Jerome Powell’s Interview Confirms That the Fiat System Is Flawed, Bitcoin Is the Solution

It’s time to try another way.

As Chairman of the Federal Reserve, Jerome Powell is at the forefront of the fight against the economic crisis that has been raging in the United States since the emergence of the coronavirus pandemic in early March 2020.

Every statement by Jerome Powell is therefore expected by a large number of people. The decisions taken by the Fed even more so, of course.

Contrary to what happened during the economic crisis of 2008 when the Fed was slow to act, the Fed has decided to be pro-active with this economic crisis of 2020. The Fed very quickly decided to lower interest rates by 150 basis points in the month of March 2020 to bring them down to zero.

At the same time, the Fed decided to conduct an unlimited quantitative easing program to save the monetary and financial system whatever the cost. Finally, the Fed also lowered the reserve requirement rate for U.S. banks to zero.

All these decisions made by the Fed are historic and were taken with incredible speed.

An economic crisis more serious than the Great Depression

What happened next proved Jerome Powell and the Fed were right. The U.S. economy has plunged completely since then. The number of unemployed in the U.S. has increased by 37 million since the start of the coronavirus pandemic.

U.S. GDP fell by almost 5% in the first quarter. The number of companies on the verge of bankruptcy continues to rise. Applications for bailouts from the U.S. federal government are pouring in.

Unprecedented support plans have been decided, but most of the money is going to the biggest companies. As always, small businesses are being left behind.

It is exactly the same for American citizens. It is the poorest, those who were already in great difficulty, who are suffering the most from this economic crisis.

In his exclusive interview for the 60 Minutes show on May 17, 2020, Jerome Powell confirmed that everyone is aware of this problem:

“The people who’re getting hurt the worst are the most recently hired, the lowest paid people. It’s women to an extraordinary extent. We’re actually releasing a report tomorrow that shows that, of the people who were working in February who were making less than $40,000 per year, almost 40% have lost their jobs in the last month or so. Extraordinary statistic. So that’s who’s really bearing the brunt of this.”

— Jerome Powell

The statistics prove it: the poorest are the most affected by this economic crisis, which is already looking much worse than the Great Depression in the 1930s.

However, all the money printed by the Fed is going mostly to the monetary and financial system.

Jerome Powell confirms this very honestly when asked where the money that the Fed has been creating since the beginning of its unlimited quantitative easing program comes from:

“We print it digitally. So as a central bank, we have the ability to create money digitally. And we do that by buying Treasury Bills or bonds for other government guaranteed securities. And that actually increases the money supply. We also print actual currency and we distribute that through the Federal Reserve banks.”

— Jerome Powell

The Fed has the power to create an infinite amount of U.S. dollar from thin air, as Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, said in an interview on the same 60 Minutes show on March 23, 2020.

In his interview, Jerome Powell also confirms that the economic situation will be even worse in the second quarter of 2020:

“So the level of economic activity is going to decline substantially in the second quarter. It will be reported at an annual rate, which will basically be four times as much as the amount it shrank in that quarter. But it’s going to be a sharp decline by any measure.”

— Jerome Powell

However, he tries to reassure us by saying that it is indeed the coronavirus pandemic that has caused this extraordinarily difficult economic situation. For Jerome Powell, “the economy was fine, and the financial system was fine” before that.

So Jerome Powell believes that a recovery of the economy will be quicker, even if it will necessarily take time.

Economy cannot fully recover without a coronavirus vaccine

Before we can envisage a real recovery of the economy, Powell also explains that the coronavirus will have to be brought under control. Until this virus is brought under control, the economy will always be at risk from the uncertainty it creates.

If the economy is to get back on its feet, and everything is to get back on track, people will need to regain confidence.

They will have to regain the desire to go to restaurants, to travel, to take planes, or all sorts of things that allow the economy to function properly.

The economy will only start to recover when those activities are going to start up again. So there is still a great deal of uncertainty about the economy in the weeks and months ahead.

Returning to the subject of support for those who need it most, Jerome Powell went on to explain that it is not within the Fed’s prerogative. It’s in the hands of the U.S. government and Congress. He shares his view:

“The Congress has done a great deal and done it very quickly. There is no precedent in post-World War II American history that’s even close to what Congress has done. They have passed $3 trillion in stimulus, which is 14% of GDP. It is vastly larger than anything they’ve ever done. And also very, very quick. So a lot of that money is just starting to flow through the economy. And it’s going to help households and businesses in coming months. The thing is that the coronavirus shock is also the biggest shock that the economy’s had in living memory.”

— Jerome Powell

In his view, the U.S. Congress has done an excellent job in moving quickly to put over $3 trillion to support the U.S. economy.

Like everyone else, Jerome Powell is well aware that this is not enough given the incredible shock to the economy that this coronavirus pandemic has caused.

As to whether the Fed or the U.S. Congress will have to do more, Jerome Powell doesn’t really know. He suggests that both will have to do more in the coming weeks:

“And I don’t think we know the answer to that. It may well be that the Fed has to do more. It may be that Congress has to do more. And the reason we’ve got to do more is to avoid longer run damage to the economy. If we let people be out of work for long periods of time, if we let businesses fail unnecessarily, waves of them, there’ll be longer term damage to the economy. The recovery will be slower. The good news is we can avoid that by providing more support now.”

— Jerome Powell

The Fed will probably have to inject more money into the fiat system

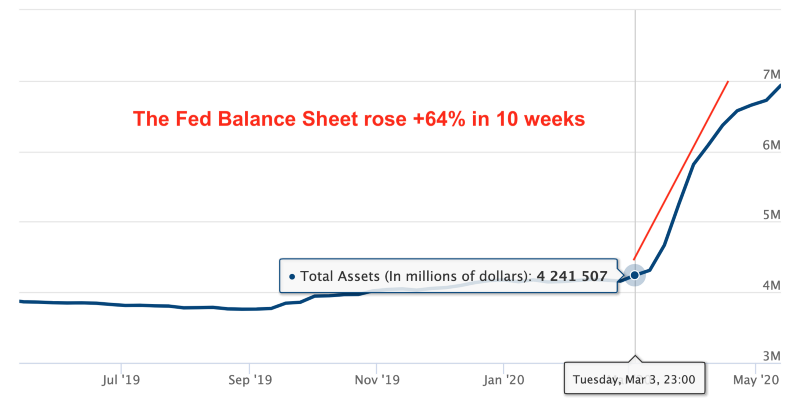

We can therefore expect more liquidity injections into the fiat system from the Fed in the coming weeks. This prospect is quite incredible when you realize that the Fed Balance Sheet has already increased by 64% in just 10 weeks:

At the level of the United States government, a new $3 trillion stimulus package will be presented to the Senate. This plan would be in addition to the 3 trillion dollars already injected into the economy by the American government.

This new stimulus package will again be accompanied by a $1,200 stimulus check for all eligible citizens.

It should be remembered that many Americans had favored the purchase of Bitcoin with their previous check, which already reflected a total loss of confidence in the U.S. dollar.

The citizens have this feeling simply because they can see that nothing is getting better for them when more than 10 trillion dollars have already been put on the table between the Fed and the U.S. government. Many people feel that all this money is just saving a fiat system that only increases the disparity between the rich and the poor.

As the the theories behind the Cantillon Effect explain very well, all the money injected in this way goes directly to the richest. The latter are therefore becoming even richer with the economic crisis we are currently experiencing.

The poorest are being hit hardest by the great monetary inflation and will have even more difficulty surviving.

The Fiat System Is Flawed, Bitcoin Is the Solution

The interview with Jerome Powell shows the limits of the current monetary and financial system. This system, created de facto by Richard Nixon in 1971, will soon approach 50 years of existence.

Since inception of the current system, the inequalities between rich and poor have continued to grow.

And the current situation is going to make things worse in the coming weeks despite all the goodwill of the Fed or the American government. The fiat system is simply flawed, and it cannot be fixed as it stands.

An alternative solution is emerging: it is called Bitcoin.

Bitcoin is a completely different view of the money than the U.S. dollar, whose inflationary nature makes it impossible to create a sustainable economy that benefits the greatest number of people.

One economic crisis follows another with an ever-increasing magnitude each time.

Whereas hundreds of billions of dollars were enough in 2008, we are now talking in trillions of dollars. In the future, we will probably switch to the higher unit, the quadrillion.

Satoshi Nakamoto created Bitcoin with a radically opposite approach as he explained on February 18, 2009 in a message posted on the P2P Foundation forum:

“Instead of the supply changing to keep the value the same, Bitcoin supply is predetermined and the value changes. As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.”

— Satoshi Nakamoto

Bitcoin was designed to be a formidable store of value that grows in value as the number of users grows. To achieve this, Satoshi Nakamoto has chosen to artificially limit the number of Bitcoins that can exist.

In the future, you will probably have to choose to continue with a fiat system that keeps increasing inequalities, or gradually switch to an alternative that is more respectful of your wealth, which is Bitcoin.

The interview with Jerome Powell clearly highlighted this need in my opinion. It is up to you to educate yourself to make the right choice for the future.

2 Responses

[…] Jerome Powell’s Interview Confirms That the Fiat System Is Flawed, Bitcoin Is the Solution […]

[…] Jerome Powell’s Interview Confirms That the Fiat System Is Flawed, Bitcoin Is the Solution […]