Does Your Fiat Money Still Have Any Value?

This is an issue that is becoming increasingly important at the moment.

Weeks go by, and unfortunately, they all look the same. I say unfortunately because the economic news are clearly not good at the moment. In the space of a month, more than 21 million people have joined the ranks of job seekers in the United States.

The United States ended February with an unemployment rate of only 3.5%. At the time of writing, the unemployment rate is now around 16%. Such a rapid increase had not been seen since the Great Depression in the early 1930s.

At that time, the unemployment rate was 3.1% just before the crash of 1929. The 15% threshold had only been reached in 1931. All this shows how serious the current situation can be considered. It only took a month for the unemployment rate to rise as much as it did in almost a year and a half at the beginning of the Great Depression.

Faced with this situation of extraordinary magnitude, the Fed made historic decisions, culminating in a liquidity injection of at least $8 trillion.

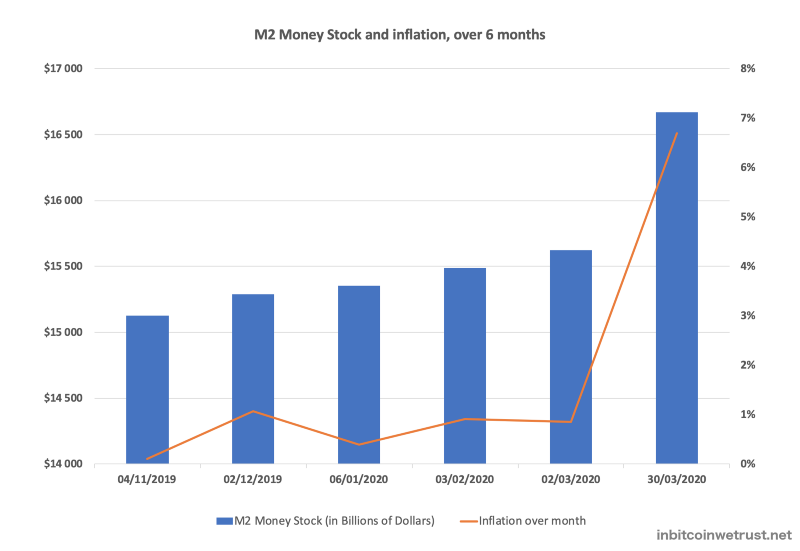

Represented by the M2 Money Stock Index, the outstanding money supply of the U.S. dollar increased by 6.7% in March 2020 alone:

At such a frenetic rate of printing U.S. dollars during the year 2020, the money supply in the U.S. dollar could very well go from $16.5T to nearly $30T.

The poorest will be the first to be impacted

Such an increase in the money supply in circulation is likely to induce a currency devaluation in the weeks and months to come. People whose wealth is mostly made up of cash will be the first to be impacted by this devaluation.

Those who own stocks, gold, or real estate will necessarily be more sheltered from the consequences of this inflation of the U.S. dollar.

As you may have guessed, it is the poorest citizens who have a “wealth” composed mainly of cash. As always, it is, therefore, the poorest people who will suffer the most from the Fed’s current policy of unlimited quantitative easing.

The other central banks have already followed the Fed’s lead starting with the European Central Bank, which has already injected 1.3 trillion dollars into the system, and also China, which has injected more than 500 billion dollars of liquidity.

At the current pace, the global money supply in circulation will reach $100T fairly quickly.

Governments also take action

These monetary stimuli address only part of the equation since they only help the banks, or the financial markets. Businesses and citizens are not directly helped by these monetary stimuli.

Thus, some governments have decided to put in place plans on a scale rarely seen before to help businesses, but also citizens to cope with this exceptionally difficult situation.

In the United States, a $2T package has been decided by the government and the U.S. Congress.

Most of this package is intended to finance bailouts for companies such as airlines for example.

These are the same companies that have preferred to carry out massive share buyback programmes in recent years to artificially inflate the price of their shares on the stock market, rather than building up treasury to face the difficult times that have just begun.

American citizens will get crumbs as part of this $2T plan.

I say crumbs because American citizens are only going to get a check for $1,200 as part of this monetary stimulus plan. In total, that will be just under $400 billion. Most of the $2T of the monetary stimulus plan decided by the U.S. government will therefore not go to American citizens.

These actions are financed by public debt

To finance its plan, the United States has once again increased its public debt, which now exceeds $24 trillion. This debt now exceeds 110% of U.S. GDP.

This figure, which could frighten ordinary mortals, is far from frightening Japan, whose public debt is slowly approaching 250% of its GDP.

Moreover, Japan is following the same path as the United States in the midst of this crisis. The Land of the Rising Sun has just declared a state of national emergency with an exceptional monetary stimulus plan that includes a $930 check for each citizen.

Other countries will undoubtedly follow this path in the weeks and months to come.

As a result, total global debt now exceeds $70 trillion. It is on its way to $100 trillion in the coming years, and it is not clear what could hinder this trend, unfortunately.

What is most worrying is that all these measures of a magnitude never seen before will probably not be enough to overcome this economic crisis, the effects of which we cannot yet really measure.

The idea of a universal income is gaining ground in the U.S.

Given the uncertainty of the economic situation in the weeks and months to come, Democrats in the House of Representatives have just introduced a law that proposes to give all eligible Americans a check for $2,000 each month until unemployment figures return to pre-crisis levels.

Such a proposal brings back the idea of a universal income for all citizens.

If such a measure were to be adopted, there is even a good chance that the American authorities will never be able to turn back the clock.

We have already seen that the $1,200 check was only a drop in the ocean, so much so that the poorest American citizens need much more than that to cope with the misery in which they live.

Their situation was already more than precarious before the coronavirus crisis, and all this is not going to help the case.

In the coming months, a major issue is likely to return to the forefront:

Should the United States continue to rely on the capitalist ideology that has enabled it to build its globally envied economic power ?

Or should the United States tilt this ideology to adopt certain doctrines of socialism such as that of a universal income for all citizens?

On this question, we have no answer at the moment. The situation will therefore be closely monitored in the coming months.

These decisions raise many questions

On the other hand, there is another big question that the decisions that are being made now will lead you to ask yourself:

Does Your Fiat Money Still Have Any Value?

Until now, you have lived a classical life in the current monetary and financial system. You had a 9-to-5 job that allowed you to survive. May be, you were an entrepreneur.

This work allowed you to buy things you wanted, to have a car, and the house of your choice. Of course, you had to pay taxes on your income.

All this gave your money a value in the current monetary and financial system. The U.S. dollar meant something strong to you.

After seeing that the Fed could print more than $8T in a snap, and then the U.S. government could decide in agreement with the U.S. Congress to send a check for $1,200 to all Americans, you might ask yourself some of the following questions:

- Does the fiat money I own still have any value?

- Why do I pay taxes if money can be created so easily?

- Why do I have so many debts to pay every month if money can be printed like this?

All these questions are legitimate. They are reinforced even more by the proposal to introduce a universal income.

If a universal income were to be introduced, why would it be arbitrarily set just at $2,000?

Since the Fed can print as much money as it wants, why doesn’t it decide to make all Americans millionaires in order to solve the problem of poverty in the United States?

These decisions raise many questions for which we have no answers at the moment.

The fiat money you own seems to have no real value anymore

As you can see, the easy money policy followed by the Fed, but also by all other central banks, clearly puts everything we own at risk. What’s more, the constant pursuit of quantitative easing policies allows central banks to put off solving the real problems until later.

The real ills of the current monetary and financial system are never solved. They are only postponed for 10 or 15 years. When the next economic crisis erupts, the magnitude is even greater.

For example, hundreds of billions of dollars were enough in 2008. For this new crisis, we are talking in trillions of dollars. In future economic crises, central banks will probably speak in quadrillions of dollars.

So the worst seems to be coming, and I have the feeling that the worst thing that is happening is that fiat money will no longer be worth anything for a majority of people.

Many will question the current system and ask what good it does to work so hard to make money if a simple snap of the finger can print trillions of dollars. Or if a universal income of an arbitrary amount can be paid each month.

In my view, the economic crisis we are experiencing could give way to a real ideological and social crisis with a profound questioning of the current system.

In conclusion, I cannot answer for you the question I have invited you to reflect on in this story. For my part, I am more and more disappointed by this monetary and financial system, and I am already moving towards an alternative solution to cover my backsides.

This solution is named Bitcoin, but it is only my personal choice.

For your part, I leave it up to you to judge the answer you wish to give to this question. Feel free to use the comments to share your opinion with me on this subject, which concerns us all.

2 Responses

[…] Does Your Fiat Money Still Have Any Value? […]

[…] The trillions of dollars printed out of thin air by the Fed and other central banks, as well as the trillions of dollars borrowed by all governments to finance stimulus packages, have made a growing number of people feel that fiat money no longer has any value. […]