Bitcoin’s Volatility: Myth and Reality

Bitcoin protocol has not changed since its inception.

Bitcoin is too volatile. It will never be a true store of value, let alone a currency. Like me, you must have read or heard opponents of Bitcoin state these untruths loud and clear.

Earlier this year, Deutsche Bank’s research department published a three-part report on the Future of Payments. I will spare you the details of that report, but one of the things that came out of it was the following:

“Bitcoin is too volatile to be a reliable store of value.”

— Deutsche Bank Report on Future of Payments in 2020

This type of completely false assertion about Bitcoin’s volatility is unfortunately too widespread. The problem is that the general public tends to take everything that politicians, bankers, or economists say at face value.

This lack of questioning in order to directly verify things related to money becomes a major concern when an economic crisis like the one we are experiencing today takes shape.

Indeed, in the midst of an economic crisis, you have to make the right decisions about money in order to best protect yourself against the great monetary inflation that the decisions of the Fed and other central banks produce.

In order to help you see this more clearly, I propose to come back to the alleged Bitcoin’s volatility that all its opponents use as an ultimate weapon to discourage new people from entering the Bitcoin world.

Myth: Bitcoin is volatile

Bitcoin teaches you one essential thing: to question everything in order to check things for yourself. This is reflected in Bitcoin’s slogan:

“Don’t trust, Verify.”

When you have a doubt about Bitcoin, but it also applies to money, and the economy in general, you should check for yourself. It is by doing your own research that you will be able to find out what is true.

So Bitcoin would be too volatile according to Deutsche Bank, but also according to many of its opponents.

So we will check if Bitcoin and its protocol are really volatile. When it was created by Satoshi Nakamoto, Bitcoin had a clear and precise monetary policy:

- A finite quantity of Bitcoins, the amount of which was known in advance, since it was limited to 21 million units.

- A creation of new Bitcoins automatically performed when a block of transactions was correctly mined.

- An inflation of the creation of new Bitcoins that had to be halved every 210,000 blocks added to its Blockchain. This event is the famous Halving.

- An incentive to secure the Bitcoin network for miners via the BTC reward, but also the transaction fees.

Since the launch of Bitcoin, a new block is issued every 10 minutes on average.

Satoshi Nakamoto had anticipated that the computing power available to secure the network could increase or decrease over time.

With a sharp rise or fall in the Hash Rate, this average 10-minute delay between each mined block would not be respected, which would have prevented the predictability of new Bitcoins production over time.

To avoid this, an adjustment of the difficulty to mine blocks on Bitcoin is made every 2016 blocks. Taking into account the average of one block mined every 10 minutes, this gives an adjustment every 2 weeks or so.

A little more than eleven years after the creation of Bitcoin, this unique monetary policy is still present with unchanged properties. Virtues of this quantitative hardening’s policy is currently being highlighted.

Indeed, the quantitative hardening on which Bitcoin is based is the opposite of the unlimited quantitative easing currently practiced by the Fed.

In an increasingly uncertain world from a geopolitical point of view, Bitcoin gives you incredible certainty. The most important one being that 1 BTC of 2020 will still be worth 1 BTC in 2100.

The guarantees on Bitcoin’s monetary policy are practically immutable as it would take a full consensus of the Bitcoin community to change its characteristics.

I can assure you that this will never happen, because no one has an interest in changing the properties that make Bitcoin so unique. Bitcoin is a true democracy, because no user is more important than another.

The next time someone tells you that Bitcoin is volatile, you can easily show them that it is just a myth. On the contrary, the Bitcoin protocol has been incredibly stable since its inception while everything tends to change constantly in the world we live in.

Reality: Bitcoin’s volatility only concerns its price

While Bitcoin’s volatility is a myth, its price is volatile. So the reality is that Bitcoin’s volatility is only about its price.

It is important to understand that Bitcoin is an extremely young market.

Many people tend to forget this, because Bitcoin has already managed to reach a market capitalization of more than 170 billion dollars in such a short period of time. However, its market is still very small when compared to gold and its 8 trillion dollars of global valuation for example.

Moreover, Bitcoin is the only truly free market in the world.

Bitcoin works all the time. You can buy or sell 24/7. In fact, no one can stop Bitcoin when its price falls or rises sharply. There are no circuit breakers like there are on Wall Street or other financial markets.

Bitcoin lets its users find the true break-even price for Bitcoin themselves. This explains why Bitcoin was able to lose 50% of its value on Black Thursday in March 2020. The good side of this is that Bitcoin quickly recovered its previous value in just over a month.

Bitcoin’s price volatility should therefore be seen as a feature rather than a bug.

It is up to you to be smart enough to make Bitcoin’s volatility your greatest ally. The best way to do this is to choose to become a Bitcoin HODLER. By supporting the Bitcoin revolution at any cost, you will be truly rewarded, and the volatility of its price will not impact you any more than that.

In the future, as the size of Bitcoin’s market cap grows, it is likely that its price will become less and less volatile.

But this will take time. It will probably take many more years. In the meantime, this does not prevent Bitcoin from already representing a better store fo value for the masses than gold.

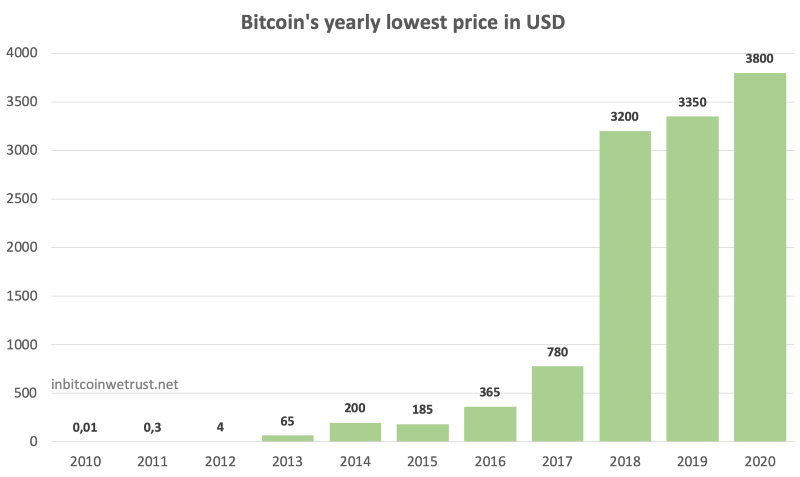

Rather than looking at Bitcoin’s annual highs, you need to focus on its annual lows, which have been rising steadily since its inception:

This easily proves that despite the volatility of its price, Bitcoin is a tremendous store of value.

People who continue to criticize Bitcoin forget to mention that it is objectively superior to gold in many areas: divisibility, portability, recognizability, non-confiscable, greater scarcity, …

By checking things out for yourself, you will be able to find out all this for yourself.

Conclusion

Contrary to what its opponents try to make believe to discredit it, Bitcoin is not volatile. In fact, its protocol has been extraordinarily stable for more than 11 years now.

Bitcoin’s stability actually gives you essential certainty in an increasingly uncertain world.

On the other hand, Bitcoin price is volatile. Nevertheless, this volatility is mainly due to the youth of Bitcoin. Furthermore, it should be seen as a feature of Bitcoin rather than a bug.

This does not prevent Bitcoin from remaining the best store of value available in 2020 as great monetary inflation takes hold of the world. Rather than believing all the myths against Bitcoin, I now invite you to be more critical in order to discover the reality as it is.

1 Response

[…] Schulman began by pointing out that the volatility of Bitcoin’s price was currently a barrier to its adoption by merchants that operate on low margins: […]