Bitcoin Is Your Hedge Against Currency Devaluation

The crisis we are going through will only strengthen this position.

Since the week of March 9, 2020, the world has definitely entered a crisis. The increasingly rapid spread of COVID-19 poses a major risk of a slowdown in the world’s major economies. As the starting point of this global pandemic, the Chinese economy was the first to be heavily impacted.

With the arrival of the coronavirus epidemic in Europe and the United States, the economic slowdown will soon affect many other countries. The uncertainty created by this situation has caused a real panic on the financial markets for just over a week.

The symbol of this widespread panic is to be found in the abysmal fall of Wall Street. The Dow Jones, which some saw reaching 30,000 points during the year 2020, even broke the 19,000 points threshold on March 18, 2020.

In one month, the Dow Jones has lost more than 35%.

All major U.S. companies are being hit hard. Around the world, the situation is exactly the same, starting with European companies.

The containment measures decided in Italy, Spain, Germany and France will put an end to economies that didn’t need it. Nevertheless, from a health point of view, it was of course the best decision for trying to stop the spread of the coronavirus.

Central Banks Called to the Rescue

Against this backdrop, we have been witnessing a real liquidity crisis over the past week. All liquid markets are being impacted. Gold has been affected, as well as Bitcoin which lost 50% of its value on March 12, 2020, going from $8K to just under $4K.

This kind of rapid decline of Wall Street had not been seen since 1987.

All Wall Street traders are appealing to the Federal Reserve to come to the rescue of a very bad situation.

Under pressure from Wall Street, but also from Donald Trump, the Federal Reserve made exceptional emergency decisions:

- Cut interest rates by 100 basis points with a target of 0 to 0.25% now. Note that it had already decided a 50 basis point cut on March 3, 2020 as a matter of urgency.

- Another round of quantitative easing for $700B this time. In details the Fed will buy $500B in treasuries and $200B in mortgage-backed securities.

- 0% reserve requirement rate for banks.

These exceptional measures will certainly not be enough, but they are a first effort by the Federal Reserve to provoke a monetary stimulus that is supposed to revive Wall Street and the U.S. economy.

Nevertheless, Donald Trump, and the Federal Reserve, will still have to act in order to support U.S. citizens in this unfolding economic crisis. Major measures are expected in the days or weeks to come.

In Europe, the situation is exactly the same, and the European Central Bank has decided in urgency, on March 18, 2020, an injection of liquidity of 750 billion euros.

Again, I doubt it will be enough, but it is a first step.

Around the world, all the other central banks are following the same path:

- The Bank of England has decided on a £400 billion liquidity injection.

- The Bank of Japan has decided on a liquidity injection of 12 trillion yen.

- The Bank of China has decided on a liquidity injection of 550 billion yuan.

I will stop here, but it is clear that the central banks of the world’s major economic powers are trying to put in place joint action for trying to prevent a widespread collapse of the global financial system.

These Decisions by Central Banks Devalue What You Own

I will focus a little more specifically on the Federal Reserve and the U.S. economy in what follows, but be aware that the problem is the same in every other country in the world.

The liquidity crisis that we are witnessing sees a majority of people exchanging their assets against the U.S. dollar.

As financial markets collapse, gold falls, and oil prices hit their lowest levels in over 15 years, the U.S. dollar strengthens against all of these markets.

In order to prevent Wall Street from continuing to sink, and to stabilize stock prices, the Federal Reserve opted for a weakening of the U.S. dollar.

This weakening of the U.S. dollar requires a massive injection of liquidity, which is tantamount to printing more money. In fact, the amount of U.S. dollars in circulation will increase further.

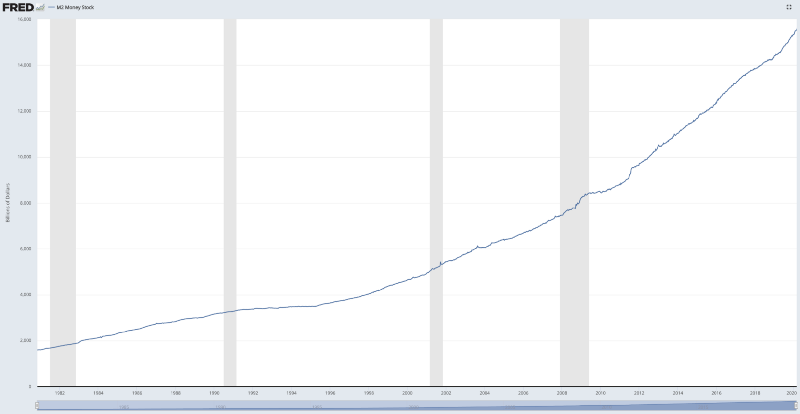

To help you better quantify this incessant increase in the money supply in circulation, look at the following chart:

This chart represents the evolution of the Federal Reserve’s M2 Money Stock since 1985.

The M2 Money Stock measures the money supply that includes financial assets held mainly by households such as savings deposits, time deposits, and balances in retail money market mutual funds.

When the Federal Reserve makes an emergency decision to inject more than $1T into the U.S. economy, the M2 Money Stock rises accordingly.

As an individual, what you own in U.S. dollars is devalued accordingly.

The people at the head of the Federal Reserve know very well what they are doing when they do this. Their goal is to allow a transition from the current deflationary environment, where the U.S. dollar is rising in value, to an inflationary environment, where the U.S. dollar is devalued.

Such a devaluation of the U.S. dollar may allow assets such as those traded on Wall Street to be artificially inflated again.

It is also a risky decision, because by pulling the rope too often using this monetary creation weapon, the Federal Reserve is taking the risk of a total failure of the current monetary and financial system.

Bitcoin Was Created to Serve as a Hedge Against Currency Devaluation

De facto created by Richard Nixon when he ended the convertibility of the U.S. dollar into gold in August 1971, the current monetary and financial system is also an experiment. It has been going on for 49 years, but the more time passes, the closer we get to the end of the experiment.

An alternative to the current monetary and financial system will have to emerge sooner or later.

The successive devaluations we are witnessing cannot leave the entire population unmoved for another 50 years.

More and more people are disappointed with the current system. Little by little, they are losing faith in a system that does not protect what they have. The monetary stimuli decided by the central bankers are having less and less effect.

Even Wall Street is beginning to doubt these policies of monetary creation as shown by the current value of the Dow Jones which remains around 20,000 points despite all the announcements of the Federal Reserve and other central banks around the world.

To save the current system, the Federal Reserve will have to print even more money. Some say that the figure could be as huge as $5T.

If such a decision were to be made in the coming weeks, the U.S. dollar would be devalued like never before. To combat the effects of this massive devaluation, many people will turn to very scarce assets.

Among these scarce assets is of course Bitcoin, which has a maximum supply of 21 million units.

Whatever happens, there will never be more than 21 million Bitcoins in circulation. So people who will exchange their fiat currencies for Bitcoin will have a huge guarantee.

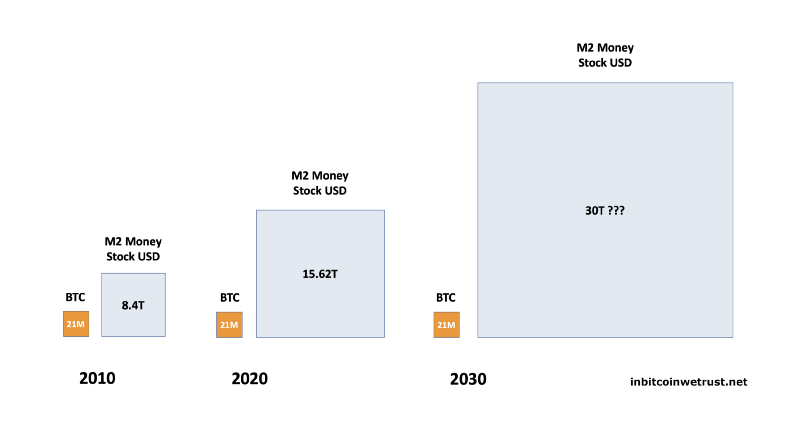

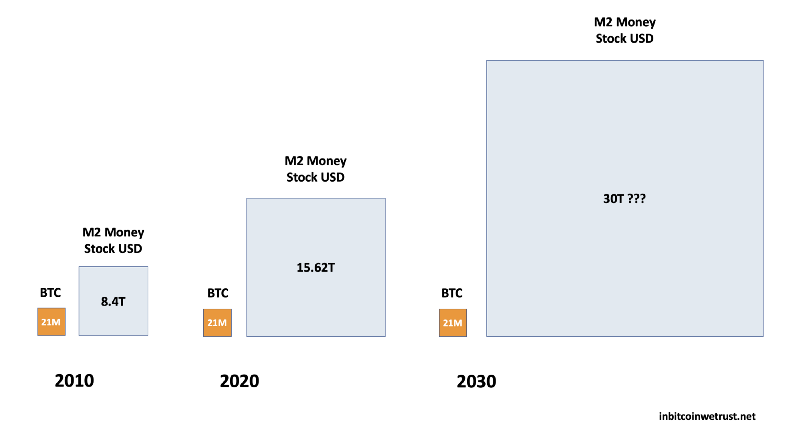

To help visualize this huge difference, here is a very telling illustration:

If you bought a Bitcoin in 2010, you had 1 Bitcoin out of 21 million in your possession. In 2020, you still have 1 in 21 million Bitcoin in your possession.

In 2030, you will still own 1 in 21 million Bitcoin.

On the side of the U.S. dollar, the situation is totally different. In 2010, you owned $1 in $8.4T. In 2020, that same U.S. dollar is only $1 out of $15.62T.

With the recent decisions made by the Federal Reserve, the devaluation of the US dollar will inevitably continue over the next decade.

To combat the massive devaluation of what you own in US dollars, Bitcoin is your best option right now.

No one knows if Bitcoin will complete its revolution in the future. However, at least you have a guarantee that if Bitcoin does, what you own in Bitcoin will be protected forever.

In my opinion, this essential guarantee is well worth taking the risk, controlled, of buying at least one Bitcoin.

Right now, this is clearly your best chance to opt-out of the current monetary and financial system in order to protect yourself from the many currency devaluations that will occur in the years to come.

4 Responses

[…] such, I believe Bitcoin will be a perfect hedge against currency devaluation in the difficult months […]

[…] this context, Bitcoin is increasingly seen as a hedge against the currency devaluation that we will undergo. To help you form your own opinion on the matter, I offer you a comparison of […]

[…] Bitcoin Is Your Hedge Against Currency Devaluation […]

[…] Bitcoin protects you from currency devaluation, and this is something that is essential at a time when the Federal Reserve makes monetary stimulus its only response to all the ills of the economy. […]