The 3 Main Lessons That HODLING Bitcoin Teaches You

Being a real Bitcoin HODLER will definitely change your life.

The Bitcoin world is divided into two main categories: HODLERS and others! HODLERS are very special individuals who fundamentally believe in Bitcoin as a technology that can revolutionize the current dominant financial system and who will therefore accumulate Bitcoins by keeping them regardless of its price in the market. The term HODLER comes from HODL, a slang term that has become a hit on the Internet.

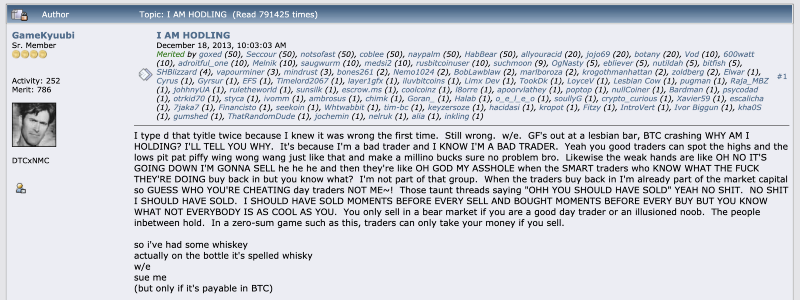

It all started on December 18, 2013 on the Bitcoin forum when a user, registered under the pseudonym GameKyuubi, posted a message that has been part of the legend since:

When reading this user’s message, we guess that he must have been in an unnatural state and that he therefore made an error in the title of his message by inverting two letters within the word “HOLDING” and finally writing: “I AM HODLING”.

This post quickly had a viral effect and now people who believe in Bitcoin in the long term are called HODLERS quite naturally. Being part of the HODLERS is something very special in a market as volatile as Bitcoin. It goes without saying that this can put some people’s nerves to the test in prolonged bearish market conditions such as those experienced throughout 2018.

Nevertheless, the HODLERS hold their ground no matter what happens on the market and finally, they grow out of it thanks to 3 main lessons learned from keeping their Bitcoins at all costs.

1. Just Like Bitcoin, Your Attention Is Scarce And Therefore Precious

When designing the Bitcoin, Satoshi Nakamoto decided to set an arbitrary limit of 21 million BTC that could be put into circulation by 2140 at the most, thereby creating the equivalent of a deflationary currency and making Bitcoins scarce.

Everything that is scarce in life is precious.

This scarcity of Bitcoin will allow it to become a true store of value for the greatest number of people in the future. The HODLERS are convinced of this and that is why they continue to accumulate Bitcoins month after month.

By keeping a cool head as the market goes up or down, and as the FOMO feeling spreads on the Web, HODLERS quickly realize that there is another thing that is rare in life: time.

Your time on Earth is running out. It is scarce and therefore extremely valuable.

The HODLERS have understood this well and that is why they conscientiously value their attention time on the Web or elsewhere. That famous attention time that companies are willing to do anything to take over!

Only one valid advice for your Bitcoins and your attention time: use them wisely for things that are really worth it.

2. Bitcoin Can Be Boring, Just Like Life, But You Have To Appreciate The Boredom

Bitcoin is very volatile. It is therefore quite possible that its price on the market will take 20% in a few hours. Similarly, it is quite possible that its price could drop by 20% in a few hours as well. When buying Bitcoins, you must therefore keep these risks in mind in order to make your own choices in full knowledge of the facts.

Nevertheless, it should not be assumed that Bitcoin experiences such large fluctuations every day.

Between these periods of intense price fluctuations, Bitcoin often sees its price stagnate for long days, weeks or even months in some cases!

Profit-hungry investors even go so far as to say that Bitcoin can become boring.

On this point, I have only one thing to say: they are absolutely right. Bitcoin can be a dreadful bore for investors seeking only profit.

The HODLERS quickly understand that this boredom with Bitcoin is a part of life. It’s even a good thing! You have to know how to enjoy this boredom and enjoy these periods of prolonged calm. Just because we are in a world where everything is going faster and social media companies are trying to addict you at all costs by trying to constantly boost your dopamine level doesn’t mean you can’t stop and slow down if you want !

Take the time to enjoy boredom throughout your life just as the HODLERS enjoy the long periods of calm in the Bitcoin price.

3. HODLING Bitcoin Teaches You To Follow Your Instinct

In addition to patience, HODLERS develop another important quality by clinging to their precious Bitcoins. They learn to follow their instincts. Indeed, when the Bitcoin drops by more than 100% in a few months, you have to believe fundamentally in the Bitcoin to remain a HODLER.

That’s precisely what the HODLERS are: fervent defenders of Bitcoin against all odds.

If you have decided to keep your Bitcoins and become a HODLER, it is because you are convinced that Bitcoin is a revolutionary technology that will change the current monetary system in the future.

You are deeply convinced that Bitcoin is the future.

In fact, you will follow your instincts no matter what and keep your Bitcoins even if the whole world decides to sell. Even better, you will take advantage of this opportunity to strengthen your positions by accumulating more and more Bitcoins.

This unwavering faith in your instincts will spill over into the rest of your life. That’s a certainty! When you have a conviction on any subject, you will stick to it because you will be more confident despite the criticism of others.

Conclusion

For HODLERS, Bitcoin is a technology that promises to revolutionize the world we know today. This unshakeable faith in Bitcoin and the revolution it embodies teaches a number of lessons, of which the three I have just described are the main ones.

By becoming a HODLER, you will necessarily become aware of the importance of everything that is scarce with your time on Earth as the most important thing. You will then learn to appreciate the boredom that life can sometimes bring. Finally, you will acquire an unwavering faith in your instinct thanks to the simple fact to believe in Bitcoin despite the criticism of those around you.

1 Response

[…] It is one of the 3 essential lessons that HODLING Bitcoin teaches you. […]