Bitcoin Price Reaches $13K: Stay Calm and HODL, the Fundamentals Tell Us It Is Just the Beginning

It is the perfect time to be a Bitcoin HODLer.

The third Halving in Bitcoin history took place on May 11, 2020. While today is October 22, 2020, it is now 5 months and 11 days since this Halving took place.

After the third Halving in May 2020, some newcomers to the Bitcoin world were getting impatient with the lack of change in the Bitcoin price. By the end of June 2020, while the Bitcoin price remained in an increasingly narrow range around $9K, some even ended up calling Bitcoin a boring asset.

This was a lack of knowledge about Bitcoin and its history. These people focused on the ambient noise, instead of fully focusing on the real signal: the fundamentals of the Bitcoin revolution that continued to strengthen block after block.

Throughout the summer, Bitcoin continued to see its fundamentals strengthen. More and more players came into the Bitcoin world, testifying to the total change of mindset surrounding Bitcoin.

The ultra-positive announcements for Bitcoin have continued to multiply over the last few weeks

The Grayscale investments fund raided Bitcoin by buying more and more for its customers who are mainly institutional investors. MicroStrategy, a large Nasdaq listed company, has made Bitcoin its primary treasury reserve asset. The U.S. banking regulator has given the green light to U.S. banks to buy and hold Bitcoin for their customers.

And yesterday, October 21, 2020, it was finally PayPal that officially announced that it would offer its customers the purchase and sale of Bitcoin directly from its platform from the beginning of 2021.

The 346 million PayPal users will also be able to pay in Bitcoin in the 26 million businesses in the PayPal network.

This announcement by PayPal has extended the Bitcoin price increase that began earlier this week. Since October 19, 2020, the Bitcoin price has increased by +12%:

In the early hours of October 22, 2020, the Bitcoin price even peaked at $13,184. At the time of writing, the Bitcoin price is $13,016.

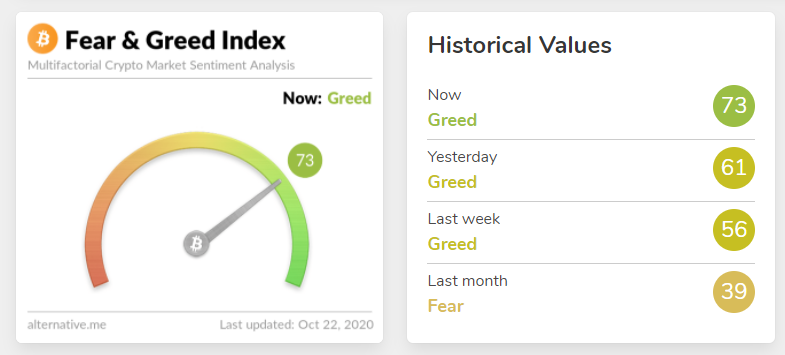

This increase has had a strong impact on market sentiment as you can imagine. From now on, it is the feeling of greed that prevails:

If this increase in the Bitcoin price is pleasant, you will have to stay calm, because the best is yet to come for Bitcoin. Those who have made the choice to become Bitcoin HODLers have some excellent days ahead of them in the months and years to come.

The fundamentals of Bitcoin continue to be excellent, and I even feel that the current price of Bitcoin is significantly undervalued compared to what these five fundamentals tell me, which I will detail in the following:

1. The percentage of addresses that have been holding Bitcoin for more than a year has reached a new All-Time High

The coronavirus pandemic will, in all likelihood, be remembered as the tipping point in Bitcoin history. It triggered an economic crisis of a magnitude not seen in decades.

This economic crisis then forced central banks and governments to print more and more fiat money out of thin air while further increasing public debts. These two metrics are reaching record heights around the world now.

Major economic powers with a GDP to public debt ratio below 100% are now the exception, whereas 20 years ago they were the norm.

The flaws of the current monetary and financial system have been highlighted more than ever in 2020. The actions of the central banks have triggered great monetary inflation in the face of which many have understood that Bitcoin was their best option.

More than ever, Bitcoin validated its status as the best possible store of value for the greatest number of people during this year. The increase in the number of Bitcoin HODLers reflects this. And this is just the beginning.

2. The quantity of BTC stored on centralized exchange platforms has been steadily decreasing since the beginning of 2020

In the Bitcoin world, there is a golden rule that everyone who wants to make the most of the Bitcoin revolution must know and apply:

“Not your Keys, Not your Bitcoins.”

If you don’t have the private keys associated with your Bitcoins, they are not truly yours. You depend on a third party, which is often a trading platform such as Coinbase, Kraken, or Binance.

Your Bitcoins are in danger. Indeed, these platforms may decide for arbitrary reasons to confiscate your Bitcoins.

For this reason, you should never leave your Bitcoins on these platforms for longer than necessary. As a sign that education about Bitcoin is progressing, the amount of BTC stored on these centralized trading platforms has been steadily decreasing since the beginning of 2020.

It is also a strong signal that more and more people have chosen to opt for a HODLing strategy for the coming months. With the very strong Bull Run awaiting Bitcoin, this is an excellent choice.

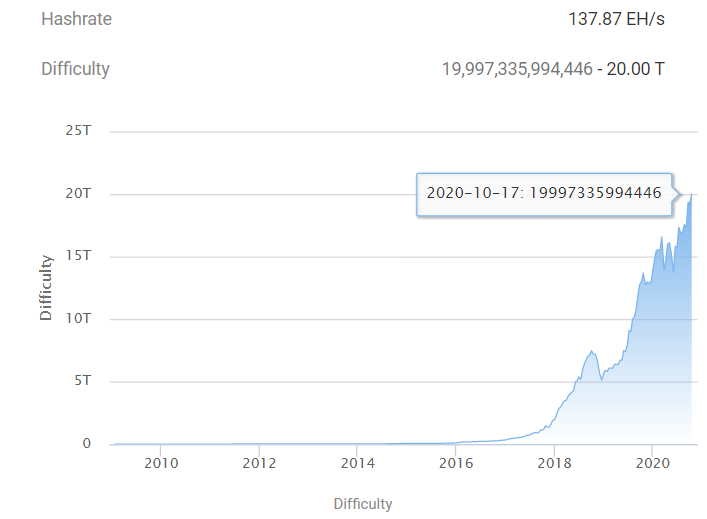

3. Bitcoin Hash Rate Has Never Been So High

Bitcoin Hash Rate has been breaking records ever since Bitcoin’s third Halving. This is a testament to the confidence that miners have in the future of Bitcoin.

Bitcoin remains by far the most secure decentralized network in the world.

This increase in Bitcoin Hash Rate obviously leads to a proportional increase in the difficulty to mine new blocks on the Bitcoin network:

This ensures that the average 10-minute delay between the issuance of each block is respected over the long term on the Bitcoin network. The issuance of new Bitcoins over time can thus be planned more or less precisely.

With the current mining difficulty of the Bitcoin Blockchain, we can say that the Bitcoin network is 19,997,335,994,446 times more secure than it was when it was launched on January 3, 2009.

This is reassuring for newcomers to the Bitcoin world. They can buy Bitcoin with the assurance that their money will be protected from hacking attempts.

4. Addresses on the Bitcoin network holding more than $1 are at a new All-Time High

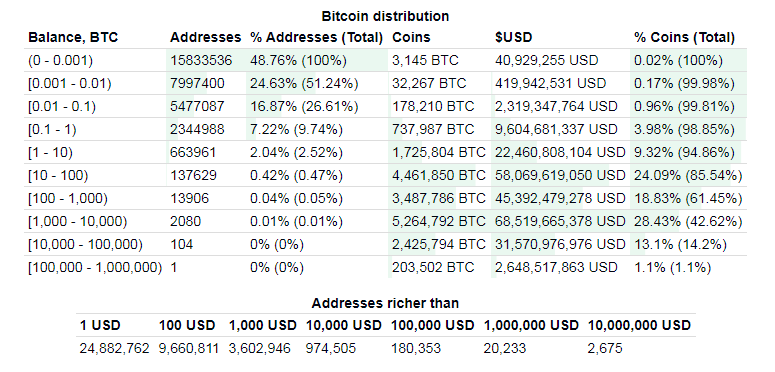

It is always interesting to study the evolution of the address richness on the Bitcoin network. By doing so, we can always deduce certain trends. Here is the current distribution of Bitcoin wealth:

We can see that the number of addresses with more than $1 in BTC reaches a record level in October 2020.

This is a sign that the market is in a phase of accumulation that will continue to intensify in the months and years to come. The start of the Bull Run is happening before our very eyes.

More and more people are realizing the importance of accumulating every single Satoshi they can get. This is essential, because in the future when talking in Satoshi rather than BTC will be the norm, it will make a big difference.

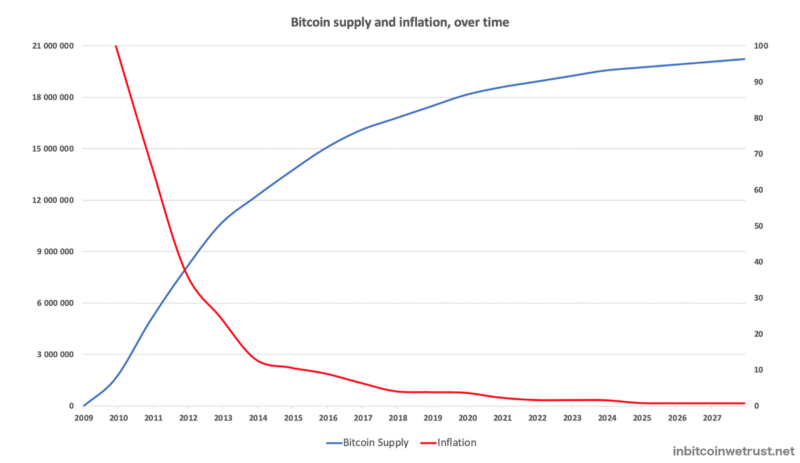

5. Annual inflation in the supply of new Bitcoins is at an All-Time Low

I have chosen to put this last point to see if you understand how Bitcoin’s monetary policy works. If so, you must have said: it’s normal. In fact, the annual inflation of the supply of new Bitcoins is steadily decreasing over time, reaching zero around 2140.

Here is the expected evolution of the supply of new Bitcoins in the coming years:

Since the third Bitcoin Halving, the inflation of the annual supply of new Bitcoins is only 1.8%. This figure will fall to below 1% after the fourth Bitcoin Halving in 2024 at block height 840,000.

Bitcoin’s programmatic monetary policy guarantees you all of this because no human can change this arbitrarily as it can happen in the current monetary and financial system.

The new Bitcoins will become scarcer in the months and years to come. This scarcity will be opposed to a constantly increasing demand because Bitcoin responds to the great need that emerges in 2020: that of protecting its wealth over time in a way that is resistant to censorship.

Conclusion

The Bitcoin price has just exceeded $13K. It has been above $10K for 88 days now. This is the longest series of consecutive days above $10K in Bitcoin history.

Many even wonder if we will ever see Bitcoin again with a price below $10K.

This is a real question that we have the right to ask ourselves since the fundamentals of Bitcoin are so excellent. The price of $13K should not make you lose your cool. Bitcoin’s objectives are much greater. One watchword in this period: continue to be a Bitcoin HODLer.

Time will prove to you that this is the winning strategy with Bitcoin.