Bitcoin Is Designed to Be Saved, U.S. Dollar to Be Spent

It’s up to you to make the best choice for your future.

Since the establishment of the Bretton Woods system in 1944 at the end of the Second World War, the status of the U.S. dollar as the world reserve currency has steadily strengthened. The end of the convertibility of the U.S. dollar into gold, unilaterally decided by Richard Nixon in August 1971, has even strengthened the hegemony of the U.S. dollar at the world level.

While it is not based on anything tangible, the U.S. dollar inspires enormous confidence in hundreds of millions of people around the world. Many even swear by the U.S. dollar.

This hegemony has allowed the United States to impose its law on the rest of the world for several decades now. In addition to these geopolitical considerations, the U.S. dollar, as well as all other fiat currencies, are formidable weapons that lock people into an infernal spiral.

The infernal spiral I am referring to is the infinite spending of what you own in fiat money.

The infinite amount of U.S. dollar makes savings useless

The U.S. dollar was designed to be spent. If you want to exercise your fundamental right to save the money you earn, you are going to be a big loser.

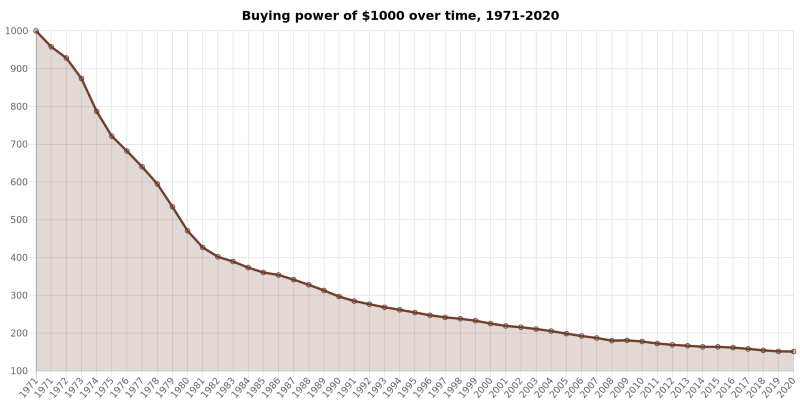

Inflation of the U.S. dollar inevitably erodes your purchasing power over time. Thus, $1,000 in 1971 represents today only $151 in purchasing power in 2020:

Since Richard Nixon introduced de facto the current system in 1971, the U.S. dollar has lost 85% of its value. The worst thing is that this situation has become the norm: between 2010 and 2020, the US dollar has lost 17% of its value. That is huge.

The current monetary and financial system, in which the U.S. dollar is the dominant currency, therefore gives you no reason to save the money you’ve earned so hard by working.

When you ask a person to choose between $1,000 to spend immediately even if they don’t need anything, or $836 that will be available in 10 years when they really need to make a purchase, you know as well as I do what the person will choose.

The person will obviously prefer to spend all or part of his $1,000 rather than lose money with inflation. They don’t need anything, but will eventually consume to fit into the mould of society that the current monetary and financial system has defined.

The problem with the U.S. dollar, and this is true again of all other fiat currencies, is that it exists in infinite quantities.

If you still had any doubts, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, admitted it without any shame at the 60 Minutes of March 23, 2020:

“There is an infinite amount of cash in the Federal Reserve. We will do whatever we need to do to make sure there’s enough cash in the banking system.”

— Neel Kashkari

The money you have in U.S. dollar can therefore be devalued at any time on the simple decision of a minority of people who have not even been elected by the people.

Economic crisis of 2020 exposes flaws in the monetary and financial system like never before

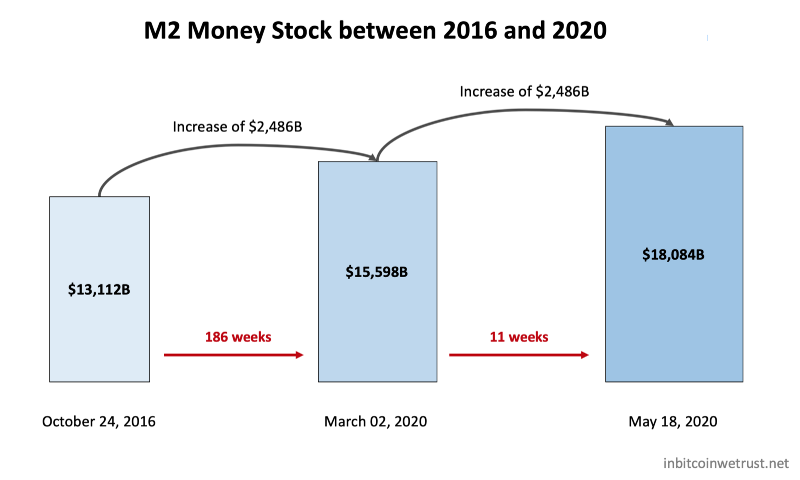

Since the beginning of March 2020, the Fed has printed nearly 2.5 trillion dollars, bringing the M2 Money Stock above 18 trillion dollars for the first time in its history.

The coronavirus pandemic began at the very beginning of March 2020. In eleven weeks, the amount of U.S. dollar in circulation increased by $2,486B. The previous increase of such an amount took 186 weeks:

At the current pace, the $20 trillion is likely to be reached by the end of 2020.

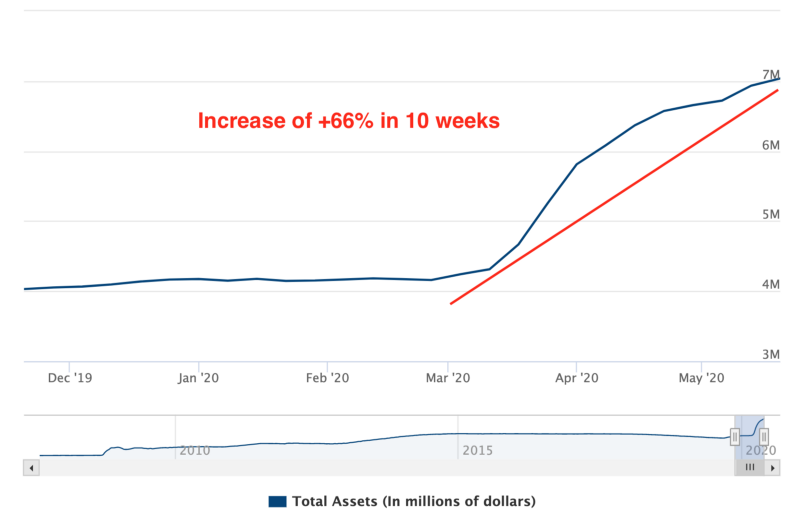

All this money printed by the Fed is injected directly into the monetary and financial system, which must be saved at all costs. The Fed Balance Sheet has increased by +66% over the same period of time. It exceeds 7 trillion dollars for the first time in its history now:

All this money printed by the Fed is making the rich people richer, while it is the poorer people who really need help right now.

In the midst of this economic crisis, Jeff Bezos’ fortune has increased by nearly $35 billion, Mark Zuckerberg’s by $25 billion, and Elon Musk’s by nearly $12 billion.

Meanwhile, the poorest citizens are struggling to survive.

The great monetary inflation that we are currently experiencing as a result of these actions by the Fed and other central banks is unfortunately not the only problem with the fiat system. At the same time, governments are carrying out stimulus plans financed by public debt.

The public debt of the United States has just exceeded 25 trillion dollars. All of the world’s major economic powers now have a public debt-to-GDP ratio well above 100%.

At last count, the sum of the stimulus plans decided by the G20 member countries amounts to more than 9,000 billion dollars.

All of this places an extremely heavy burden on future generations. Indeed, it is the people who will have to pay for these colossal public debts. On the other hand, those responsible for these economic crises that follow one another at regular intervals always get out of them without any damage, because they are protected by the fiat system.

The current system is unfair, but no one wants to change it

The bankers are of course to blame in the first place. Corruption scandals involving banks have been going on for decades. It seems inconceivable to be able to trust these institutions, which have far too much power over what you own.

For example, a bank may at any time seize your cash arbitrarily, or at the express request of a government. Banks also do not refrain from censoring their customers’ transactions in a totally arbitrary manner. Since they are private, banks will tell you that they apply the rules of their choice.

You have no power with the U.S. dollar and fiat currencies.

Everything I have just explained to you shows you that the U.S. dollar and the entire monetary and financial system around it have been designed so that spending is your best option.

By spending your money quickly, you avoid all the problems associated with a decline in your purchasing power, or the confiscation of what you have. However, this is probably not what you want to do.

Like any citizen, you would like to be able to live your life on your own terms by enjoying your hard-earned money. If this is the case, you should look for a way to opt out of this fiat system where the U.S. dollar is king.

The powerful at the head of the current monetary and financial system know perfectly well that the current system is unfair.

Jerome Powell confided this in a recent interview for the 60 Minutes program, during which he said that he knew very well that all the Fed’s actions to support the American economy impacted first and foremost those who needed help the most:

“The people who’re getting hurt the worst are the most recently hired, the lowest paid people. It’s women to an extraordinary extent. We’re actually releasing a report tomorrow that shows that, of the people who were working in February who were making less than $40,000 per year, almost 40% have lost their jobs in the last month or so. Extraordinary statistic. So that’s who’s really bearing the brunt of this.”

— Jerome Powell

In spite of this, Jerome Powell has nothing to propose to fundamentally change a totally unfair system. He is not the only one to blame, since none of the powerful people at the head of the current system will take the risk to come and change the situation.

Bitcoin is a people-led revolution that fixes the flaws of the current system

As is often the case in this kind of situation, the solution can only come from the people. And that requires a revolution. This peaceful revolution is called Bitcoin.

Created by Satoshi Nakamoto following the banking crisis of 2008, Bitcoin should be seen as a response to the flaws of the current monetary and financial system.

Bitcoin is a unique invention in the history of mankind that Satoshi Nakamoto gave to all the inhabitants of the Earth as a gift.

It is up to its users to make Bitcoin a success or a failure.

Bitcoin gives the weapons to the citizens of the world to regain control over what they own. It is up to them to seize this extraordinary opportunity.

I have shown you the fact that the U.S. dollar exists in infinite quantities is a major problem. Bitcoin corrects this because it exists in finite quantities: only 21 million Bitcoins will be put into circulation.

The scarcity of Bitcoin is one of its major strengths.

Even better, Bitcoin’s monetary policy is written in the network’s source code. Thus, it does not depend on any human decision. By definition, humans are prone to corruption, which leads them to make bad decisions for the community as a whole by letting their greed take precedence over their morals.

Bitcoin runs automatically, and no one can change its monetary policy, which is therefore predictable. The number of new Bitcoins produced each day is halved for every 210,000 blocks mined. This allows existing Bitcoin units to increase in value over time.

Bitcoin highlights the virtues of quantitative hardening, which you have to contrast with the unlimited quantitative easing conducted by the Fed and other central banks.

Bitcoin is a savings technology that gives you the power

In fact, Bitcoin is a savings technology. A formidable store of value whose superiority over gold is slowly beginning to appear to more and more people.

When you decide to enter the Bitcoin world, you can make the choice to save without risk, since you are guaranteed that 1 BTC of 2020 will always be equal to 1 BTC of 2100.

With the U.S. dollar, you have the opposite guarantee as I showed you earlier.

Even better, Bitcoin allows you to become your own bank. As long as you take responsibility for the security of what you own, Bitcoin will give you total control over your wealth.

You don’t need any permission on the Bitcoin network to make a transaction. You can send money to a friend on the other side of the world without risking your bank asking you intrusive questions about why you are sending money.

These are your Bitcoins, you can do whatever you want with them as long as you have the associated private keys. It’s not for nothing that Bitcoin remains the best solution for making cross border money transfers in terms of security, speed, and transfer fees.

Finally, Bitcoin allows you to resist any kind of censorship since no one can confiscate your Bitcoins. This allows you to save money with peace of mind.

Your Bitcoins are yours and yours alone as long as you have the associated private keys.

For people living in authoritarian regimes, Bitcoin is vital because it is their best chance to protect their wealth. First of all from the hyperinflation that is ravaging countries such as Iran, Venezuela, Lebanon and Zimbabwe.

Secondly, if people living in a country like Afghanistan are forced to leave their country because they are threatened, they will be able to transport their wealth to their host country without any worries. With fiat money, or even worse gold, it is very likely that these people will no longer have their assets when they arrive in their host country.

In the course of their journey, unscrupulous people will have taken everything they own. With Bitcoin, this is impossible. All you have to do is memorize your 24-word recovery phrase. Then you can recover your Bitcoins from anywhere in the world.

So Bitcoin was designed to give you the ability to take full control of your money destiny. As such, it is totally opposed to the U.S. dollar.

Conclusion

A majority of people still see the U.S. dollar as the ultimate symbol of wealth. Unfortunately, not all of these people realize that the U.S. dollar, like all other fiat currencies, has been put at the center of a system that aims to make you spend more and more money.

By taking away your interest in saving your money, the monetary and financial system pushes you to consume more and more against your will.

Until now, many people thought that there was an irremediable side to this. The emergence of Bitcoin over the past decade has changed all that. With Bitcoin, you have a secure and reliable savings technology at your disposal.

You need to make the best choice for your future by picking the most protective solution that respects your desires. From my point of view, Bitcoin is clearly that solution. It’s up to you to decide if this is the case for you as well, or if you prefer to have blind faith in the US dollar.

1 Response

[…] Bitcoin Is Designed to Be Saved, U.S. Dollar to Be Spent […]