Diversification With Altcoins Is an Illusion Because They All Depend on Bitcoin’s Success

Open your eyes, and focus on the real revolution.

Bitcoin is the undisputed king of the cryptocurrency world. A real consensus exists on this fact that Bitcoin’s dominance over the entire cryptocurrency industry confirms. On the other hand, Altcoins’ fans believe that Bitcoin will not remain the undisputed leader in the future.

Among absolute Ethereum fans, many believe that a reversal of dominance between Bitcoin and Ethereum will occur in the future. This hypothetical event even has a name, since Ethereum fans call it “Flippening”.

The great Flippening illusion

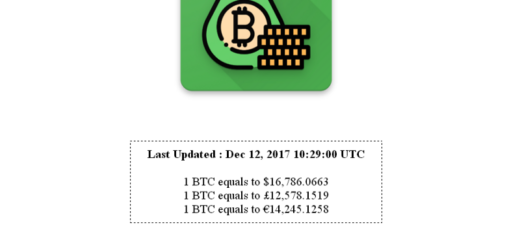

In order for this Flippening to take place, Ethereum’s market cap would have to overtake Bitcoin’s market cap. To give you a better idea of what this means, you have to keep in mind that Ethereum currently has a market cap of $26 billion, while Bitcoin is close to $170 billion.

This shows you how far Ethereum has to go before an event such as the Flippening can take place.

Nevertheless, many people are firmly convinced that this event will take place one day. Many go even further, thinking that Ethereum itself will be dethroned by another cryptocurrency. A kind of Flippening of the Flippening.

Thus, some imagine that EOS or Cardano will be able to surpass Ethereum in the future.

The big question I invite these people to ask themselves is the following:

How could a Flippening take place if Ethereum itself is not able to keep its leading position in the field of smart contracts and decentralized applications?

I let you try to answer this question. For my part, the answer has already been found, which is why I only buy Bitcoin.

Some people want to hedge against risk by diversifying with Altcoins

That said, many people feel it is important to diversify their portfolio of cryptocurrencies. To convince themselves of the importance of doing so, these people will refer to what is done in the world of traditional finance. In the stock market, it is customary to invest in companies in different sectors.

Since some companies have cyclical activities, this allows you to hedge against the decline of some, while others will be on the rise.

However, this approach is criticized by some, including Warren Buffett himself. Reputed to be one of the greatest investors of all time, Warren Buffett frequently explains that diversification is not a must if you know what you are doing :

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

— Warren Buffett

In any case, while in the stock market such a strategy may make sense, it cannot be as relevant in the cryptocurrency world.

Some people are looking to diversify their portfolio in cryptocurrencies by thinking that, alongside Bitcoin, they will buy:

- Ethereum, which is the leader in smart contracts and decentralized applications platforms

- Basic Attention Token, which offers an innovative advertising model for the Web

- NEXO, which is a platform offering instant credit lines

- Enjin Coin from the Enjin platform, which is the leader in gaming on the Blockchain.

- …

I see a lot of questions on forums or platforms like Quora from people asking if their portfolio with an allocation of 50% Bitcoin, 20% Ethereum, 10% BAT, 10% NEXO, and 10% ENJ is relevant for the future.

The allocation percentages will vary from person to person, as will the Altcoins selected, but you get the idea.

These people feel reassured having diversified their portfolio in cryptocurrencies in this way.

Diversification with Altcoins does not protect you from the real risk

I will surely disappoint some of them with what I am going to tell you here, but you must open your eyes and understand that this diversification with Altcoins is a mere illusion.

The fact that these cryptocurrencies operate at first glance in different sectors does not constitute a diversification that allows them to protect themselves from the real risk in the cryptocurrency world.

So what is the real risk in the cryptocurrency world to which all Altcoins are subject?

If Bitcoin were to fail in its revolution, then all Altcoins would fail as well. No Altcoin could survive without Bitcoin. In fact, you were not diversifying against the potential risk of Bitcoin failure by buying Altcoins.

This diversification with Altcoins that gives you a sense of security is just an illusion that you must get out of.

All the cryptocurrencies that are created are only failed attempts to prove that the Blockchain can be successfully used for something other than Bitcoin. Altcoins that claim to be able to replace Bitcoin with supposedly superior technology will fail sooner or later.

Their marketing teams may make you think they have a lot to offer, but you should not lose sight of the fact that the unique invention has already taken place on January 3, 2009 with Bitcoin.

The revolutionary invention has already been invented with Bitcoin

Bitcoin is much more than a cryptocurrency, it is the protocol for money on the Internet.

Bitcoin is a unique invention in the history of mankind. Altcoins that seek to seduce you, and take advantage of your propensity to let greed blind you, come too late. The real revolution has already taken place, and it is embodied by Bitcoin.

Beware of the greed that is the number one enemy in the Bitcoin’s world.

Sooner or later, Bitcoin will be able to respond to all the use cases that some Altcoins implement and that Bitcoin does not implement yet.

The community of the most brilliant developers is around Bitcoin. Services will be added around the Bitcoin Blockchain to offer smart contracts in the future if needed.

Also, if decentralized finance goes beyond the mere fad that it is currently in, it’s a good bet that services will be offered on top of the Bitcoin Blockchain sooner or later in the future.

Diversification with Altcoins is a mere illusion

The main thing you should keep in mind if you ever think about buying Altcoins to diversify is the following:

There is absolutely nothing that the other cryptocurrencies on the market do that Bitcoin won’t be able to do in the future.

Starting from this premise, which should become a golden rule, you will realize that diversification in the world of cryptocurrencies serves absolutely no purpose.

To paraphrase Warren Buffett, this diversification that some people absolutely pursue is only a protection against ignorance. That famous ignorance about the fact that Bitcoin is the real revolution.

Once you understand this, you will be able to focus on Bitcoin to avoid wasting your time and money on Altcoins, which are frequently referred to as Sh*tcoins. Of course, this name doesn’t owe anything to chance.

1 Response

[…] This diversification strategy is a pure illusion because all these Altcoins are dependent on the suc…. Without Bitcoin, these Altcoins would not exist. If Bitcoin fails, these Altcoins will fail. […]