Bitcoin Inflation Works for You While USD Inflation Works Against You

A comparison to help you understand the danger of U.S. dollar inflation.

Since the beginning of the economic crisis that has been sweeping the world, the Fed has been on the move. The prestigious institution created in 1913 took several historic decisions during the month of March 2020. The Fed began by lowering rates by 150 basis points in two steps. This spectacular cut brought interest rates to zero.

The taboo of zero rates was thus broken in barely two weeks. These decisions then paved the way for an easy money policy that the Fed officially announced on March 23, 2020. On that day, the Fed announced that it would conduct an unlimited quantitative easing program in the coming weeks to support the U.S. economy.

At the time of writing, more than $6T has already been injected into the monetary and financial system that the Fed has decided to save whatever it costs to the American people.

On April 9, 2020, the Fed decided to build on this momentum by announcing an additional $2.3T program to support the U.S. economy. This program includes various measures with loans to American companies in difficulty, plans to buy corporate bonds both at an investment-grade level as well as high-yield, or junk, bonds.

All these decisions taken by the Fed will have enormous consequences on the daily lives of hundreds of millions of people around the world. Indeed, they will further increase the money supply of the U.S. dollar, which will lead to significant inflation.

In this context, Bitcoin is increasingly seen as a hedge against the currency devaluation that we will undergo. To help you form your own opinion on the matter, I offer you a comparison of inflation between the USD system and the Bitcoin system.

Focus on U.S. Dollar Inflation

The U.S. dollar is unanimously recognized as the world’s reserve currency today. Thus, all decisions taken by the Fed regarding the increase in the USD money supply have repercussions at the global level.

Indeed, the other central banks are each time obliged to align themselves with the Fed’s decisions.

When the Fed decides to print more than $6T in a few weeks, the citizens of the world will have to suffer the consequences in the months to come.

Unfortunately, the poorest will be more impacted than the richest. This is why the disparities are growing with the current monetary and financial system. The outstanding money supply of the U.S. dollar is represented by the Federal Reserve’s M2 Money Stock Index.

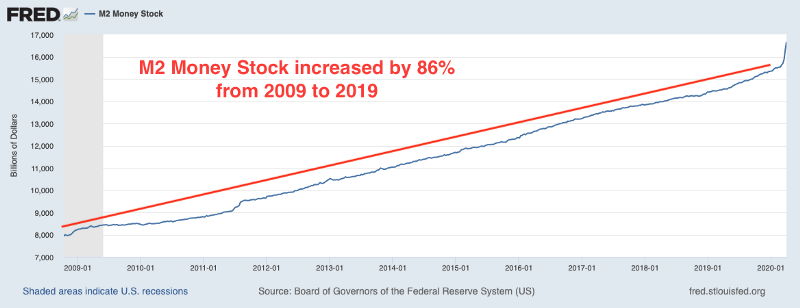

From 2009 to the end of 2019, the M2 Money Stock increased by 86%:

This increase represents an addition of $8T to the outstanding U.S. dollar money supply during this period.

During the year 2019, inflation in the M2 Money Stock had been 6.5% in total.

At the beginning of the year 2020, the U.S. dollar money supply was $15,129B. As you can see on the previous graph, a very strong increase has just taken place during the month of March 2020.

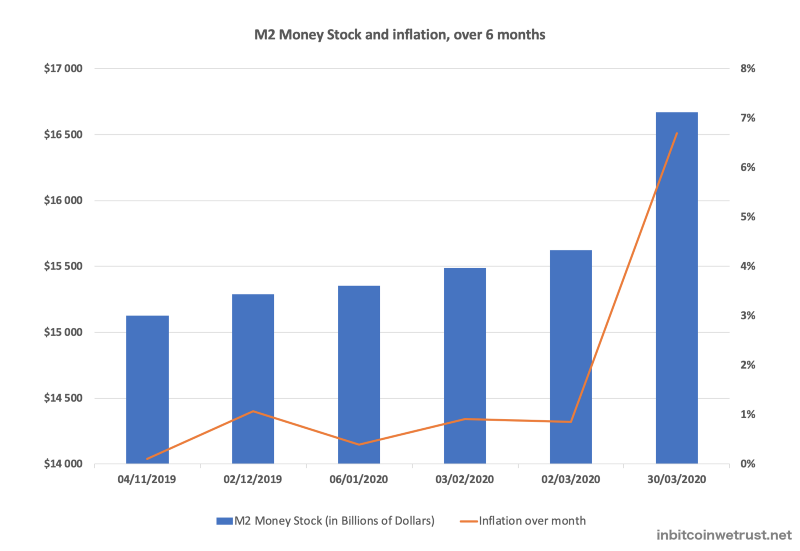

This increase is the result of the unlimited quantitative easing program that the Fed is currently conducting. To better understand the strong acceleration of this trend on the M2 Money Stock, I suggest you take a closer look at the first quarter of 2020:

While M2 Money Stock inflation was 6.5% for the whole of 2019, it is already 8.5% in the first quarter of 2020 alone.

Worse still, in March 2020 alone, M2 Money Stock inflation is 6.7%.

April 2020 will be similar if not worse with the Fed’s quantitative easing program that will continue and the $2.3T program it has just announced.

If M2 Money Stock growth keeps the same pace as March over the rest of 2020, we would be on track for an increase of nearly 80% by the end of the year.

That’s huge, and that could give us an outstanding U.S. dollar money supply of nearly $30T by the end of 2020.

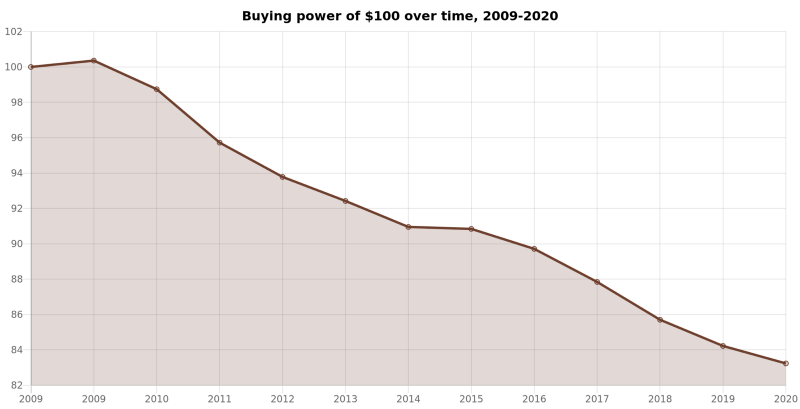

To give you a better idea of what this is going to mean in terms of loss of purchasing power, just look at the evolution of a purchasing power of $100 from 2009 to 2020:

With the already large increase in the outstanding money supply of the U.S. dollar from 2009 to 2020, your purchasing power of $100 in 2009 had lost almost 20% by 2020 to just over $80.

I’ll let you imagine the huge drop in purchasing power that we will all experience with the massive liquidity injections that the Fed is currently conducting.

Focus on Bitcoin Inflation

Now that you have a better understanding of how the Fed’s decisions are weighing on U.S. dollar inflation, and especially how much this inflation will increase in the coming months, I will talk to you about Bitcoin’s monetary policy.

Bitcoin has a well-known monetary policy that is written in its source code:

- A maximum supply fixed at 21 million units.

- A halving of the number of Bitcoins created for each block of transactions that occurs automatically every 210,000 blocks, approximately every 4 years.

- An inflation of the number of newly created Bitcoins that decreases over time towards zero.

Since Bitcoin has no leader, it is not possible for a single person deciding to change these unique properties of Bitcoin.

The difficulty to mine a transactions’ blocks, and thus create new Bitcoins via the reward given to miners, is adjusted every 2016 blocks added to the Bitcoin Blockchain.

This difficulty adjustment allows Bitcoin to stay on average on 144 validated transaction blocks per day. With the reward for miners of 12.5 Bitcoins currently, you understand that an average of 1800 new Bitcoins are created every day.

Around May 10, 2020, the third Bitcoin Halving will take place, which means that the Bitcoin reward given to miners for their work in securing the network will be halved.

After this third Bitcoin Halving, we will only have 900 new Bitcoins created every day.

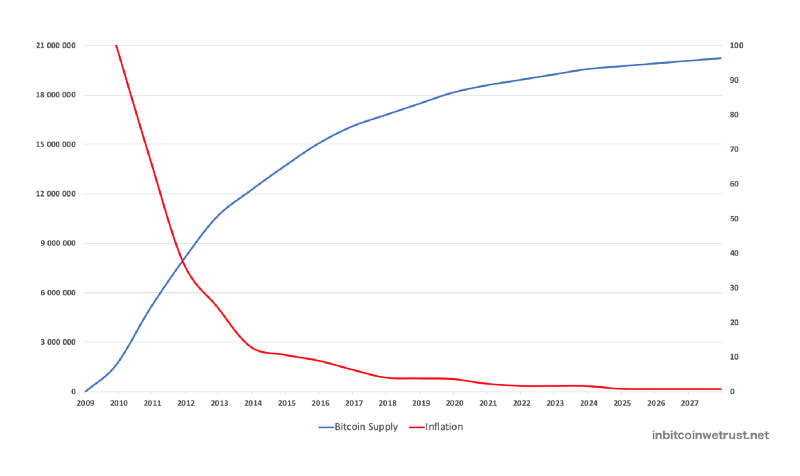

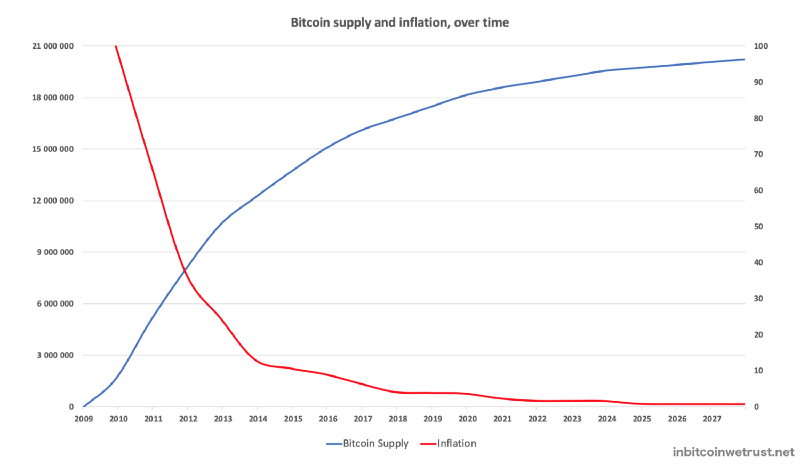

Since the creation of Bitcoin, the curves comparing the increase in Bitcoin supply over time with Bitcoin inflation look like this:

As you can see, Bitcoin supply is gradually approaching the 21 million unit limit which will be reached around 2140.

In addition, Bitcoin inflation continues to decrease year after year, with this decrease accelerating with every Bitcoin Halving.

After the third Bitcoin Halving in May 2020, annual Bitcoin supply inflation will drop below 2% for the first time, reaching around 1.8% in 2021. Following the fourth Bitcoin Halving in early 2024, inflation will even fall below 1%.

The reduction of Bitcoin inflation, and the fact that it tends towards zero over time, is therefore a huge guarantee for its users: the Bitcoins you own will become more and more valuable over time. Your Bitcoins become valuable because they are becoming more and more scarce.

Bitcoin Inflation Works for You

You now have a clear and accurate view of the recent inflation of the U.S. dollar and Bitcoin. I think you will have understood that the inflation of the U.S. dollar depends on decisions of a minority of people that are not elected by the people.

It is thus the Fed that has full power to decide to increase the outstanding money supply of the U.S. dollar even if it means devaluing what everyone owns strongly.

The decisions made by the Fed are totally arbitrary and unpredictable. You have no guarantee about the future evolution of the M2 Money Stock. However, reading the figures from past years, as well as recent Fed decisions, you can assume that the money supply will grow faster and faster in the future.

On the Bitcoin side, there is no leader to decide what monetary policy to follow.

When you enter Bitcoin world, you already know the nature of its monetary policy. It has never changed in more than eleven years of existence. This is an incredible feat that makes Bitcoin so valuable.

Bitcoin gives you certainty in an increasingly uncertain world: 1 Bitcoin you buy today will always represent 1 Bitcoin out of 21 million in the future.

The reduction of Bitcoin inflation over time will make the Bitcoins already created even scarcer. Every Bitcoin Halving causes a shock to the supply of Bitcoin which is accompanied by an increase in demand.

According to the principles of the law of supply and demand, Bitcoin price increases even more strongly in the months following each Halving.

Bitcoin owners therefore not only see their wealth preserved, but also increase over time. Bitcoin rewards you if you believe in its revolution by making the decision to be a Bitcoin HODLER.

Bitcoin works for you. On the other hand, the U.S. dollar works against you because your wealth will only erode over time if you do not take preventative decisions.

The decision to buy Bitcoin or not to buy Bitcoin is yours. For me, the decision to buy Bitcoin must come from an individual awareness.

The only thing you absolutely have to do is to educate yourself about money, the U.S. dollar, the fiat system, but also about Bitcoin so that you really have all the cards in your hand when it comes to making the best possible decision for your future.

1 Response

[…] Bitcoin Inflation Works for You While USD Inflation Works Against You […]