The Decision to Buy Bitcoin Depends on Individual Awareness First and Foremost

Everyone has to make their own way.

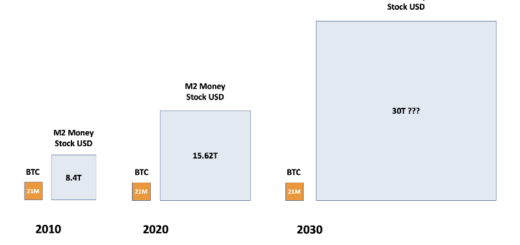

The economic crisis is taking hold in most of the world’s major economic powers. By deciding to cut interest rates to zero, and then launching a program of unlimited quantitative easing, the Federal Reserve was the first central bank to use the weapon of monetary stimulus.

At present, it is estimated that this quantitative easing program will represent a liquidity injection of at least $6T. Faced with what will cause a real monetary devaluation of the U.S. dollar, other central banks around the world will have no choice but to align themselves.

In fact, the Fed has just announced that it is significantly increasing its U.S. dollar liquidity for other central banks around the world. The Federal Reserve will thus export its inflation to the other fiat currencies of the world.

The devaluation of the U.S. dollar will eventually become a global currency devaluation.

The purchasing power of all the inhabitants of the Earth will therefore be strongly impacted.

Facing this economic crisis, Bitcoin is your hedge. The leading cryptocurrency is your best alternative if you want to opt-out of the current monetary and financial system.

The decisions taken by the Fed and other central banks should disappoint a little more people in the fiat system. All these people then become potential users of the Bitcoin system.

Wishing to accelerate this collective awareness of the need for the Bitcoin plan, I am among those who are trying to explain the limitations of the current monetary and financial system in these difficult times.

Reading an exchange on a forum a few days ago, I saw a person explaining that he was planning to give Bitcoins to a friend in order to get him into Bitcoin. All this got me thinking. I wondered whether or not this type of inducement to use Bitcoin was relevant.

In this story, I offer you to discover the fruit of my reflection, and especially the conclusion that is mine.

You Can Explain the Advantages of Bitcoin

Bitcoin is a totally decentralized Peer-to-Peer system that puts its users at the center of the game. Thus, every user has the same importance in the Bitcoin world. There is no leader who makes the decisions for the community.

Besides this democratic side of Bitcoin, you can explain that its monetary policy is really protective of the wealth of its users.

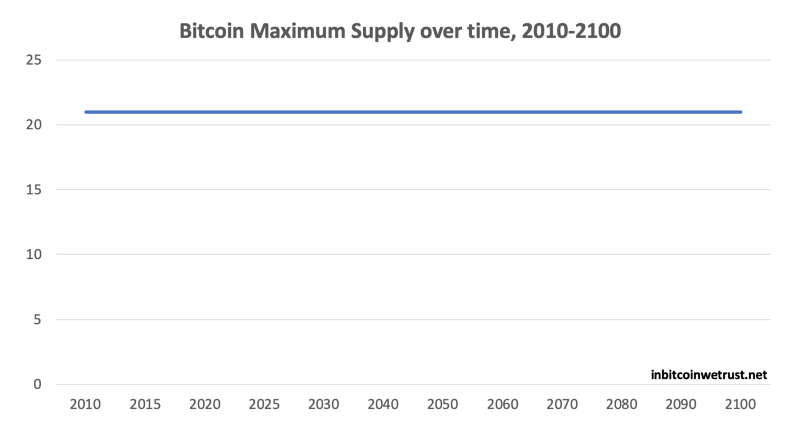

By buying Bitcoin, you know that there will never be more than 21 million Bitcoins in circulation. This limit in the Bitcoin source code is a consensus, and it will never be changed.

It makes Bitcoin incredibly scarce. The other advantage of Bitcoin is that its monetary policy is invariant. It is programmatic and predictable. Whatever happens, the daily production of new Bitcoins is halved every 210,000 blocks of validated transactions.

So you know exactly when the supply of new Bitcoins will be halved. The next Halving is scheduled for May 2020.

All these Bitcoin properties that have never changed in more than eleven years of existence guarantee that 1 Bitcoin of 2020 will always be equal to 1 Bitcoin of 2100.

If you buy one Bitcoin today, you will own one in 21 million. This will never change if you take care of your Bitcoin.

You Can Highlight Flaws in the Current System

Once the most obvious advantages of Bitcoin are highlighted, you tell yourself that the simplest thing to do is to highlight the flaws of the current monetary and financial system.

To find an example of the flaws of the current system, you don’t have to go far.

The $6T liquidity injection decided by the Fed in March 2020 is a perfect example. This injection is decided in a totally arbitrary manner by people who are not democratically elected by the American people.

A minority of people decide to save the banking system at all costs by devaluing what a majority owns. The Fed is the antithesis of Robin Hood: it takes from the poor to make the rich even richer.

Forty-nine years after its de facto establishment by Richard Nixon in 1971, experimentation with the current system seems to have reached its limits. The people who benefit from this system do not stop getting richer while the wealth gap with the poorest continues to widen.

In an attempt to appease the people, the U.S. government has decided on a check of $1,200 for each citizen.

Make no mistake about it, this monetary stimulus for individuals is primarily intended to support U.S. consumption. If governments were really interested in the fate of their citizens, they could simply write off their debts. They have the power to do this because they have unlimited money at their disposal.

But they will never do that. They rather save the banks, the financial markets, and businesses.

As an individual, you have to be aware of all this.

People Will Remain Skeptical

I have just briefly explained to you one of the obvious flaws of the current system. Nevertheless, if you still believe in this system, I think it is unlikely that I have convinced you.

The reality is that all the people who benefit from this system seek above all to protect their positions in this system.

This system has its flaws, but since you’ve gotten richer, you don’t want to question everything for a fairer system. I sincerely believe that it is a mistake to think that way. Unless you are a billionaire in U.S. dollar, the decisions made by central banks will impact you sooner or later.

It is only a matter of time before the easy money policy of the Fed and other central banks will wipe out everything you own.

The longer it takes for you to realize this, the more your wealth will have melted like snow in the sun. For some people, it is only when the snow has completely disappeared that they will realize this.

Bitcoin skeptics are a bit like climate skeptics. But sooner or later they will have to face the facts.

Everyone Must Follow Their Own Path to Bitcoin

The fruit of my reflection leads me to think that offering Bitcoins to friends in the hope that it might convince them of the inevitability of the plan Bitcoin for the future is absolutely useless.

A good example of the futility of offering Bitcoins to a non-believer is symbolized by Warren Buffett’s reaction when Justin Sun, the controversial founder of the TRON cryptocurrency, offered him a smartphone with a wallet application and a complete Bitcoin inside.

Warren Buffett simply said he wasn’t interested at all, and that he would never own Bitcoin.

His skepticism prevents him from being interested in Bitcoin without any preconceived ideas. Given his wealth and age, Warren Buffett can afford to miss the Bitcoin opportunity anyway.

For you and me, the question is a no-brainer in my opinion. We must seize this unique opportunity for a better future in which we can choose to live on our own terms. Nevertheless, I came to this conclusion by following my own path with Bitcoin.

Typically, the path followed with Bitcoin consists of 7 main steps:

- Skepticism

- Questioning

- Hesitation

- Taking Action

- The Deepening Of Knowledge

- Buy And Hold Bitcoin

- Be A Bitcoiner

The amount of time each person spends in these different steps can, of course, vary. In the end, everyone has to go through it, and offering $100 in Bitcoin to someone you know, or more depending on your means, won’t change anything.

The conviction that the plan Bitcoin is necessary cannot be bought.

The Decision to Buy Bitcoin Is First and Foremost a Matter of Individual Awareness

The economic crisis that we are going to experience in the coming weeks is likely to cause a true shock to many people. They will realize that the current monetary and financial system has no protection for what they own.

The monetary devaluation that we are going to undergo in order to save the current system was something that had been inevitable until now.

Now we have a system that allows us to opt-out to protect ourselves as best we can from this future currency devaluation. This solution is the famous Bitcoin that everyone has been talking about with increasing insistence for many months.

If you are not yet ready to take the step to enter the Bitcoin world, it is not a problem. Everyone has to go their own way to become aware of the importance of Bitcoin for our future world.

If you’ve already taken the step and bought Bitcoin, it’s a great thing for your future. However, there is no point in wasting your time trying to convince other people around you by offering them small portions of Bitcoin.

Everyone has to make their own decisions about their future.

The decision whether or not to buy Bitcoin falls clearly within this framework. Only through individual awareness can a person discover the importance of the Bitcoin experiment.

1 Response

[…] The Decision to Buy Bitcoin Depends on Individual Awareness First and Foremost […]