3 Essential Reasons Why We Need Plan Bitcoin

The powerful at the head of the current system have made Plan Bitcoin mandatory.

Bitcoin’s adoption has been progressing block by block since its inception more than eleven years ago now. If you have any doubt about this, just check it out for yourself. Numbers don’t lie. And the numbers for Bitcoin are excellent. Bitcoin is stronger than ever.

Even so, I must admit that Bitcoiners are still a minority in society.

A majority of people still do not understand why Bitcoin is essential for today’s world, but even more so for the world of the future. Many remain blinded by what the powerful at the head of the current system say.

They do not seek to go beyond what the education system has taught them since their earliest childhood. They follow the masses blindly.

This is a very damaging thing, because they are missing out on a revolution that is there to help them take the best possible care of their future in terms of money.

In reality, if plan Bitcoin has become a necessity for all of us today, it is primarily because of the attitude of the people at the head of the current monetary and financial system. Among the reasons alone that justify plan Bitcoin, I will present the three main ones in the following.

1. We cannot trust governments and central banks

In a perfect world, you could have complete confidence in the actions of the politicians running your country. Nevertheless, you will agree with me that this remains a utopia.

Experience shows that politicians often make bad decisions.

Worse still, many politicians are corrupt. They take advantage of the current system to raise money, or favor companies whose leaders they know.

The economic crisis of 2020 is only the result of the economic crisis of 2008 whose ills have never been addressed. The governments of 2008 simply postponed solving the real problems by injecting tens of billions of dollars into the system at that time.

When the problems at the root of an economic crisis are not really dealt with, experience now shows us that they always resurface. Worse yet, when these problems resurface, their magnitude is increased tenfold.

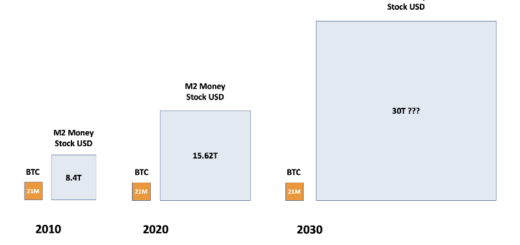

In 2020, central bankers have had to move up a gear.

Trillions of dollars had to be printed this time around to support a monetary and financial system that was running out of steam.

Not only the Fed’s balance sheet, but also that of the European Central Bank, explode. Both central banks have now moved ahead of BlackRock as the world’s largest asset managers.

If the money printed by the central banks helps support their respective economies for a while, it only postpones the problems. Worse still, it puts a heavy burden on the heads of future generations, who will have to pay more and more debts through taxes that will necessarily increase in amount.

In the end, it is always the people who have to foot the bill for all these economic crises.

This is all the more unfair because the people are in no way responsible for the mistakes of their leaders.

Some of these leaders, I am talking about the central bankers here, are not even elected by the people, but simply appointed. Their legitimacy is therefore subject to debate.

The great monetary inflation induced by the actions of the central bankers will put in difficulty a majority of people who need help now more than ever.

Rather than printing more and more fiat money, the real solution would be a thorough review of the current system. Unfortunately, the powerful people who run it will never do so.

Satoshi Nakamoto had this in mind when he created Bitcoin:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Satoshi Nakamoto

Since the solution cannot come from the minority that benefits from the fiat system, it must emerge from the people. This is precisely where the Bitcoin Revolution comes from. It is a necessity in order to separate money and state.

Bitcoin gives power to the people. It is a unique opportunity for all of us to take total control of what we own.

2. We cannot trust banks

Private banks are attached to the central banks of their respective countries. They represent the link between the central banks and the people. In today’s monetary and financial system, banks therefore have an essential role.

In order for the current system to work perfectly, we must be able to have full confidence in the banks.

The many scandals that have involved the banks for decades clearly show us that this is impossible. While most banks, starting with Goldman Sachs, accuse Bitcoin of facilitating illegal activities, it is actually the banks that are doing the most dubious things.

The banking system is so opaque that the banks can do as they please. Of course, a few scandals do erupt from time to time. For example, Danske Bank was convicted of facilitating the laundering of more than 200 billion dollars between 2007 and 2015 through its Estonian subsidiary.

Goldman Sachs was convicted of facilitating the laundering of more than 6 billion dollars in the 1MDB scandal.

Nevertheless, for a few scandals that broke out, hundreds of billions of dollars have been laundered with impunity by banks around the world for decades without anyone ever knowing about it.

Corruption in the banking world is a major problem that is unfortunately never dealt with at the root.

Unfortunately, the problems with the banks do not stop there. As private institutions, they have the right to apply the rules of their choice with their clients. This includes being able to censor, as they wish, actions carried out by their clients with their own money.

For example, your bank can prohibit you from making a transaction with your hard-earned money if it wishes to do so.

Better still, your bank may decide to freeze your assets on a simple arbitrary decision, or close your account. You think this is impossible? Yet, it happened recently in France where a client had all his accounts closed overnight.

The reason given by this bank with its unscrupulous practices? The customer had dared to criticize the bank’s customer service on Twitter!

Banks use and abuse censorship.

When he created Bitcoin, Satoshi Nakamoto was well aware of this problem as well:

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.”

Satoshi Nakamoto

Bitcoin is therefore a necessity to overcome the fact that it is impossible to trust banks.

I didn’t mention it, but as Satoshi Nakamoto explains very well, the fact that banks lend money when they only have a fraction of the money lent in reserve is a big problem. This creates credit bubbles.

The Fed’s decision on March 23, 2020 to lower the minimum reserve requirement for U.S. banks to zero further reinforces this problem.

Finally, the money transfer fees taken by the banks are far too high. With Bitcoin, you are able to send money instantly for ultra low fees without anyone being able to censor you.

3. We cannot trust human nature

A system in itself is never entirely good or entirely bad. The difference is going to be in the people who are going to run that system. It is the humans who run the current system that have made it so negative for a majority of people.

The current system has flaws, but the problem is that they have been fueled by the behavior of the humans who run it.

The banking system is opaque, and allows corruption. Nevertheless, if humans were fundamentally honest, it would be possible for this banking system to function without corruption.

Experience has shown us that human nature cannot be trusted in this respect.

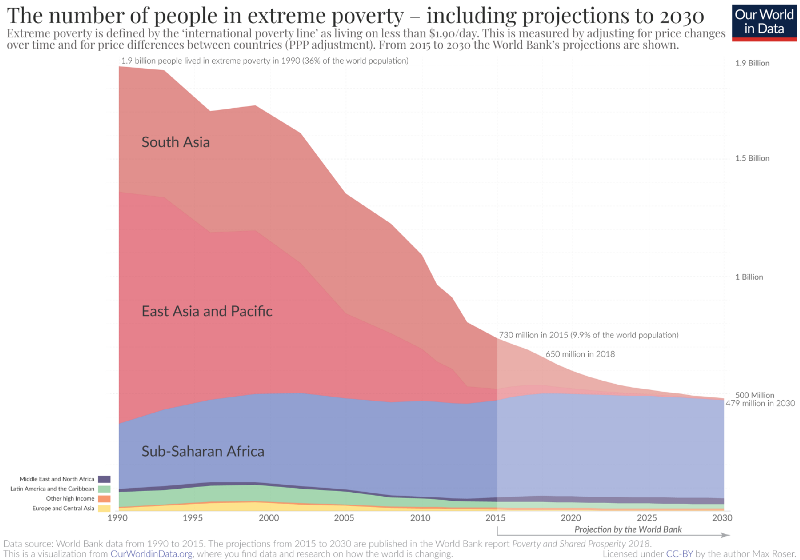

The figures for extreme poverty in the world are clear. It has been falling steadily since 1990 according to the World Bank figures:

The problem here is that we talk about extreme poverty if you live on less than $1.90 a day.

It is clear that by 2030, only African countries will still be affected by what the World Bank calls extreme poverty.

However, it must be understood that despite the progress observed since 1990, all this remains largely insufficient. While the number of millionaires and billionaires continues to grow at a frenetic rate, the poorest people have to make do with crumbs.

The current monetary and financial system is failing to be fair to the maximum number of people on the planet.

Unfortunately, humans cannot be trusted to be altruistic. Some are, of course, altruistic, but the majority are not. Thus, the richest take advantage of all economic crises to get even richer, but they redistribute very little of their wealth to the most needy throughout the world.

These two problems of human nature are fixed by Bitcoin.

Bitcoin offers a new beginning to all those excluded from the current banking system. Millions of people in Africa see Bitcoin as a unique opportunity to benefit from banking services. Bitcoin offers them a tremendous store of value that will change their future.

Bitcoin is a revolution that aims at the financial inclusion of hundreds of millions of people previously excluded from society.

Since the current system has failed to build a faired world for the many, Bitcoin has emerged to fill that void. Millions of people have already made Bitcoin their Plan A. This will only intensify in the years to come.

In addition, Bitcoin offers the advantage of running automatically by following the rules established by its source code.

No arbitrary human decision can change the rules of Bitcoin’s monetary policy, for example. This offers all Bitcoin users incredible guarantees in a world as uncertain as ours.

Conclusion

In an ideal world where we could have total confidence in central banks and private banks, Bitcoin would have no reason to exist. In a utopian world where humans would be altruistic by nature to help others, Bitcoin would not be a necessity.

If humans did not give in so easily to greed and corruption, Bitcoin would never have become the success it is today.

If the current monetary and financial system had succeeded in financially including the world’s poorest people, Bitcoin would never have been created by Satoshi Nakamoto.

Unfortunately, we live in an imperfect and inequitable world, so Bitcoin is a necessity to fix the flaws of the current system.