Bitcoin Will Remain The Undisputed Cryptocurrencies Leader For A Long Time

I will give you 8 key arguments to convince you.

When browsing the Internet in search of relevant information on Bitcoin and cryptocurrencies, it is common to be redirected to forums or community sites such as Reddit or Quora. If we take a closer look at the questions asked about Bitcoin and Altcoins, we realize that a question comes up almost all the time: which cryptocurrency will be the next Bitcoin?

This question of which cryptocurrency can be the next Bitcoin comes back of course in different formulations. Nevertheless, the idea behind these formulations remains the same. All crypto investors are looking for Altcoin which could become the next Bitcoin.

I’m going to give you my answer to this question which seems essential for a lot of investors.

For me, Bitcoin will remain the undisputed cryptocurrency leader for a very long time. The cryptocurrency that could replace Bitcoin one day has not yet been born. If you doubt it, I will give you my 8 key arguments to convince you of it.

1. First-Mover Advantage

The first successful implementation of a cryptocurrency based on the Blockchain concept, Bitcoin was launched in early 2009 by Satoshi Nakamoto. In fact, Bitcoin benefits fully from what is known in marketing as the “First-mover advantage”.

Indeed, by being the first to occupy a new market segment, the first-mover necessarily has a huge initial advantage over its future competitors. This advantage can last over time provided that the first-mover continues its development in a fast and sustained way.

Concerning Bitcoin, this is exactly the case. The Bitcoin consensus algorithm, Proof-of-Work (PoW), is criticized by many people for being extremely resource-intensive and energy-intensive. Thus, many faster and less energy-consuming alternatives have been developed by competing Blockchain projects.

All these projects showcase their technology far superior to that of Bitcoin. While their technology is superior to that of Bitcoin, it is the users who make the strength of a Blockchain. And in this little game, Bitcoin is still, and by far, the Blockchain offering the greatest utility network value.

The First-mover advantage effect of Bitcoin persists even 10 years after its creation and it is set to continue for a long time when we notice that Bitcoin has again achieved domination of around 70% on the entire cryptocurrency market!

2. More Than 10 Years Of Service

If Bitcoin fully benefits from the First-mover advantage, it benefits just as much from the seniority that it confers. Thus, Bitcoin has been a success for more than 10 years now. It has suffered many attacks. Worse still, it has very often been announced as dead.

Nevertheless, Bitcoin has always recovered even stronger after all the crises it has been through. After the Mt. Gox hack in 2014, everyone announced that Bitcoin was about to die. Instead of succumbing to this type of piracy, the Bitcoin community has always learned from its mistakes to recover and become stronger.

This resilience gives confidence in Bitcoin, whose Blockchain has improved over the years to become ever more reliable and secure. No other cryptocurrency can boast the same service record as Bitcoin.

This is another huge advantage of Bitcoin.

3. Network Effect

Due to its ever-increasing number of users compared to the number of users of other cryptocurrencies, Bitcoin also benefits from the so-called network effect. This effect is also known as Metcalfe’s Law.

This theoretical and empirical law was enunciated by Robert Metcalfe. It stipulates that the utility of a network is proportional to the square of the number of its users. This law would apply under the assumption of homogeneity of the nodes of the network, which may consist of agents or objects.

In concrete terms, the more Bitcoin users there are, the more useful the Bitcoin network becomes squared. As this network utility increases, new users will have a greater interest in using Bitcoin when they enter the world of cryptocurrencies.

It is a virtuous circle that benefits Bitcoin to the full.

This Metcalfe’s Law has a concrete application in the world of social networks and explains in large part Facebook’s phenomenal success compared to all its competitors. In the case of Facebook, another factor also comes into play since Mark Zuckerberg’s company has taken care to acquire its most dangerous competitors in terms of growth in order to prevent them from ever overtaking Facebook.

As a result, WhatsApp and Instagram became the property of Facebook. But that’s another story…

4. Viral Effect

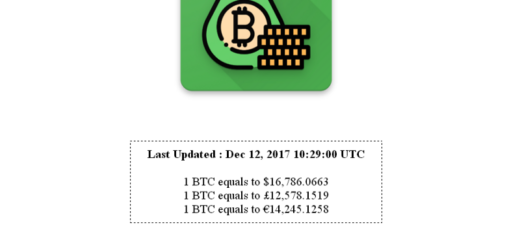

In addition to the application of Metcalfe’s Law, which makes it even more useful and attractive to users, Bitcoin also benefits from a phenomenal viral effect. We were able to see this during the euphoric end of 2017 that the world of cryptocurrencies will have experienced.

As Bitcoin flew away, the other cryptocurrencies followed the same path. Nevertheless, all the media coverage was for Bitcoin. Only Ethereum and Ripple managed to make their way to a slightly wider audience of investors.

This media coverage is a huge advantage for Bitcoin as it allows it to capture the majority of new entrants. And here again, we are entering a virtuous circle since the more users Bitcoin has, the more interesting and useful it becomes to have them.

5. Bitcoin Is The Gatekeeper Coin

Bitcoin is the entry point through which all beginners pass when they arrive in the world of cryptocurrencies. Bitcoin is clearly the reserve cryptocurrency. To be able to buy a specific Altcoin, you almost always have to buy Bitcoin first on the main exchange platforms.

For the general public, when we talk about cryptocurrencies, we immediately think of Bitcoin. This combination of “Bitcoin = cryptocurrencies” is again an advantage for the Bitcoin Blockchain, which is attracting more and more new users.

And as I explained earlier, the power of a cryptocurrency does not come from its technology but rather from the number of users on its network. In this area, Bitcoin is far ahead and will continue to be for many years to come.

6. Bitcoin Is A Store Of Value

Since its creation, Bitcoin has been compared to gold. For many, Bitcoin represents digital gold. This comparison is based on the fact that, in the same way as gold, there is a finite quantity of Bitcoins that can be put into circulation. In addition, the new Bitcoins are created through a process called mining and for which participants are called miners.

If the comparison had stopped there until now, it now seems that Bitcoin is showing performances that are strangely similar to those of the gold price. Bitcoin is becoming a real store of value to which investors turn in difficult times.

Thus, if tensions between the United States and Iran intensify or if Donald Trump announces new customs duties against China as part of his trade war, the price of Bitcoin will rise again.

7. Institutional Investors Rely On Bitcoin

The days when Wall Street institutional investors looked at Bitcoin and cryptocurrencies from above are over. From now on, cryptocurrencies are taken very seriously. Institutional investors have decided to invest in it and it should come as no surprise to you, they have chosen Bitcoin to launch it.

Thus, the very serious New York Stock Exchange (NYSE) will launch its Bakkt platform on 23 September 2019 after several postponements due to tense discussions with the US regulator.

So, Bakkt is the NYSE Bitcoin Futures Platform on which their Bitcoin ETF should enable new investors to enter the Bitcoin world.

The event is important for Bitcoin but also for the whole world of cryptocurrencies. Initial estimates put the value of this new platform at around $800 million as soon as it is launched. The emergence of such platforms should enable the cryptocurrency sector to enter a new dimension.

And here again, it is Bitcoin that is leading the way and will benefit first.

8. Bitcoin Scalability’s Problems Are A Good Thing

The euphoric end of the year that Bitcoin experienced in 2017 with a price reaching almost $20,000 made it possible to become aware of a major defect of its Blockchain. It is not scalable enough to allow mass adoption by the general public.

Indeed, the very large number of transactions to be validated had caused a network bottleneck at the time, causing transaction costs to explode while causing huge validation delays. Thus, some transactions could take up to 2 days to be validated during the peak of this Bitcoin boom.

For many, these scalability problems with Bitcoin were proof that it was not the right technological solution to allow the mass adoption of a cryptocurrency.

From my point of view, I think we should take the problem in the opposite direction. The fact that Bitcoin has reached such a large number of users and transactions that we can really see this problem is a very good thing. Indeed, Bitcoin is the only cryptocurrency to have achieved such popularity.

Bitcoin will therefore be the first cryptocurrency to have to solve these scalability problems in real conditions for large-scale use. If it succeeds, it will once again be a step ahead of its competitors, who will have to go through it if they want to replace Bitcoin one day as the leader in the world of cryptocurrencies.

Conclusion

First to enter the cryptocurrency world, Bitcoin has for it the First-Mover advantage that has allowed it to establish its domination over the past decade. Its long history gives it a high level of reliability that reassures institutional investors. Their entry into Bitcoin via the Bakkt platform should further strengthen its status as the undisputed cryptocurrencies leader.

As for the scalability problems of Bitcoin, I am confident that the Bitcoin community will be able to address them in the coming years, which will give Bitcoin a strong advantage over other cryptocurrencies with more advanced technologies in theory but that has never been tested in real conditions with as many users as the Bitcoin.

Thus, Bitcoin will remain the undisputed cryptocurrencies leader for a very long time to come.