After the Multi-Billion Dollar FTX Debacle, 2023 Will Be a Pivotal Year for American Regulation in…

From Congress to regulators to the administration, everyone in Washington is passing the buck to determine their share of responsibility for the cryptocurrency platform’s failure.

Sam Bankman-Fried spent the holiday season at his parents’ home in California, with an electronic bracelet and their house as collateral, to assure the American justice system that he will be in court in New York in the first week of 2023, to start answering for his actions.

The former little prince of cryptos, who saw his exchange and trading platform FTX, which was valued at $36 billion until then, collapse, faces up to 115 years in prison, suspected of having, in bulk, fraud, conspiracy, or violation of the rules of election financing.

After the serious management control flaws pointed out by FTX’s liquidator in the days following the bankruptcy, the picture painted today is one of a vast fraudulent scheme.

“I knew it was wrong,” admitted the CEO of the trading business Caroline Ellison, who has already pledged to cooperate with the courts in the hope of reducing her sentence, as has FTX co-founder Gary Wang, at her first appearance.

In Washington, everyone is currently passing the buck to determine their share of responsibility in a bankruptcy that will cost investors dearly.

The Treasury has long listed the thousands of complaints and crypto scams received by the FBI or regulators, calling on Congress to clean up.

Additional powers

At the head of the SEC, Gary Gensler had also denounced the “wild west of cryptocurrencies” and suggested to Congress to give him more powers to secure the market. The White House has, for its part, set up a cordon sanitaire, refusing to speak about the millions of dollars given to Democrats by FTX and Sam Bankman-Fried.

One of the strengths of the American model is often to let new sectors emerge before regulating them, taking advantage of the abundant money to launch and test new models, with Americans also accepting more financial risk.

The pessimists can nevertheless see in this the powerful hand of lobbying that delays the regulation projects.

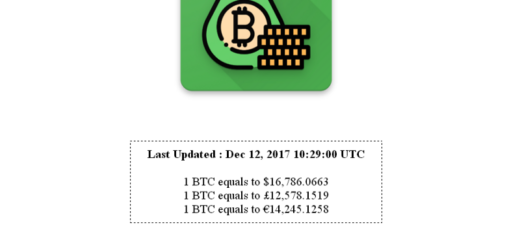

Since the creation of Bitcoin thirteen years ago, the cryptocurrency industry has bought time with regulators, notably by launching a long battle over the definition of assets, and in so doing over the designation of the regulator — SEC or CFTC — which ultimately favored the status quo … and the development of offshore platforms.

A saving grace?

Will FTX’s bankruptcy launch a life-saving shock? “There’s not a lot of adult supervision around here,” Barack Obama snarled after the massive Madoff scam, amid a financial crisis that gave rise to the massive Dodd-Franck banking separation act.

While Europe has set up a first framework regulation with MiCA, the House of Representatives has matured a first text on stablecoins (cryptocurrencies whose value is based on a stable basket of currencies). It could be the first pillar of a regulatory framework, but it failed to pass before the end of the session.

The ball is now in the court of the new Congress elected in November 2022, which takes office on January 3, 2023.

Less than two months after FTX’s failure, the handful of pro-crypto parliamentarians (John Boozman, Debbie Stabenow, Cynthia Lummis, Kirsten Gillibrand …) and the few opponents (Sherrod Brown, Elizabeth Warren …) are still in a battle of positions on what to do about the handful of other texts under discussion.

By reflecting on everyone, the FTX debacle may encourage the sector to move forward.

FTX’s former rival, Binance, now insists it wants “transparency and regulation.” And the SEC could serve as a spur if it speeds up its investigations, with the primary goal of pushing crypto players to comply with investor protection demands. Having lost control of the House of Representatives, Democrats will no longer be able to pass major budget projects in Congress: they could therefore devote their energies to advancing regulatory projects by seeking a common denominator with Republicans.

Cryptos aren’t the only regulatory registry on the congressional desk, either: there are also numerous bills aimed at regulating tech that need to be unlocked. The year 2023 is therefore likely to be a busy one for American regulation.