Bitcoin Is Not a Get Rich Quick Scheme, It Is Here to Avoid You Get Poor Slowly Over Time

Bitcoin is your best weapon facing the current system.

Becoming rich with Bitcoin is the fantasy of many people. The fact that Bitcoin allowed transforming $1 invested in 2010 into $90K at the end of 2019 is not unrelated to this. An asset with a return on investment of +9,000,000% in 10 years is something never seen before in history.

Logically, a majority of people come to buy Bitcoin attracted by the lure of financial gain.

As I often say, this is not a bad thing. Most recent Bitcoiners have also come into the world of Bitcoin primarily attracted by the incredible financial investment it represents.

The difference comes afterward.

Once the first purchase of Bitcoin is made, some will make the mistake of leaving it at that. These people will miss out on the Bitcoin revolution because they won’t make the effort to learn more.

Indeed, after buying Bitcoin for the first time, you would miss the point if you didn’t make the effort to better understand the purpose of Bitcoin, but also to learn more about money and the economy in general.

Those who do so never regret it. They systematically become Bitcoiners who are convinced of the future success of Bitcoin.

Bitcoin is so much more than just a get rich quick scheme

Bitcoiners also understand this fundamental truth about Bitcoin:

Bitcoin is not a get rich quick scheme, rather Bitcoin’s purpose is to prevent you from getting poor slowly but surely over time because of the current monetary and financial system’s flaws.

I must confess that this formula was greatly inspired by a tweet from Jameson Lopp:

The message in this tweet is so powerful that I decided to make it a full story to help some people better understand why Bitcoin is more than just a get rich quick scheme.

The current monetary and financial system was unilaterally introduced in August 1971 by Richard Nixon when he decided to end the convertibility of the U.S. dollar into gold. This system was then officially confirmed by the Jamaica Accords in January 1976.

Since the de facto introduction of the current system, central banks have been free to print as much fiat money as they wish. This means that the current system is not based on anything tangible.

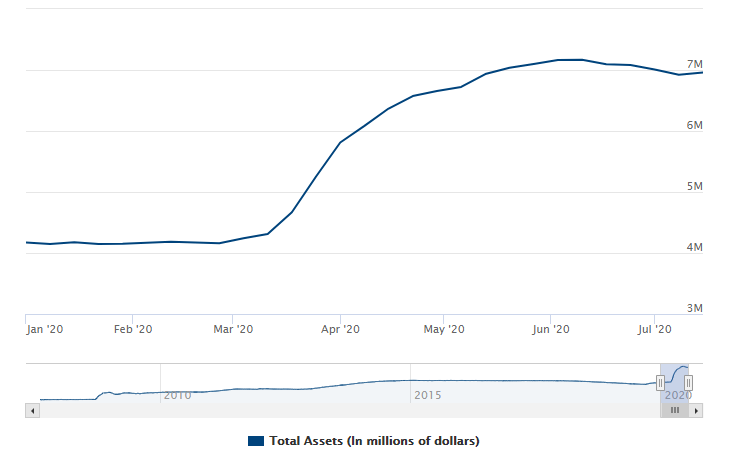

If you still doubt it, just look at how easily central banks have been able to print more than $10 trillion out of thin air since March 2020.

The Fed is in first place with its $3 trillion printed and then injected directly into the current monetary and financial system. The incredible increase of its Balance Sheet over this period is clear proof of this:

Great monetary inflation has devastating effects

The great monetary inflation that we are experiencing has a variety of consequences:

- Helps governments to borrow always more fiat money. Most G20 countries now have a public debt-to-GDP ratio well above 100%.

- Creates a speculative bubble in the stock market that faces what I call the iceberg illusion.

- An unprecedented increase in the wealth of the richest.

- The poorest are being put in more trouble than ever before.

- Significant currency devaluation of the U.S. dollar and other fiat currencies in the coming months and years. Since 1971, the purchasing power of $1,000 has lost 85% of its value. If you had wanted to beat the effects of inflation since 1971, you would have been able to turn that $1,000 into $6,330 by 2020.

This list is unfortunately far from being exhaustive, but it does show you the extent of the damage caused by this policy of unlimited quantitative easing conducted by the central banks.

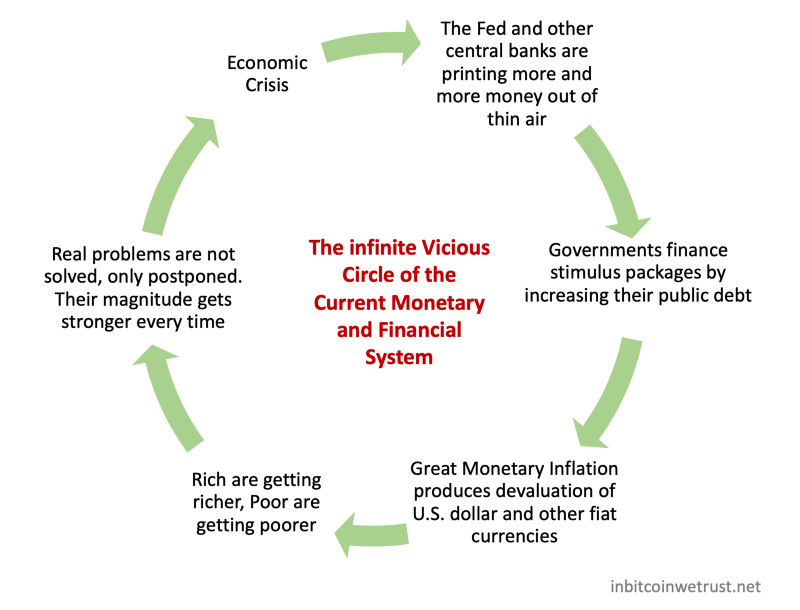

The current system locks us into a vicious circle:

This vicious circle is made up of six major stages which have been in an infinite loop since the establishment of the current monetary and financial system in August 1971 :

- An economic crisis intervenes. The reasons can be a banking crisis as in 2008 or a health crisis as in 2020 with the coronavirus pandemic.

- Faced with this economic crisis, the Fed and the other central banks always end up opting for the same solution: to print more and more fiat money. This fiat money printed out of thin air is then injected directly into the monetary and financial system.

- The governments of the major economic powers implement stimulus plans, which are almost always financed by an increase in public debt. The public debt-to-GDP ratio of most G20 countries is now above 100% or even worse.

- All of these decisions lead to great monetary inflation. The value of the U.S. dollar, which is the world’s reserve currency, has been steadily declining over time, as shown by the change in the purchasing power of the U.S. dollar since 1971.

- The injections of money benefit the richest people. Each economic crisis further strengthens their wealth. The poorest, who need help the most, are put in even greater difficulty by these decisions. The current system, therefore, benefits a minority of people who are already rich.

- The real problems of the monetary and financial system are known, but they are never really addressed. Injections of money in almost infinite amounts only serve to postpone the resolution of problems. As these are never solved, a new economic crisis always occurs about ten years later.

The vicious circle of the current system is dramatic because from crisis to crisis, the magnitude of the problems increases.

The infinite printing of fiat money is at the root of all the problems of the current system

The endless printing of fiat money by the Fed and other central banks is clearly at the root of all the ills of the current system. Unfortunately, the Fed and other central banks continue to use this mechanism to put off solving the real problems in the current system until later.

To give you an example, it’s a bit like an alcoholic deciding to treat his addiction by drinking more alcohol every day.

This would make no sense, and would only postpone the resolution of his problem.

Unfortunately, central banks have been doing this consistently since 1971. The problem is that they have made the economy addicted to this easy money policy. Stopping this policy now would have devastating consequences, yet it would be the only thing that makes sense to ensure a better future for all in the long term.

As it stands, the current monetary and financial system only increases the inequalities of wealth between the very rich and the poor. Since no one wants to make the necessary efforts to change it, it condemns us to become a little poorer every day.

Until the economic crisis of 2008, we had no way out of this infernal spiral.

Bitcoin is the solution to get out of the vicious circle of the current system

And then Satoshi Nakamoto invented Bitcoin and gave it to the world as an incredible gift. It is then up to its users to make it a success or a failure.

Bitcoin’s great strength is that it puts the power in the hands of its users, and therefore in the hands of the people.

Bitcoin forces you to take control of your destiny when it comes to money so that you no longer let a minority of powerful people make bad decisions for a majority of people who have to suffer the consequences.

Buying Bitcoin today, and HODLing it in the long run, will make you rich in the future. That is my belief and the belief of all Bitcoiners.

However, we don’t buy Bitcoin just for that. We buy Bitcoin because we can no longer tolerate that the fruit of our labor, the fiat money we earn, is constantly devalued by the people who run the current system.

What’s the point of working hard to see your fiat money lose its value over time?

The U.S. dollar was designed to be at the heart of a system that pushes you to spend more and more. You have to keep buying things you don’t need. If you want to save for the long haul, you will lose out.

With the current system, you have no choice.

Bitcoin gives you the power and freedom

Bitcoin allows you to preserve your wealth in a way that is resistant to censorship. Once you have taken possession of the private keys of your Bitcoins, you are the only master on board.

No one can confiscate your Bitcoins from you, and no one can prevent you from making the transactions of your choice on the Bitcoin network.

Bitcoin is a store of value far more accessible to the masses than gold, but more importantly, it is far scarcer than the precious metal. There can never be more than 21 million BTC in circulation. This limit will never be changed, as no consensus will be found to move in that direction.

Bitcoin gives you the guarantee that 1 BTC of 2020 will be equal to 1 BTC of 2050.

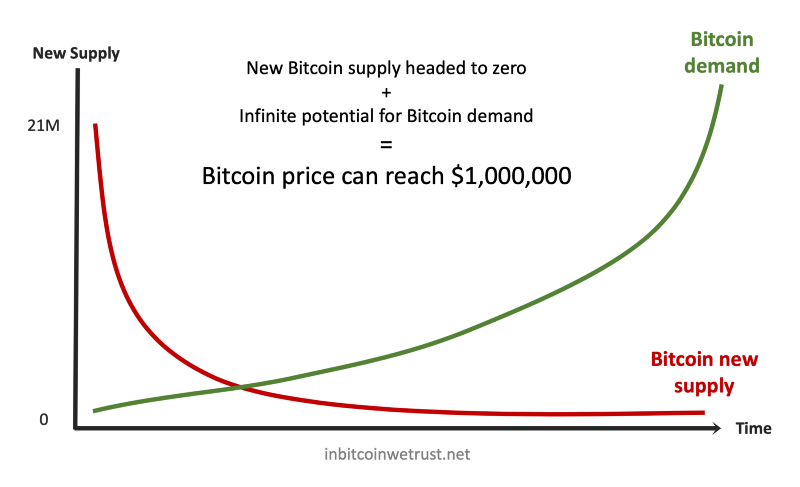

This essential fact must be added to the inflation in the supply of new bitcoins, which is steadily declining over time. It will reach zero when all bitcoin is extracted by 2140.

The reduction in the supply of new Bitcoins is inevitable because it is written into the Bitcoin source code itself. It will come in opposition to the demand for Bitcoin, which will continue to grow in the coming years:

Applying the principles of the law of supply and demand, it is easy to see why the price of Bitcoin could reach one million dollars within 20 years.

The continued currency devaluation of the U.S. dollar over time will further facilitate this sharp increase in the Bitcoin price in the future.

Bitcoin allows you to live your life on your own terms. Bitcoin is a savings technology that gives you the ability to focus on the long term.

You can decide to save your Bitcoins without the risk that their value will decrease. The opposite is true. By having a fundamental trust in Bitcoin, and becoming a Bitcoin HODLER no matter what, your patience will be rewarded.

Your Bitcoins will continue to appreciate in value over time.

Conclusion

With Bitcoin, you can break out of the pattern of becoming poorer and poorer over time. Even more than the possibility of becoming rich, Bitcoin offers you the possibility of no longer being condemned to become poor.

The total freedom that Bitcoin gives you is priceless. Few people understand it now, but the coming years will allow more and more people to open their eyes to discover the ugly truth about the current system.

They will then naturally opt to buy the hardest money in the world, namely Bitcoin. Time is on Bitcoin’s side, and its success is inevitable.