Don’t Pay for Bitcoin Trading Signals, Just Learn How to Decipher the Fed Secret Code

Think long-term with Bitcoin.

Many people would like to be able to effectively predict future movements in the Bitcoin price. Some people are so eager to believe it that they end up being fooled by those who tell them that it is entirely possible.

With the recent rise in the Bitcoin price close to $16K, these questions are multiplying.

As a result, more and more people are trying to sell Bitcoin Trading Signals services at a premium price. Some Telegram groups also offer this type of service. The people who do this are just trying to take advantage of your gullibility and greed.

As I often say, greed is the number one enemy in the Bitcoin world. If you allow yourself to be trapped by this type of service, you will lose time and probably a lot of money.

You need to understand the why of Bitcoin

Rather than looking at Bitcoin as a get rich quick scheme, you should look for a better understanding of the problems Bitcoin addresses. You should understand that the purpose of Bitcoin is to allow you to protect your wealth over time in a way that is resistant to censorship.

Bitcoin is your best weapon to prevent the current monetary and financial system from slowly but surely impoverishing you in the years to come.

Once you understand this, you can adopt the best strategy that exists with Bitcoin: become a Bitcoin HODLER.

By becoming a Bitcoin HODLer, you will make the smart choice to bet on the Bitcoin revolution rather than on the U.S. dollar, which is at the center of a system whose collapse seems inevitable.

Bitcoin price volatility is back at the forefront

Over the last few days, the volatility of the Bitcoin price has returned to the forefront:

During the first 48 hours following the 2020 U.S. presidential election day, the Bitcoin price rose sharply by +18%. Its price rose from $13.5K to nearly $16K.

The Bitcoin price stabilized around $15.3K, before plunging rapidly following the announcement of the election of Joe Biden as President of the United States.

Bitcoin then saw its price drop by -5% in a few hours. Quickly, the opposite trend was observed, and the Bitcoin price rose by +5%. At the time of writing, the price of Bitcoin is $15.2K.

This volatility is obviously a fantasy for all traders who would like to be able to take advantage of it. This is the feeling that feeds those who create Bitcoin Trading Signals type services.

My advice is simple: you should not fall into this trap.

Being a Bitcoin trader is the best way to lose money

Trading is a discipline that requires very specific skills. 99% of people don’t have those skills. If you go into Bitcoin trading without mastering what you are doing, you will lose a lot of money, that’s for sure.

What’s worse is that it’s often the beginners who get into the business of trading. Yet beginners are even less in control of their emotions than those who have been in the world of Bitcoin for longer periods of time. As a result, many give in to the FOMO feeling and then to the FUD feeling. This makes them lose a lot of money.

Becoming a Bitcoin HODLer is a smart bet on the future.

You will buy Bitcoin in Dollar-Code Averaging (DCA) mode to smooth your costs. The volatility of Bitcoin will become your greatest ally. Then you will secure your Bitcoins on a hardware wallet for HODL Bitcoin no matter what.

By carefully repeating this process, you will be able to accumulate enough BTC to be among those who will benefit most from the Bitcoin revolution in the years to come.

HODLing Bitcoin is the best strategy

The HODLing Bitcoin strategy is based on several observations:

- It is impossible to accurately predict the Bitcoin price in the short term. No one can tell you with complete reliability that the Bitcoin price will rise or fall tomorrow.

- The Bitcoin revolution will take time. Patience is the key to benefiting from it.

- The Bitcoin price will rise sharply in the years to come because Bitcoin meets the great need that emerges in 2020, namely to protect its wealth over time in a censor-proof way. With a demand set at 21 million units and an issuance of new Bitcoins that slows down over time, the Bitcoin price can only increase if we rely on the principles of the law of supply and demand.

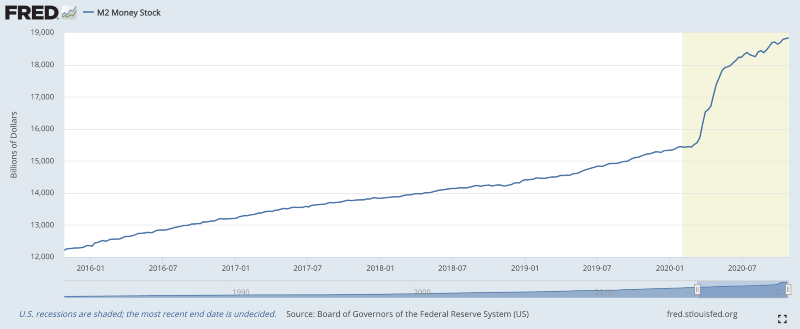

- The Bitcoin price will increase even more strongly due to the endless inflation of the M2 Money Stock.

This last element is essential to understand.

Rather than Bitcoin Trading Signals, which are nothing but wind, you need to learn how to decipher the Fed’s secret code.

The Fed conducts an aggressive monetary policy that favors the increase of the Bitcoin price

Since the beginning of the coronavirus pandemic, the Fed has printed nearly $3,500 billion out of thin air :

This +22% increase in the M2 Money Stock in such a short period of time is unprecedented in history at a time when the world is in peace.

All this money printed out of thin air by the Fed allows the U.S. government to continue to increase the U.S. public debt which has now exceeded $27,200 billion as we are in November 2020:

This never-ending inflation continues to devalue the value of the U.S. dollar over time. Since 1971, the value of the U.S. dollar has fallen by -85%. The current situation will plunge the world into a period of great monetary inflation that will make the situation even worse.

This will inevitably benefit the Bitcoin price in the U.S. dollar in the years to come.

To this aggressive monetary policy, the Fed has added a lowering of interest rates to zero which has induced a Tech bubble in the U.S. stock market.

Nevertheless, the economic situation in the United States is still extremely delicate. There will be great uncertainty in the U.S. economy, and even in the world economy until a coronavirus vaccine is made available to as many people as possible.

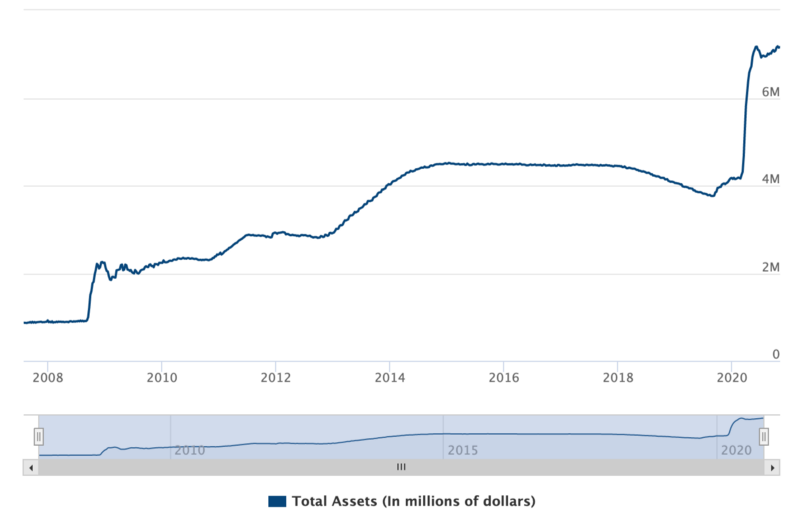

Jerome Powell tells us that the Fed will continue with this strategy

In light of this, Jerome Powell told during a Fed conference on November 5, 2020, that the U.S. central bank will continue its aggressive monetary policy in the coming months. The Fed is far from having exhausted its range of tools to support the American economy if we listen to what Jerome Powell says.

Jerome Powell also believes that the U.S. government and Congress must also act again with a new stimulus plan:

“I just would say that I think we’ll have a stronger recovery if we can just get some more fiscal support, when it’s appropriate… the size Congress thinks is appropriate”

— Jerome Powell

What Jerome Powell has just told us corresponds to the Fed’s secret code to tell us that the Bitcoin price will continue to rise sharply in the coming months and years.

The Fed, which has already surpassed BlackRock in 2020 as the world’s largest asset manager, will continue to increase its Balance Sheet in the coming months:

The U.S. government will be able to continue raising the U.S. public debt with the Fed’s blessing.

Conclusion

In the face of this great monetary inflation, the demand for Bitcoin will continue to explode at all levels. Institutional investors are buying Bitcoin massively. Large companies will come to follow the trend initiated by MicroStrategy and Square, while individual investors will come in droves in the coming months as the Bitcoin price increases even more.

Rather than trying to profit from Bitcoin’s volatility via Trading, the only thing to do is to employ the DCA approach when buying Bitcoin. This will allow you to profit from Bitcoin safely.

If you want to convince yourself of the merits of this approach, you only need to take a closer look at what the Fed does and says. The Fed’s actions are far more reliable than any other Bitcoin Trading Signals in the world regarding the long-term evolution of the Bitcoin price.