Bitcoin Works for You, While You Work for the U.S. Dollar

This is a fundamental truth that you need to understand.

Triggered by the coronavirus pandemic, the economic crisis of 2020 plunges us into a recession of a magnitude not seen in decades. The fact that this economic crisis was caused by a health crisis has accelerated things.

Lockdown of most of the world major economies will have long-lasting consequences, the effects of which we barely measure today.

Many are satisfied to see the stock market return to pre-crisis levels. I think this is a deception. Right now, the stock market is facing the iceberg illusion.

The current state of the economy is very worrying

There are many reasons for concern:

- A global pandemic far from being resolved.

- The beginning of a New Cold War between the United States and China.

- Growing political divisions in the United States.

- A social malaise that leads to riots in the United States.

- A public debt heading towards $30T in the United States.

- The Fed, which keeps printing more and more money and artificially inflates the financial markets.

- The number of job seekers had not increased as rapidly in 3 months since the Great Depression.

We are witnessing a decoupling of the real economy from the financial markets. Personally, I believe that this decoupling will not last. Sooner or later, the stock market will fall back to the reality of the real economy.

The Fed won’t be able to hold its current position of printing more and more U.S. dollar, and injecting them directly into the financial system.

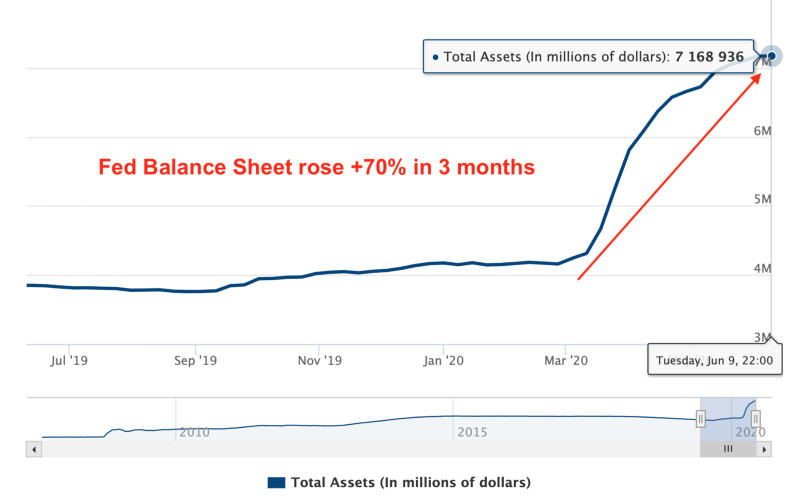

This policy of unlimited quantitative easing now makes the Fed the largest asset manager in the world ahead of BlackRock with over $7 trillion under management:

This increase in the Fed Balance Sheet is the result of the unprecedented increase in the amount of U.S. dollar in circulation in such a short period of time.

In just 3 months, the Fed has printed over $3 trillion out of thin air. This now takes the M2 Money Stock beyond $18 trillion. At the current rate, the $20 trillion is expected to be reached by the end of the year 2020.

At the same time, the U.S. government is steadily increasing its public debt to finance stimulus packages that only benefit the richest. While the poorest citizens see the U.S. public deficit exceed $26 trillion, they have to make do with crumbs: a stimulus check of $1,200.

The great monetary inflation will devalue what you own in U.S. dollar

The current actions are inducing a great monetary inflation that will devalue what you own in U.S. dollar. What many Bitcoin advocates have been pointing out for years is in that is emerging as a revelation to a growing number of people:

You’re working for the U.S. Dollar, while Bitcoin is working for you.

This ugly truth can be demonstrated by a simple example.

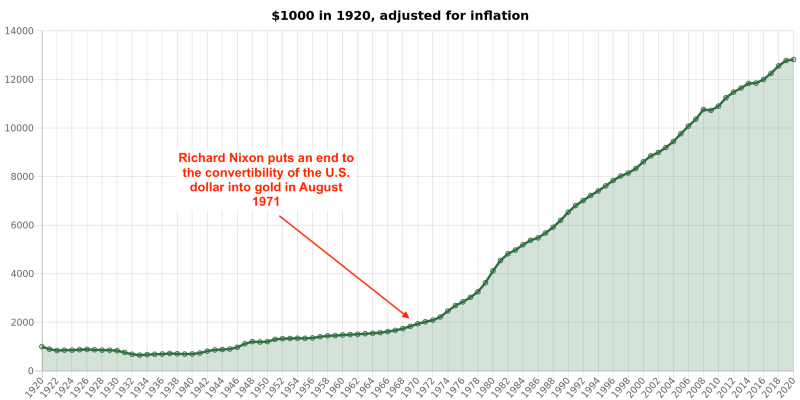

Imagine a person owning $1,000 in 1920. In order to still have the same purchasing power, this person would have to own $12,819 in 2020:

Without it, this person would not have been able to beat the effects of monetary inflation.

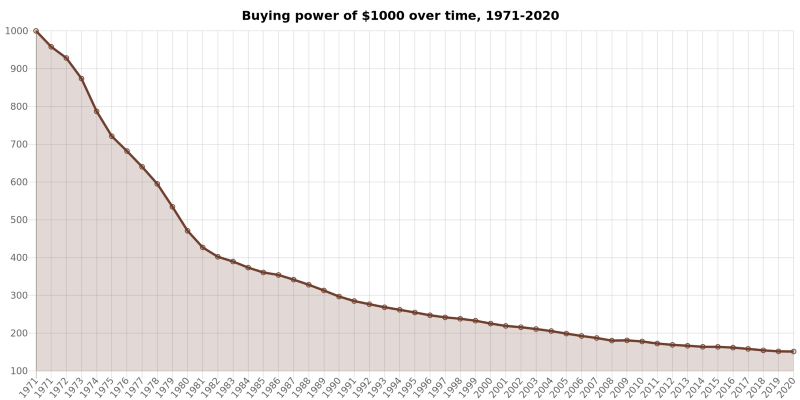

Your purchasing power in U.S. dollar is being eroded by this great monetary inflation. If you take a closer look at the figures, you will see that a purchasing power of $1,000 has lost 85% of its value since 1971:

The worst thing is that this situation has become the norm: between 2010 and 2020, the U.S. dollar has lost 17% of its value. That is huge.

With the U.S. dollar, and that goes for any fiat currency as well, you are doomed to witness a decline in your wealth. If you simply wish to maintain the same purchasing power, you will have to work much harder.

So you are working for the U.S. dollar.

The current system is flawed, and not fixable

You are a slave to a monetary and financial system that does not respect you. Within that system, decisions are made by a minority of people who are not representative of the people. You have understood here that I am talking about central bankers.

Two things have particularly shocked me since the beginning of this economic crisis concerning the Fed.

The first is to hear Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, boasting in an interview for the 60 Minutes program on March 23, 2020 that the Fed had an infinite amount of U.S. dollar at its disposal:

“There is an infinite amount of cash in the Federal Reserve. We will do whatever we need to do to make sure there’s enough cash in the banking system.”

— Neel Kashkari

A little more restraint on his part would have been welcome.

The second thing that shocked me was what Jerome Powell said during his interview for the same show 60 Minutes on May 17, 2020. Jerome Powell confirmed what we all know without any shame:

“The people who’re getting hurt the worst are the most recently hired, the lowest paid people. It’s women to an extraordinary extent. We’re actually releasing a report tomorrow that shows that, of the people who were working in February who were making less than $40,000 per year, almost 40% have lost their jobs in the last month or so. Extraordinary statistic. So that’s who’s really bearing the brunt of this.”

— Jerome Powell

The Fed thus knows perfectly well that its monetary policy benefits a minority of people while putting a majority of poor people in difficulty. Nevertheless, the Fed will not change its way of acting.

Jerome Powell is aware of the problem, but he will not seek to change the system, even if it is unfair. His only advice is to say that we will have to be strong in the coming months, which will be extremely difficult.

Jerome Powell then asked to the American government for pursuing policies to help the poorest as best they could.

Everybody is passing the buck, but nobody is taking action.

In contrast to the current system, where the U.S. dollar is the hegemonic currency, we have Bitcoin.

Bitcoin is a democratic alternative to the current system

Bitcoin is an emerging solution from the people. With no leader at its head, Bitcoin belongs to all its users. It is a true democracy that responds only to its source code.

No arbitrary decision can be made by a minority with Bitcoin. Everything must be based on a consensus of its community. All Bitcoin users have equal weight. Every user can decide to become a node in the network.

The monetary policy is written in Bitcoin source code. It is therefore automated and predictable.

When buying Bitcoin for the first time, you know that it is available in limited supply. There will never be more than 21 million Bitcoins mined. Furthermore, the inflation of the supply of new Bitcoins is halved for every 210,000 mined blocks.

The third Halving of Bitcoin took place on May 11, 2020. Since then, Bitcoin has an annual supply inflation of less than 2%. It is currently 1.8% which puts Bitcoin just ahead of gold and its yearly inflation of 1.6%.

After the next Bitcoin Halving in a little less than 4 years from now, the annual inflation of the supply of new Bitcoins will fall below 1%. Eventually it will reach zero when all Bitcoin has been produced by 2140.

As you can see, everything is clear and precise with Bitcoin.

You won’t have the unpleasant surprise of someone deciding to add the equivalent of $3 trillion to the available supply of Bitcoin. In fact, Bitcoin offers you an incredible guarantee:

1 Bitcoin purchased in 2020 will still represent 1 Bitcoin out of 21 million in 2100.

Bitcoin highlights the virtues of quantitative hardening.

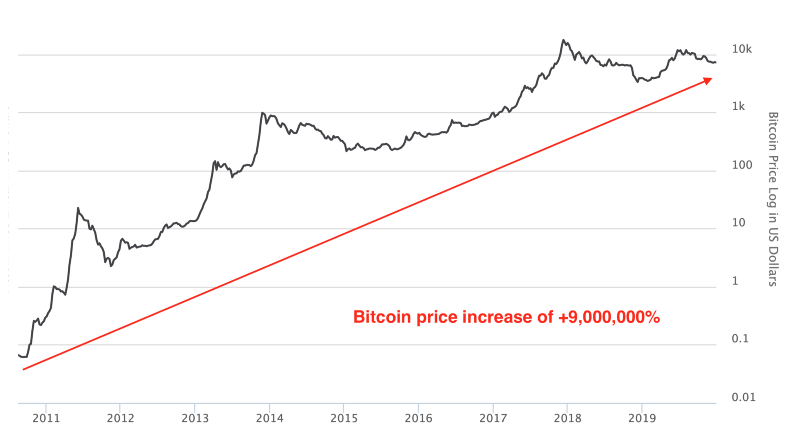

This unprecedented monetary policy contrasts with the quantitative easing of central banks. The more time passes, the more the Bitcoin units already in circulation increase in value. This is confirmed by the evolution of Bitcoin price since 2010:

In 2010, a Bitcoin was worth less than $1. In 2020, it is worth more than $9,000.

Bitcoin works for you by allowing you to think long term

So Bitcoin works for you. It allows you to preserve your wealth. It is a tremendous store of value with qualities objectively superior to gold for the masses: divisibility, portability, recognizability, not confiscable, and a much greater scarcity.

All you need to buy Bitcoin is a smartphone and an Internet connection. Then you can start buying it for as little as $10 if you wish. With gold, that’s impossible.

By becoming a Bitcoin HODLER, that is, by having complete confidence in Bitcoin to keep it no matter what, you will see the initial value of your purchase grow over time.

By doing nothing but trusting Bitcoin, your wealth will grow. So Bitcoin literally works for you.

The best part of all this is that Bitcoin will then allow you to preserve your wealth without any risk of censorship. No one will be able to stop you from making the transactions you want to make, or confiscate what you own.

Unlike the fiat system which uses you completely without ever giving you a say, Bitcoin needs you just as much as you need it.

This interdependence between Bitcoin and its users is essential to me.

Conclusion

Bitcoin is still at an early stage. Its growth potential for the coming years is immense. Those who will seize the unique opportunity that Bitcoin represents will be able to truly benefit from its revolution.

Unlike the U.S. dollar, where you have to work harder and harder to maintain your purchasing power, Bitcoin works for you. All you have to do is be a Bitcoin HODLER, and then fundamentally believe in its revolution.

If you succeed, you will be able to free yourself from the current monetary and financial system. You will take complete power over your wealth. You will be able to seize the unique opportunity that Bitcoin gives you: to live your life on your own terms.