The Uncomfortable Truth about Bitcoin as a Means of Payment That You Absolutely Must Hear Now

The greatest value of Bitcoin is elsewhere right now.

Despite its undeniable success, Bitcoin still faces a significant number of opponents. These opponents seek every excuse to criticize Bitcoin in order to discredit it in the eyes of the general public. The narrative of Bitcoin opponents often revolves around the same topics.

Bitcoin would be dangerous because it is nothing more than a Ponzi scheme, or a tool making easier money laundering or ransomware.

I am not going to go over these baseless accusations again. If you read me on a regular basis, you must have already read several of my stories in which I have deconstructed these false arguments.

In particular, I invite you to read the story in which I explain that Bitcoin is actually more difficult to use than the U.S. dollar for illicit purposes.

Having said that, I read very often Bitcoin opponents attacking it on another subject that I find more interesting to study. Some argue that Bitcoin is a failure because it cannot be a means of payment for the general public in its current state.

Attacks on Bitcoin’s ability to be a means of payment for everyday life are more interesting

People who attack Bitcoin on its ability to be a generalized means of payment for the general public can be classified into two categories:

- Bitcoin opponents who are a little more intellectually honest than those who are content to attack Bitcoin with all the clichés that have been known for the past ten years, and which are false.

- Cryptocurrency users, who may have been Bitcoiners at one time, but have now switched to Sh*tcoins.

Those in the first category will attack Bitcoin as a means of payment to demonstrate that it cannot succeed in its revolution to create a better world for the future.

The second category, which can be called Sh*tcoiners, will attack Bitcoin in order to defend their favorite Sh*tcoin and put it forward.

I often read Bitcoin Cash supporters attacking Bitcoin on this point. Fans of Litecoin do the same, trying to explain that since Bitcoin cannot be used as a means of payment, it will need a companion for everyday payments.

Of course, these Litecoin fans believe that their favorite cryptocurrency could play the role of digital silver alongside Bitcoin, which is recognized as digital gold.

I’m sorry to disappoint those who strongly support Litecoin, but I don’t think that will happen, as Litecoin’s potential is more than limited for the future.

Having said that, I’ll be able to come back to the subject that interests me in this story.

So the big question is :

Can Bitcoin be a relevant daily means of payment for the general public in 2020?

It’s a delicate question, but an extremely interesting one. For a payment method to be relevant to the general public in their daily lives, it has to meet certain criteria:

- Low transaction fees. Ideally, they should be known in advance.

- Fast transaction validation delay.

- Low volatility in value of the medium of exchange.

- Be easy to use.

Transaction fees on the Bitcoin network

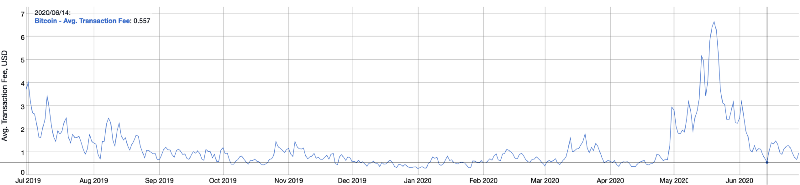

On the first point, while the average transaction fees on the Bitcoin network are mostly well below one U.S. dollar, they are actually rather above $0.50:

In addition, transaction fees on the Bitcoin network can be subject to significant spikes over a period of several days as seen in May 2020.

The average transaction fees then remained above $2 on a sustainable basis. Of course, you could always wait for the perfect time to lower your transaction fees, but if you want to use Bitcoin as a means of payment in your daily life, you won’t always have the luxury of waiting.

If you want to transfer a large amount of money, the fees applied on the Bitcoin network become much more attractive immediately. It is commonplace for hundreds of millions of dollars to be transferred over Bitcoin for less than a dollar in transaction fees.

So the real problem lies in the micro-transactions that are the ones that the general public makes on a daily basis.

Transaction validation delay on the Bitcoin network

The second point concerns the average validation time on the network for a transaction. This time was deliberately set at 10 minutes when Satoshi Nakamoto designed Bitcoin.

In order to ensure the predictability of new blocks being issued over time, the mining difficulty on the Bitcoin network is adjusted every 2,016 mined blocks. Thus, the objective of an average time of 10 minutes between the issuance of each block on the Bitcoin Blockchain is maintained over the long term.

If you go to the supermarket, I don’t think you have time to wait at least 10 minutes at the checkout for your Bitcoin payment to be validated. Moreover, after 10 minutes you will have only had confirmation of your transaction at best.

For purchases under $1,000, this will be sufficient.

However, depending on what you are going to buy, the seller may require 3 confirmations if the price exceeds $1,000. Ideally, the confirmation time should be at least 30 minutes.

Bitcoin itself is therefore not a relevant solution in this case.

Bitcoin price volatility is a feature

The third point is to guarantee the seller that the medium of exchange with which you are going to pay him will always be worth the same when he receives it and the days after.

Bitcoin is still very young, and due to a relatively low market cap at the moment, its volatility remains high.

Occasionally Bitcoin price can rise 10% in a few hours. In that case, the seller would be a winner. But it also happens that Bitcoin price loses 10% in a few hours.

In this second case, the seller would lose. In fact, accepting Bitcoin as a means of payment puts him at risk.

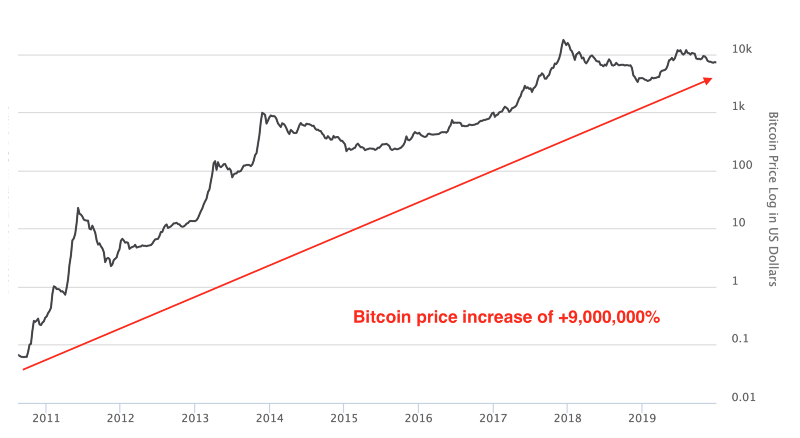

Sellers who choose to accept Bitcoin as a means of payment do so because they are thinking long term. Indeed, in the long run, Bitcoin price keeps increasing:

By being patient, and becoming a Bitcoin HODLER, the seller will be a winner in the future.

However, this is not always possible for the seller, who may have to pay for the merchandise he sells you to someone else up the distribution chain.

If the seller accepts your payment on a day such as Bitcoin’s Black Thursday, he will lose. He will have to wait for the Bitcoin price to rebound to at least break even again.

The user experience when using Bitcoin needs to improve

On the last point, I find that the user experience in the Bitcoin world has been improving over the years. Personally, I find it extremely easy to make transactions in Bitcoin.

Nevertheless, I am not a good example, as I am passionate about new technologies.

For someone who is more representative of the general public when it comes to new technologies, I am aware that using Bitcoin can be difficult.

There is still more progress to be made on the education side of usage than on the user experience side which is excellent from my point of view.

This can be resolved over time, but for now we are not there yet.

Many Bitcoiners don’t like to hear that, but Bitcoin alone is not currently a means of payment that can be adopted by the general public for everyday life.

The Lightning Network is the solution that must address these issues

If you’re a Bitcoiner, you’ll tell me that the Lightning Network is the solution that should allow you to use Bitcoin as a means of payment in everyday life. I totally agree.

With the payment channels that it creates, the Lightning Network must make it possible to meet the first two points.

Built on top of Bitcoin, the Lightning network protocol will keep transaction fees very low while offering immediate validation times.

On the other hand, the Lightning Network does not address the problem of Bitcoin’s price volatility. However, I believe that over time, as Bitcoin’s market cap increases, it will tend to decrease. Only time will improve this problem of volatility.

Finally, on the user experience side when using the Lightning Network, again, only massive education of the general public will solve this problem.

The Lightning Network is therefore a great hope that Bitcoin can become a generalized means of payment for the general public in the future. However, let’s face it, this will take a long time.

Bitcoin is not a means of payment for everyday life, so what?

In the meantime, those who criticize Bitcoin for not being able to use it as a means of payment in everyday life can continue to enjoy it.

The real answer is not to try to defend Bitcoin on this point.

You can agree with them that Bitcoin is not currently able to play the role of a means of payment for the general public in everyday life. That is the truth. It is uncomfortable for many Bitcoiners, but it is the truth of the matter.

Once we have agreed on this uncomfortable truth, I want to tell you:

Bitcoin is not a means of payment for the everyday life of the general public in 2020. So what?

In my opinion, there is no problem with this truth. Bitcoin was not designed for that. The value that Bitcoin brings to you is in no way diminished by this fact. In fact, the greatest value of Bitcoin in 2020 lies around two main axes:

- Preservation of your wealth in the face of monetary inflation. Bitcoin is a tremendous store of value.

- Resistance to censorship by the powerful at the head of today’s monetary and financial system.

Right now, this is where Bitcoin is most relevant.

That does not change the Bitcoin revolution

The fact that Bitcoin is not a means of payment for everyday life right now does not in any way call into question its revolution and the great value it brings to millions of people around the world.

Those who criticize Bitcoin on the issue of means of payment for everyday life are completely mistaken.

Gold, for example, is not a means of payment for everyday life in 2020. And yet no one questions its status as a store of value that has proven itself over the centuries.

Although it cannot be used as a means of payment by the general public for everyday life, gold represents a market cap of more than 8,000 billion dollars.

Currently, Bitcoin’s market cap is around $170 billion. So you can see the potential for Bitcoin’s price to rise over the coming years just by looking at its greatest current value: a tremendous store of value that is censorship-resistant.

For while gold is a recognized store of value, it is by no means as resistant to censorship as Bitcoin.

Gold was already confiscated by the United States in 1933

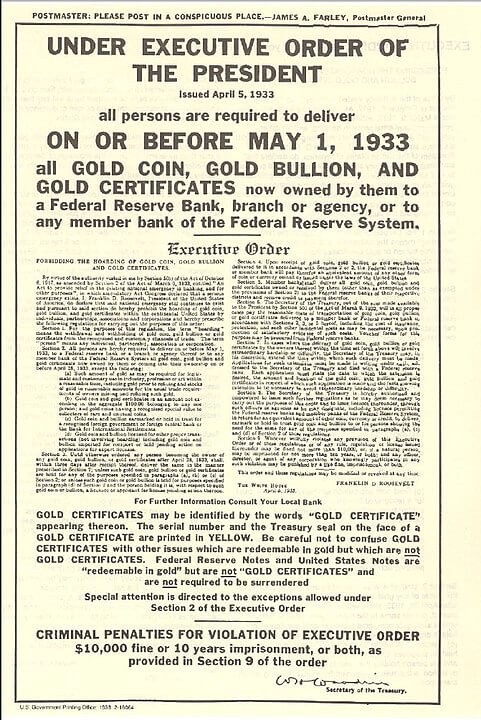

Your gold is often stored in private bank’s safe deposit boxes, and it can be confiscated at any time in reality. If you have any doubts about the ability of states to confiscate your gold, you should inquire about the “Executive Order 6102” of April 5, 1933 in the United States.

By this order, President Franklin Roosevelt confiscated gold from American citizens in order to finance his New Deal policy which was to respond to the Great Depression of the early 1930s.

The citizens, but also the private banks, had to return their gold to the federal government under penalty of prosecution. The Gold Reserve Act introduced a trade in gold at a rate of $20.67 per ounce, even though the official price was $35 at the time.

In exchange for their confiscated gold, citizens and banks received gold certificates that could not be exchanged for gold.

This Gold Reserve Act remained in effect in the United States until December 31, 1974 when President Gerald Ford authorized the purchase and possession of gold by individuals within the U.S. borders subject to certain quantities.

Storing your wealth in gold is therefore a risk.

With the economic crisis of 2020, some voices are even beginning to be raised in the United States to say that individuals should no longer be able to own gold.

Is a confiscation of gold from private individuals unimaginable in 2020?

I’ll leave that question to you alone, but from my point of view, opting for Bitcoin as a weapon to protect my wealth is something much more reassuring.

Once you have the private keys associated to your Bitcoins, you are truly in control. No one can take them away from you, and no one can stop you from using them as you wish.

Added to this are other essential guarantees such as Bitcoin’s unique monetary policy which highlights the virtues of quantitative hardening, but also the fact that the Bitcoin supply is limited to 21 million units no matter what.

Choosing Bitcoin in 2020 is therefore pure pragmatism to protect yourself from monetary inflation and government censorship which is increasing year after year.

Conclusion

Some Bitcoiners may not like to read this, but it is an uncomfortable truth to admit: Bitcoin is not currently a generalizable means of payment to the general public for use in everyday life.

The Lightning Network is a potential solution to this problem, but it is not yet ready for mass adoption. This will probably come in the future, but it will take time. We will have to be patient.

On the other hand, Bitcoin can already be used today by the general public as a great store of value, greater than gold, to hedge against monetary inflation and censorship.

Bitcoin’s greatest value is there right now, and there is no shame in honestly admitting it.