Bitcoin will eat everything in its path in the future.

The year 2021 started as incredible for Bitcoin as the year 2020 had ended. Bitcoin ended the year 2020 with a new All-Time High (ATH) for its price nearly every day. The beginning of the year 2021 saw Bitcoin do the same with a (temporary) ATH of $41,946 reached on January 8, 2021.

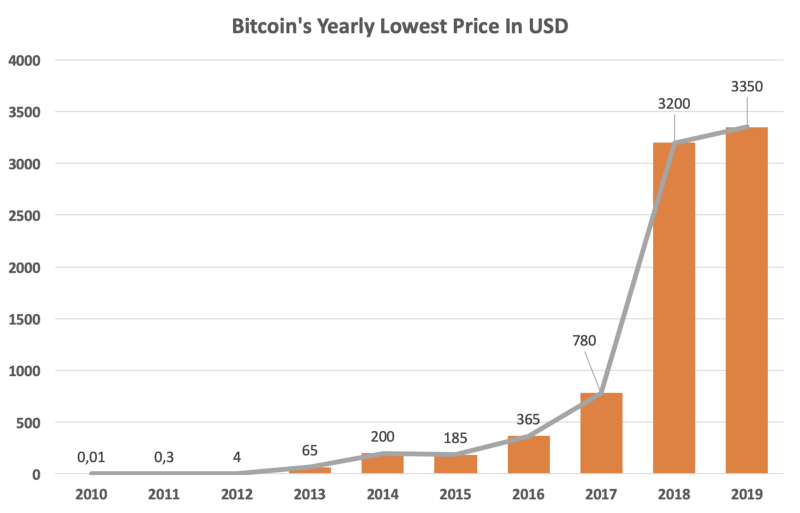

I say temporary ATH here because the price of Bitcoin is expected to go much higher in the months and years to come. Regardless of the corrections that await Bitcoin price in the coming months, the price of Bitcoin still has the potential to rise so much that the current price will look extremely cheap in the future.

On January 8, 2021, Bitcoin also broke its record in terms of market cap, reaching almost $780 billion. This is a colossal sum that is more than two and a half times greater than the maximum market cap reached by Bitcoin during the 2017 Bull Run.

Seeing Bitcoin move closer to the $1 trillion market cap has brought up an old question that many people in the Bitcoin world are asking themselves.

That question is this: How far can the Bitcoin market cap go in the future?

Bitcoin will first surpass the gold market cap

The first step for Bitcoin will be to replace gold as the favorite store of value for investors. Currently, the market cap for gold is around $10T. When Bitcoin reaches the current gold market cap, its price will be around $540K.

I say when here, not if. This is a conscious choice I am making because I believe that by the end of this decade, Bitcoin will have surpassed gold in terms of market cap. It’s only a matter of time in my opinion before a majority of people will eventually embrace Gold 2.0.

The world is changing as it digitizes. No sector will be able to resist this digitalization of the world. Gold will not escape the rule. As a version 2.0 of gold within the framework of its properties that make it an incredible store of value for the greatest number, Bitcoin can only surpass gold in terms of market cap.

Once Bitcoin has seen its market cap exceed that of gold, how far can Bitcoin go?

After overtaking gold, Bitcoin will not stop, that’s for sure

Then it will be a big unknown to me. The day we get to that point, we will obviously have more clues to try to hypothesize how to answer this question. In the meantime, we can only do prospective.

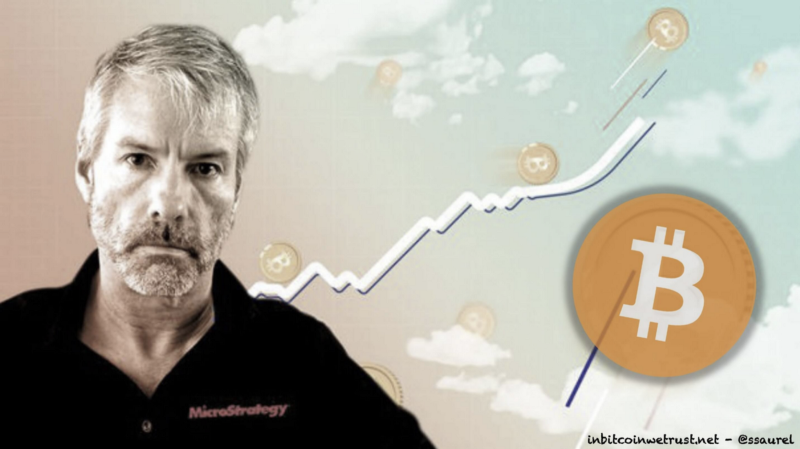

This is precisely what Michael J. Saylor, a wonderful ambassador for Bitcoin, just did in an interview on YouTube. In his interview, Michael J. Saylor believes that once Bitcoin has passed the gold market cap, it will continue its forward march to eat the market cap of other markets.

The first interesting thing to take away from his interview is that he believes that many organizations and investors do not use gold to protect their money from crises like the ones we are currently experiencing:

“It’s important to note there are a lot of organizations and a lot of investors that don’t use gold as their safe haven. They use government debt, sovereign debt, and so cash is a safe haven, and sovereign debt is a safe haven, and another safe haven people use as a store of value is the index funds. Bond index funds and stock index funds like the Russel 2,000 the S&P 500, the Dow index.”

These organizations and investors use government debt, sovereign debt, or even index funds. From this observation, it is clear that the money used as a reserve of value exceeds the gold market cap.

Money used by people to protect themselves in times of crisis far exceeds the gold market cap

Michael J. Saylor “thinks there’s between $300 and $400 trillion worth of fiat instruments: cash, debt, stock, commercial real estate indices”. On this colossal mass of money, Michael J. Saylor estimates that “50% and 75% is simply seeking a store of value as a container”.

The example given by Michael J. Saylor concerning index funds is relevant in my opinion:

“Like when I buy the S&P 500 Index or the Vanguard fund, I’m not buying it because I equally love all 500 S&P stocks equally in proportion to their market caps… I bought the index because I had a million dollars and I knew if it was cash it would be debased in purchasing power and so I needed to put it into something which was going to return more than the economic hurdle rate, or the cost of capital.”

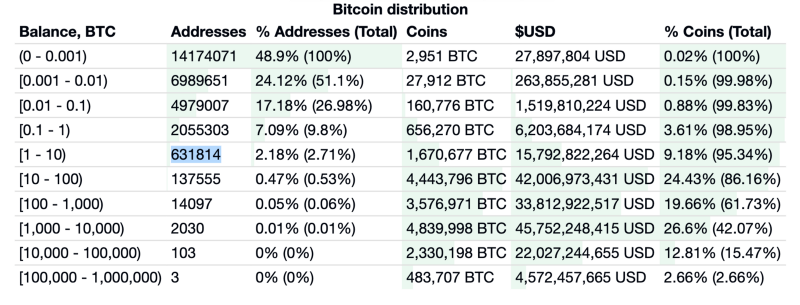

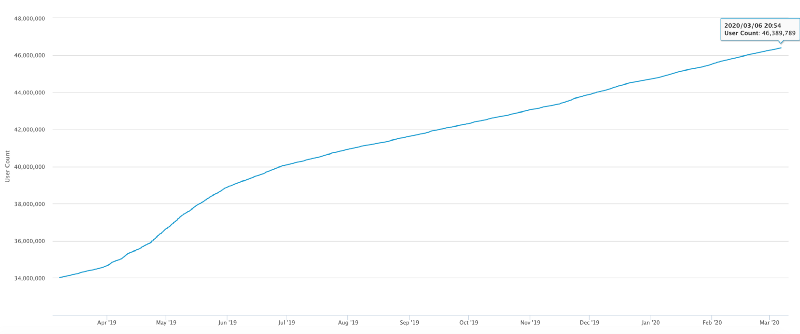

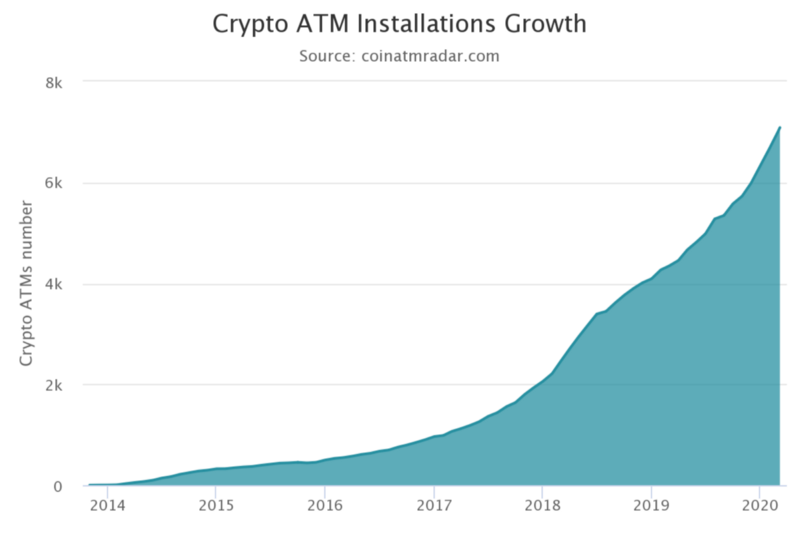

For Michael J. Saylor, it makes sense to consider that all the money dedicated to being placed in a store of value ends up in Bitcoin. Indeed, Bitcoin is the best store of value for the greatest number of people on Earth. Buying Bitcoin simply requires a smartphone and an Internet connection.

Bitcoin could therefore drain much more than $100T in theory:

“In theory, all monetary energy that’s simply looking for a store of value safe haven index should presumably drain out of real estate, cash, stocks and bonds into the Bitcoin network and as that happens the price discovery will return to real estate and bonds…”

If the top is not $100T, Michael J. Saylor estimates that it will rather be between $100T and $300T of today’s money:

“The top is more than $100 trillion, it’s somewhere between $100 trillion and $300 trillion in today’s money.”

Bitcoin price can legitimately target 14 million dollars in the future

By reaching a market cap of $300T, Bitcoin would see its price reach $14 million. While this may sound crazy to some people today, Michael J. Saylor’s demonstration is extremely solid once you understand that Bitcoin is the best store of value that exists in the world.

The best store of value in the world will necessarily ultimately attract all the money that is intended to be protected from the ravages of monetary inflation and censorship. It is therefore only a matter of time before the Bitcoin market cap reaches heights that many still imagine unreachable.

Bitcoin is used to that anyway. In fact, when it was created, nobody would have imagined that Bitcoin would be so close to a market cap of 1,000 billion dollars. Bitcoin has always been an outsider, and it will continue to be so in the months and years to come.

In the meantime, there is only one thing to do: you need to have the same confidence in Bitcoin as Michael J. Saylor, who has repeatedly admitted that MicroStrategy has been ready for HODL Bitcoin for over 100 years. So, the long-term vision in Bitcoin is the key to being among those who will benefit the most from it.