While Gold Is Reserved to the 1%, Bitcoin Is the Real Hedge Against Uncertainty for the People

Bitcoin is accessible to all.

The world is going through a situation that has not been seen for decades. The global coronavirus pandemic is sweeping away everything in its path. The coronavirus is calling into question all the certainties of all sides.

The lockdown decided in most countries of the world to limit the spread of the coronavirus during March 2020 has hit the world economy hard.

Apart from China, which is expected to remain in positive territory this year with weak growth of 1%, the economies of all other G20 countries will be in recession in 2020. The latest IMF estimates predict a recession of -6 to -15% for G20 countries.

The figures are catastrophic, but there is even more worrying. The coronavirus pandemic appears to be on the verge of starting a second wave in Asia and Europe. In the United States or some South American countries such as Brazil, the first wave has never been brought under control.

The situation is clearly beyond the control of President Donald Trump in the United States. Figures reported daily are seeing the major American states breaking records day after day in terms of the number of cases detected and the number of people who have died from Covid-19.

The world is plunged into total uncertainty for the coming months.

The $10 trillion already printed won’t be enough

To support the economy, the world’s major central banks have printed more than $10 trillion since March 2020. The Fed tops the list with more than $3 trillion that has been printed out of thin air and injected into the monetary and financial system.

All this money has allowed the G20 countries to go even further into debt to propose stimulus plans to cushion the shock on the economy that this coronavirus pandemic represents.

The United States has already spent more than 2,500 billion dollars with its first stimulus plan. This has brought the U.S. debt to more than $26 trillion. As a proportion of U.S. GDP, which will fall sharply in 2020, the U.S. also now has a debt-to-GDP ratio of over 100%.

Having a debt-to-GDP ratio above 100% seems to become the norm for G20 countries in 2020.

All this debt will sooner or later have to be repaid. It is the people who will have the heavy task of paying back these pharaonic debts with a lot of taxes.

Unfortunately, all this money printed and injected into the system will not be enough.

The Fed and the U.S. government are still going to have to act

The economic situation in the United States is still extremely bad, with a very high number of job seekers, and bankruptcies that are multiplying.

Worse still, the $600 per week compensation was given to more than 20 million unemployed Americans expires at the end of July 2020. Already in great difficulty, these millions of Americans, who are among the poorest in the country, will be exposed as never before.

Given the urgency of this situation, the American government wants to implement a new $1,000 billion stimulus package. The Democrats are calling for a more ambitious package of up to $3 trillion.

In any case, a $1,200 stimulus check for all eligible American citizens should once again be part of that stimulus package.

The Fed’s printing of the U.S. dollar is far from over. This also indicates that the U.S. public debt will probably reach $30,000 billion by the end of 2020.

The Cantillon Effect will become more pronounced

The great monetary inflation that we have been experiencing since March 2020 will therefore intensify. The resulting currency devaluation of the U.S. dollar will primarily affect the poorest citizens.

Described since the 18th century by the economist Richard Cantillon, this phenomenon is known as the Cantillon Effect. All the money printed will make the rich even richer, while the poor who have a wealth composed mainly of cash will be put in even more trouble.

This is exactly what is happening during the economic crisis of 2020.

The Fed’s actions have, for example, created a real Tech bubble in the stock market. This has made Jeff Bezos, Bill Gates, or Elon Musk even richer. A few days ago, Jeff Bezos’ fortune even jumped by 13 billion dollars in a single day.

If you still had doubts, it’s time to open your eyes, a speculative bubble has formed in the stock market around Tech companies.

Meanwhile, the real economy is heading straight into a W-shaped recession. The disconnection between the economy and the stock market cannot last forever. This iceberg illusion will end sooner or later. The big question is when.

There is great uncertainty around the world. Until a vaccine against the coronavirus has been made available to as many people as possible, a complete recovery of the world economy cannot be envisaged. This is not me saying this, but the Chair of the Fed, Jerome Powell himself.

Gold benefits from this uncertainty but remains reserved for the richest 1%

Faced with this uncertainty, investors are turning to safe havens in times of crisis. Known for decades as a safe haven in times of crisis, gold is taking advantage of the current situation to see its price in U.S. dollar break records.

The demand for the precious metal is exploding at all levels.

In these conditions, it is not surprising that gold is up +26% in 2020. The price of an ounce of gold is even close to $2,000 on the spot market.

Central banks are increasing their gold reserves, as are institutional investors, but the phenomenon is also spreading to individual investors.

However, even though gold has interesting qualities as a hedge against uncertainty, it is still reserved for an elite.

The people who currently buy gold are among the richest 1%.

The limited divisibility of gold makes it inaccessible to the majority of the Earth’s inhabitants.

Gold can be seized at any time by governments

Moreover, gold suffers from serious limitations in terms of resistance to censorship. Since gold cannot be easily transported or secured, you will have to store it in the vaults of a bank probably.

However, history has already proven that States can seize gold from their citizens at any time. This was done in the United States by Franklin Roosevelt under Executive Order 6102.

All Americans’ gold was then seized to finance the New Deal policy. The Gold Reserve Act of 1934 then led to a devaluation of the dollar against its gold fix: the official rate of $20.67 rose to $35 per ounce.

Many believe that this will not happen again. I’m no fortune-teller, but it’s a risk I’m not willing to take with what I have. This risk seems all the more real to me since many people have been raising the idea of reserving the possession of gold to central banks for several months.

As such, keep in mind what Mark Twain said:

“History doesn’t repeat itself but it often rhymes.”

Mark Twain

While it is often said that history never repeats itself twice, what happened in the past always gives today’s leaders ideas.

In any case, the price of gold will probably continue to rise in the coming months due to increasing demand from the famous richest 1%.

With gold reserved for the 1%, the rest of the world turns to Bitcoin

The poorest people will also have to find a hedge against the current uncertainty. Since gold is inaccessible, they will have to find a store of value that is easily accessible for them.

Bitcoin is the perfect answer to this need, which will grow in the coming months.

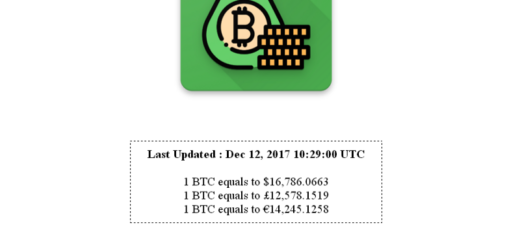

Divisible up to eight digits after the decimal point, Bitcoin can be purchased in very small quantities.

The poorest people can easily buy Bitcoin to protect themselves from the current world uncertainty.

On the other hand, all you need is a smartphone and an Internet connection to buy Bitcoin. For gold, it’s much more complicated than that, as you will be asked for identity documents.

When carrying your Bitcoins, you will only need to remember your 24-word recovery phrase. With this phrase anchored in your brain, no one will be able to steal your Bitcoins when you travel.

Your gold will have been taken from you long before, and you will have had to justify why you want to move it.

Bitcoin is totally resistant to any kind of censorship.

As long as you have the private keys to your Bitcoins, no one can confiscate them or prevent you from using them as you wish.

The year 2020 will have shown everyone on Earth how uncertain the world we live in today can be. Anything is possible, even the unimaginable.

Conclusion

The current monetary and financial system is showing its flaws as never before. The need for people to protect their wealth in a way that is resistant to censorship came to light in 2020.

This is fortunate because this is precisely the greatest value proposition of Bitcoin today. Much more than a means of payment for the everyday life of the general public, Bitcoin is the only censorship-resistant store of value available to all.

Bitcoin is the money of the people. Bitcoin is the hedge against the uncertainty for the people.

As such, the adoption of Bitcoin will explode in the future. The potential for growth in Bitcoin price is incredible, as this rising demand will face a supply of new Bitcoins that will continue to shrink in the years to come.

You shouldn’t be surprised if the Bitcoin price reaches the million-dollar mark within 20 years.