Bitcoin Is Your Antidote Against the Cantillon Effect

Bitcoin protects your savings against currency devaluation.

In the stories I write about Bitcoin, I usually say that becoming a Bitcoiner develops your critical thinking skills like never before. You are always looking to get to the bottom of things to see for yourself.

After discovering Bitcoin, I’ve been digging into economic subjects that once seemed totally disconnected from my reality. The magic of Bitcoin is also to make you want to learn more and more about everything to do with money and how it works.

This desire to understand the ultra-complex mechanisms of the monetary and financial system that governs our world today allows you to discover that things you feel have already been formalized in the past.

I imagine that you have already felt that all the decisions made by central bankers and governments benefit only a minority of people who are already wealthy. When the Fed announces a multi-trillion dollar quantitative easing program, you suspect that a tiny minority of the population will benefit.

Well, you should know that this perverse effect of the legacy system, which increases the inequalities between rich and poor, was formalized during the 18th century by Richard Cantillon.

French banker and philosopher, Richard Cantillon highlighted an early version of this phenomenon in his book “An Essay on Economic Theory”.

The Cantillon Effect

The theory put forward by Richard Cantillon explains that when a state is going to print a lot of money, who will actually benefit from it will depend on the institutional structure of that state.

In the 18th century, when Richard Cantillon wrote his book, he explained that the richer you were and the closer you were to the king, the more you would benefit from the printing of money by the state.

On the other hand, the poorer you were and farther away from the king, the more you would be penalized by this printing of money in mass.

Richard Cantillon explains in substance that money is not neutral.

Thus, the impression of money by a state has distributive consequences that operate through the price system. This general observation was later called “The Cantillon Effect”.

In Richard Cantillon’s time, the monetary system was based on gold.

In his book, he takes as an example what happens when a country discovers a new gold mine on its territory. De facto, the amount of gold in that country increases.

This increase in the amount of gold not only increases the price, but it also changes who has wealth and who does not.

Richard Cantillon writes:

“Doubling the quantity of money in a state, the prices of products and merchandise are not always doubled. The river, which runs and winds about in its bed, will not flow with double the speed when the amount of water is doubled.”

— Richard Cantillon

For Richard Cantillon, the richest people who would benefit from this new gold mine first would spend their money, which would lead to higher prices.

In the long term, the money would go to the most disadvantaged people too. However, before that happens, these poor people will have had to pay higher prices because of price inflation.

This sudden inflation will have a strong impact on the poorest because of an unequal distribution of purchasing power. Inequalities in wealth would be even more pronounced.

The Cantillon Effect in Our Time

In the year 2020, the Cantillon Effect has never been more topical. All you have to do is replace the discovery of a new gold mine with the ability to print fiat money.

During the month of March 2020, the Fed has just decided to carry out an unlimited quantitative easing program to support the U.S. economy.

Behind the technical name of quantitative easing, you have to understand that it is about printing U.S. dollar. Since the Fed is talking about an unlimited quantitative easing program, it means being able to print U.S. dollar infinitely.

More than 6 trillion dollars have already been printed in just over a month by the Fed. Other central banks follow the same monetary policy.

The question you need to ask yourself is this:

Who immediately benefits from the trillions of dollars printed by the Fed and other central banks?

This mass-printed fiat money benefits banks, hedge funds, or the private equity market. It is also used to buy government debt or mortgage-backed securities.

The Fed, and other central banks, want to ensure that there will be sufficient liquidity in the monetary and financial system.

This massive injection of liquidity has a strong impact on Wall Street. You can see this impact in the evolution of the Dow Jones since the Fed decided to conduct this unlimited quantitative easing program:

As you can see on the previous chart, the Dow Jones had just lost more than 35% of its value in one month to reach a low of 18,591 points on March 23, 2020.

On the same day, the Fed announced an unlimited printing of the U.S. dollar.

Since the announcement of its unlimited quantitative easing program, the Dow Jones has recovered nearly 30% of its value. The situation is almost identical for the S&P 500.

This increase in Wall Street is in total contradiction with the real economic situation in the United States. Since the beginning of the coronavirus crisis, more than 26 million US citizens have filed claims for unemployment benefits.

The unemployment rate in the United States has now reached 20%, up from 3.5% at the end of February 2020.

There is a total mismatch between the country’s economic situation and Wall Street, with the stock market being artificially inflated.

Behind this discrepancy, the Cantillon Effect will play to its full extent.

This strong inflation of the outstanding money supply of the U.S. dollar will lead to a currency devaluation. Those with diversified financial assets such as real estate, stocks, bonds and gold will be less affected than those with only cash on hand.

Indeed, these assets will increase sharply as a result of the looming currency devaluation.

On the other hand, do you know who has assets consisting solely of cash?

The poorest people of course. The richest people will even benefit from this crisis with the stock market bubble that is likely to continue to grow.

The poorest people will see their purchasing power strongly impacted at the very moment when prices are expected to rise. This is indeed the famous Cantillon Effect in action.

Bitcoin Is Your Antidote

The Cantillon Effect makes it clear that the money poured into the system will be forced to reach the poorest. Nevertheless, they will have been heavily penalized by price inflation when this money reaches them.

The richest will have benefited first from this money injected into the system, and the inequalities of wealth will be further widened.

The poorest people therefore have no interest in saving their fiat money because inflation will reduce their purchasing power over time.

This is where Bitcoin comes in as an antidote against the Cantillon Effect induced by the monetary policies of the world’s central banks.

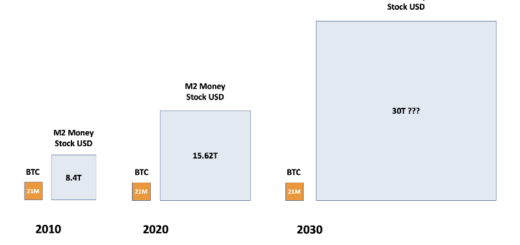

You can choose to exchange your fiat currency for Bitcoin. Bitcoin has a quantitative hardening monetary policy that protects what you own. Better yet, Bitcoin increases in value over time. Your wealth increases simply by saving.

Bitcoin gives you the opportunity to choose to postpone your decision to invest in the stock market or the real estate market until inflation is absorbed and prices become reasonable again.

When the money poured into the system in droves eventually reaches you, you will then have the option to exchange your Bitcoins for fiat money to invest.

This way you will have protected what you own without having suffered the full force of currency devaluation like those who have kept U.S. dollar in their possession.

Some will tell me that gold can also act as a store of value protecting from the Cantillon Effect. This is partly true. But the problem is that gold is not accessible to poor people like Bitcoin is.

In addition, gold suffers from major flaws compared to Bitcoin. Objectively, Bitcoin has better divisibility, durability, portability, recognizability, and is much scarcer.

Bitcoin is therefore the perfect antidote against the Cantillon Effect to which the decisions made by central banks and governments expose you.

(Disclaimer: This story contains an affiliate link for the book “An Essay on Economic Theory”. If you choose to make a purchase after clicking this link I may receive a commission at no additional cost to you. Thank you for your support!)

2 Responses

[…] since the 18th century by the economist Richard Cantillon, this phenomenon is known as the Cantillon Effect. All the money printed will make the rich even richer, while the poor who have a wealth composed […]

[…] Bitcoin Is Your Antidote Against the Cantillon Effect […]