6 Lessons the Federal Reserve Needs to Learn From Bitcoin

The oldest institution has lessons to learn from the newest system.

At the end of the day on March 15, 2020, the Federal Reserve continued its program to support the American economy, which has been hit hard by the spread of the coronavirus around the world. While the Federal Reserve had already decided to cut interest rates by 50 basis points on March 3, 2020, this time it decided in emergency to cut them by 100 basis points.

Federal Reserve interest rates are now between 0 and 0.25%. You read that correctly. The red line of zero rates has just been crossed by the Federal Reserve in a historic move that was immediately hailed by Donald Trump.

It must be said that Donald Trump had been calling for this cut for months in order for the Federal Reserve to align itself with the European Central Bank rates, which are even negative.

In addition to this interest rates cut, the Federal Reserve has also taken other key measures to stimulate the American monetary system for the umpteenth time:

- Another round of quantitative easing for $700B this time. In details the Fed will buy $500B in treasuries and $200B in mortgage-backed securities.

- 0% reserve requirement rate for banks.

With this last measure, banks will be able to lend, or more precisely print, as much money as they want.

The purpose of this new monetary stimulus was to meet Wall Street’s expectations, which had not been satisfied with the Fed’s previous announcements last week.

However, Wall Street’s reaction seems to indicate that this monetary stimulus from the Federal Reserve is being rejected by the market. For example, the Dow Jones is losing nearly 8% at the time of writing:

The losses were even greater at the opening of this session on March 16, 2020, as the Dow Jones was almost -10% at the time when trading was automatically halted.

The Federal Reserve has probably not finished with its actions to reassure Wall Street. In the coming weeks, or perhaps even before, I am even willing to bet that the Federal Reserve will follow the path of the European Central Bank by proposing negative interest rates.

A more intensive program of quantitative easing is also to be expected before the summer in my opinion.

All this shows once again that this system is no longer tenable. From my point of view, the Federal Reserve, and in general all the central bankers of the world, have several great lessons to learn from Bitcoin.

1. Monetary Stimulus Benefits Only a Minority

The Federal Reserve’s monetary stimulus is being sold as a way to support the U.S. economy. If you believe the Federal Reserve, this new stimulus would benefit the entire American population.

The central bankers of the world are also making the same misleading arguments when they do so.

The reality is that these monetary stimuli benefit only a minority. They benefit those who have abused this monetary and financial system for decades now.

These monetary stimuli only benefit the banks and Wall Street. The majority of the population suffers from these monetary stimuli because it devalues what they own a little more each time.

The worst thing in my opinion is that many people do not understand this. Those who do understand it, however, can do nothing more than suffer. Unless Bitcoin is the solution that can give hope to the majority who suffer from the mistakes of the current system.

Bitcoin is the only true free market in the world.

As such, Bitcoin does not need to be saved through the support of a central bank. Bitcoin lets the market, and therefore its users, decide its equilibrium price.

Last week, Bitcoin’s capitalization lost nearly $60 billion in just a few hours. Users needed liquidity. No one censored them. They were able to withdraw their money the same way they bought Bitcoin: by using their free will.

So Bitcoin benefits a majority because it’s totally democratic.

In the weeks to come, don’t be surprised if banks restrict withdrawals for fear that their panicked customers will want to withdraw all their money in cash.

2. Growth Can’t Be Infinite in Life

Wall Street investors, or Donald Trump, would like to believe that stock market growth can be infinite. Since the financial and banking crisis of 2008, central bankers around the world have been steadily taking steps to support the economy.

Supportive measures taken by the Federal Reserve, and other central banks around the world, have artificially inflated the financial markets.

Wall Street is full of extremely fragile publicly traded companies. Many of these companies should have failed long ago. They are only surviving because of the policy of ever lower interest rates and massive injections of liquidity.

These companies are like patients on life support who are guaranteed never to wake up, but whose families cannot bring themselves to let them go.

We are currently witnessing the end of this utopia of infinite financial market growth.

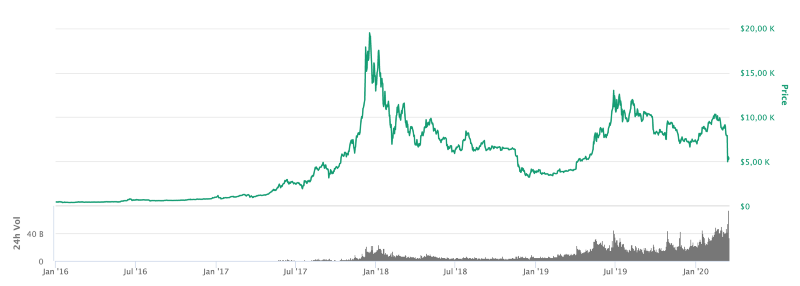

Bitcoin is letting its users decide the equilibrium price. When Bitcoin is at $20K, it is only because its users have decided it.

When Bitcoin drops 50% in a few hours, as it did on March 12, 2020, it is again because its users have decided it. Growth is not infinite, and there is no point in trying to maintain it at all costs.

On this point again, the Federal Reserve has a great lesson to learn by looking at how Bitcoin works.

3. A Monetary and Financial System Must Be Simple

I don’t know how you feel when you hear the Federal Reserve talk about interest rates, quantitative easing, buy in treasuries, or a 0% reserve requirement. For my part, I always feel that such announcements only speak to a minority of people.

This minority is made up of people who have taken the trouble to take a real interest in the economy by going beyond what they are taught.

Bitcoiners as a whole are in that minority of people who really understand the impact of the monetary stimulus decided by the Federal Reserve.

Bitcoiners understand that what the Federal Reserve decides devalues what a majority of people own. These decisions reinforce Bitcoiners’ belief that Bitcoin is the solution we need for the future.

Unfortunately, a minority of people see this as a sham. Sooner or later, however, the silent majority will wake up, and see that Bitcoin is their best option to get out of this monetary and financial system.

When these people discover Bitcoin, they will realize that a monetary and financial system needs to be simple so that everyone can understand how it works.

In the meantime, remember that every time a person loses faith in the current monetary and financial system, a new potential Bitcoin user is created.

Bitcoin can only continue to grow, given the systematic marketing campaigns in its favor lead by the Federal Reserve.

4. Resilience When Things Go Wrong Is an Essential Quality

Wall Street investors have lost an essential quality of people who achieve great things in life: resilience. At the slightest drop of more than 5%, they panic.

It must be said that Wall Street has locked them into an artificially protective system that is closer to socialism than to real capitalism.

As soon as Wall Street loses more than 7%, trading is automatically halted. Another fall of more than 13%, and trading is interrupted again. A third fall of more than 20%, and Wall Street closes for the day.

These measures were put in place to protect investors, according to Wall Street’s owners. In reality, they are only intended to protect the powerful at the head of the current monetary and financial system.

When things go wrong, Bitcoin teaches its users to be resilient.

There is no such thing as infinite growth, and life is made up of ups and downs. The best example of this roller coaster is to be found in the evolution of the price of Bitcoin since its creation:

Bitcoin price is volatile, but this corresponds to the actions of the users in its market. Bitcoin allows them to find the true equilibrium point for its price by never halting trading.

Bitcoin operates 365 days a year, 7 days a week, 24 hours a day.

5. A Monetary and Financial System Must Act for the Benefit of the Greatest Number of People

The decisions taken by the Federal Reserve are primarily intended to support Wall Street and the banks. These same players who are at the root of the ills that plague the economy today still enjoy leniency from the powerful in the system.

A monetary and financial system must act for the good of the greatest number.

Under the current system, this is no longer the case. It is no coincidence that the ultra rich are getting richer every time, while the poor see their standard of living rise too slowly. In this context, the gaps in society are only widening.

Bitcoin exists in limited quantities, so you can be sure that what you have in Bitcoin will never be devalued.

If you own 1 Bitcoin today, you will still own 1 Bitcoin out of 21 million in 10, 25 or 50 years.

This is an essential guarantee for all Bitcoin users. Again, this is a great lesson that Bitcoin can teach central bankers.

Make no mistake about it. These central bankers know very well what they are doing by increasing the amount of money in circulation. They are not stupid. Quite the contrary!

They know that they are acting on behalf of a minority, and simply to protect their outdated system. Bitcoin was built precisely to fix these problems, and that’s what it will do in the future as more and more people believe in it.

6. A True Free Market Must Let Users Decide on the Equilibrium Price

I have already mentioned it briefly in the previous points, but I will come back to it in a dedicated point. Indeed, it is essential that you understand that a true free market in the sense of capitalism must let its users decide the equilibrium price.

Bitcoin is a true free market. Bitcoin is even the only true free market in the world.

Bitcoin is constantly working to allow its users to choose its equilibrium price. When Bitcoin loses $60 billion worth of value in a few hours, Bitcoiners see it as a unique opportunity.

A unique opportunity to accumulate even more Bitcoins.

You will never see a Bitcoiner calling for help from any central bank. There isn’t one, because Bitcoin doesn’t need one. Its users will decide whether it succeeds or simply fails.

The stock market is filled with fragile companies that couldn’t withstand Bitcoin’s volatility.

Bitcoiners can withstand such volatility because they have complete confidence in a system that gives them full power back. New users entering the Bitcoin world are shocked by the resilience of Bitcoiners, but sooner or later they develop this essential quality.

Conclusion

The Federal Reserve continues to apply the same policies: lowering interest rates, then injecting liquidity on a massive scale. Wall Street is clamoring for this policy when the stock market loses 10% for more than a week.

Donald Trump, the President of the United States, is also in line with this philosophy. The philosophy of a failing monetary and financial system that needs to be artificially supported at all costs in order to continue its growth.

This artificial economic growth reassures people that are not yet aware of the limits of a system that will not be able to continue to do so for much longer.

Even the financial markets no longer seem to be satisfied with these monetary stimuli, whose effects are less and less tangible. Little by little, more and more people will lose faith in the current system.

Those disappointed in a failing and outdated system will be welcomed with open arms into a Bitcoin world that will protect them as they have never been protected before in their lives.

1 Response

[…] 6 Lessons the Federal Reserve Needs to Learn From Bitcoin […]