Bitcoin Is The Best-Performing Asset In 2019 And The Best Is Still Coming For 2020

And this is despite the significant drop in its price at the end of September.

The sharp drop in the price of Bitcoin at the end of September 2019 has revived debates on the excessive volatility of Bitcoin and cryptocurrencies in general. While this drop is a reminder that Bitcoin is different from traditional assets, it should not make you forget how far you have come in 2019 with a return to a bull market.

Some financial analysts have just published the list of the best-performing assets in 2019. And guess what? Bitcoin is at the top of the list by a wide margin.

The Bitcoin’s Price Has More Than Doubled In 2019

Bitcoin thus started the year 2019 with a price of around $3750. The rise in the price of Bitcoin was slow but steady throughout the first quarter before accelerating very strongly from May 2019. This increase continued to reach an annual maximum of around $13400 at the end of June 2019.

At that precise moment, the price of Bitcoin then showed an increase of more than 260% compared to its price on 1 January 2019.

The summer of 2019 will have been marked by a correction before the price of Bitcoin stabilized at around $10000 during the month of September 2019 just before a sharp drop below $8000 at the very end of the month.

While we are at the very beginning of October 2019, the price of Bitcoin is still around $8000. This still gives us an increase of more than 110% over the Bitcoin price on January 1, 2019.

The situation is simple: Bitcoin has more than doubled in 2019.

No Other Asset Does Better Than Bitcoin

In this context, it is extremely interesting to focus on some of the other major assets in order to compare their performances in 2019 with that of Bitcoin.

Gold, which is the usual store of value, has seen its price rise by 17% since 1 January 2019. In the equity market, we can look at the S&P 500 Index. Its performance was excellent but it remained at +21% for the year. The shares of tech start-ups are doing a little better with a +31% increase over the year.

Finally, what about the bond market? U.S. 10-year Treasury bonds yield only 1.6%, close to their historic low!

Here again, a simple observation must be made: no other asset does better than Bitcoin in 2019, and the margin is far from tenuous.

The Best Is Yet To Come For Bitcoin In 2020

Bitcoin can therefore legitimately be considered the most profitable asset from 2019 to date. This should even increase by the end of the year as many analysts are betting on a return to the annual maximum of Bitcoin, i.e. around $13000.

The great news is that the best is still coming for Bitcoin in 2020 and I will explain it to you through 4 main reasons:

1. Bitcoin Halving

The Bitcoin Halving is expected for the end of May 2020 at the latest news. As a reminder, Bitcoin Halving means that from now on the reward allocated to minors validating a block of transactions will be halved.

This reward will therefore decrease from 12.5 BTC to 6.25 BTC. In fact, the creation of new Bitcoins will be even rarer. And you know that everything that is rare is precious.

Thus, at each Halving of the Bitcoin Blockchain, there was a very significant increase in the price of Bitcoin in the following months. The year 2020 should not be an exception to this rule.

2. Next Financial Crisis

All economists keep repeating that all the conditions are currently in place for us to witness a financial crisis in 2020 on the same scale as in 2008.

The reasons are many: economic recession in many countries, Brexit and its consequences, the slowdown in China due to the trade war with the United States of Donald Trump,…

It should also be noted that in September 2019, the US Federal Reserve was forced to inject more than 53 billion dollars into US banks because they could not find enough day-to-day financing on the interbank market and from Money Market Funds. Could this be a sign of impending crunch credit?

All the actors wanted to be reassuring, but it was exactly the same in 2008. We, therefore, tend to believe that this famous financial crisis, so much so announced, will finally take place.

This will be an opportunity to see if Bitcoin will behave as a real store of value during a major global economic crisis. All this could therefore work in favor of a strongly bullish Bitcoin market in 2020.

3. FOMO Effect

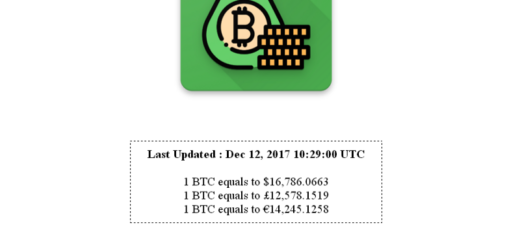

The upcoming Bitcoin Halving in 2020 and a major global financial crisis could really revive a Fear Of Missing Out (FOMO) feeling about Bitcoin among the general public. We saw the effect that this FOMO feeling had on the price of Bitcoin and cryptocurrencies in general during the euphoric year-end that we experienced in 2017.

All the conditions are really in place for this to happen in 2020.

Besides, the entry of institutional players into Bitcoin, including the Bakkt platform, has begun and this trend will inevitably intensify in the coming months, although the start seems timid for Bakkt.

4. Hash Power Is Rising More And More

Finally, vital signals specific to Bitcoin also point in the right direction. This is the case of the Hash Rate, which is constantly increasing and has also more than doubled since the beginning of 2019 to reach 90 exahashes per second.

As a reminder, the Hash Rate represents the computational power available at a given time T to validate blocks of Bitcoin transactions and thus mining new Bitcoins during this process.

The fact that Hash’s Power continues to increase again and again is an excellent sign for the Bitcoin Blockchain and shows that Bitcoin mining is once again becoming a very profitable activity.

Conclusion

Often criticized for being too volatile, Bitcoin sins because it is “a young man” in finance. Nevertheless, Bitcoin is the most profitable asset so far in 2019. Gold, the S&P 500, or the U.S. 10-year Treasury bonds remain at a distance in terms of profit.

The coming months look even better for Bitcoin, which should probably exceed its historical price of $20000 in the second half of 2020! Of course, such profitability cannot be achieved without risk, but that is the price to pay when you want to make good profits.

1 Response

[…] Bitcoin Is The Best-Performing Asset In 2019 And The Best Is Still Coming For 2020 […]