering of the reserve requirement for banks to zero puts the money you have deposited in your bank accounts at great risk.

Your bank can now create infinite debt under the guise of supporting U.S. consumption. If you want to get your money back in full, it may well be impossible to do so in the coming weeks.

There is no guarantee that this will happen, but it’s a risk you can’t rule out.

To protect yourself from this risk, you must look for a suitable solution. Today, the only solution that guarantees that you will have what you have at all times is Bitcoin.

Bitcoin works all the time. It doesn’t have a leader. No one will be able to stop you from using your Bitcoin the way you want it and when you want it.

You also saw on March 12, 2020 that Bitcoin doesn’t even stop when everyone is looking to exchange it for fiat currency. The drop in price below $4K is the ultimate proof of this. Bitcoin is the only free market in the world.

Bitcoin allows you to regain complete control over what you own. In the years to come, I sincerely believe that more and more people will consider making Bitcoin their own bank so that they can manage their money the way they want.

Faced with the major risk that lowering the reserve requirement for banks to zero poses to your money, your best option for limiting the risk is again Bitcoin.

1 Response

[…] With Reserve Requirement for Banks Set to Zero by the Fed, You Need to Think Making Bitcoin Your Own… […]